We are upgrading our transaction portal and will be back soon.

We advocate for long-term equity investments as we recognize the potential for substantial value creation over time, acknowledging the limitations of market efficiency. Through diligent research and investment strategies, we aim to achieve superior performance by gaining a deep understanding of equity markets.

Our investment approach focuses on growth, targeting companies with the potential for sustained long-term growth. Utilizing our proprietary BMV framework (Business - Management - Valuation), we identify such companies with strong growth prospects.

Valuation is a pivotal aspect of our strategy, as we seek growth companies with reasonable valuations. We prioritize companies that leverage insights into future trends and effectively incorporate them into their business models, facilitating above-average growth rates.

Management quality is paramount in our evaluation of growth companies. We emphasize management's ability to consistently perform across market cycles and uphold best-in-class corporate governance standards.

We strive for consistent investment performance across various market conditions, achieved through rigorous risk management and a disciplined investment process. Recognizing market volatility, our philosophy prioritizes downside protection while aiming for superior risk-adjusted returns over the long term.

Growth:

Leadership in:

As active managers, our goal is to consistently deliver superior performance by blending macro research with precise security selection, all while adhering to portfolio discipline and stringent risk controls.

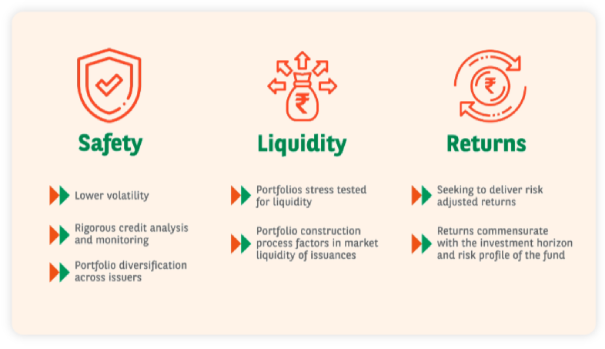

In fixed income investing, safety, liquidity, and returns are fundamental priorities, with safety taking precedence. Our approach emphasizes prudent decision-making, avoiding overly aggressive positions, and recognizing the outsized impact of risks on returns.

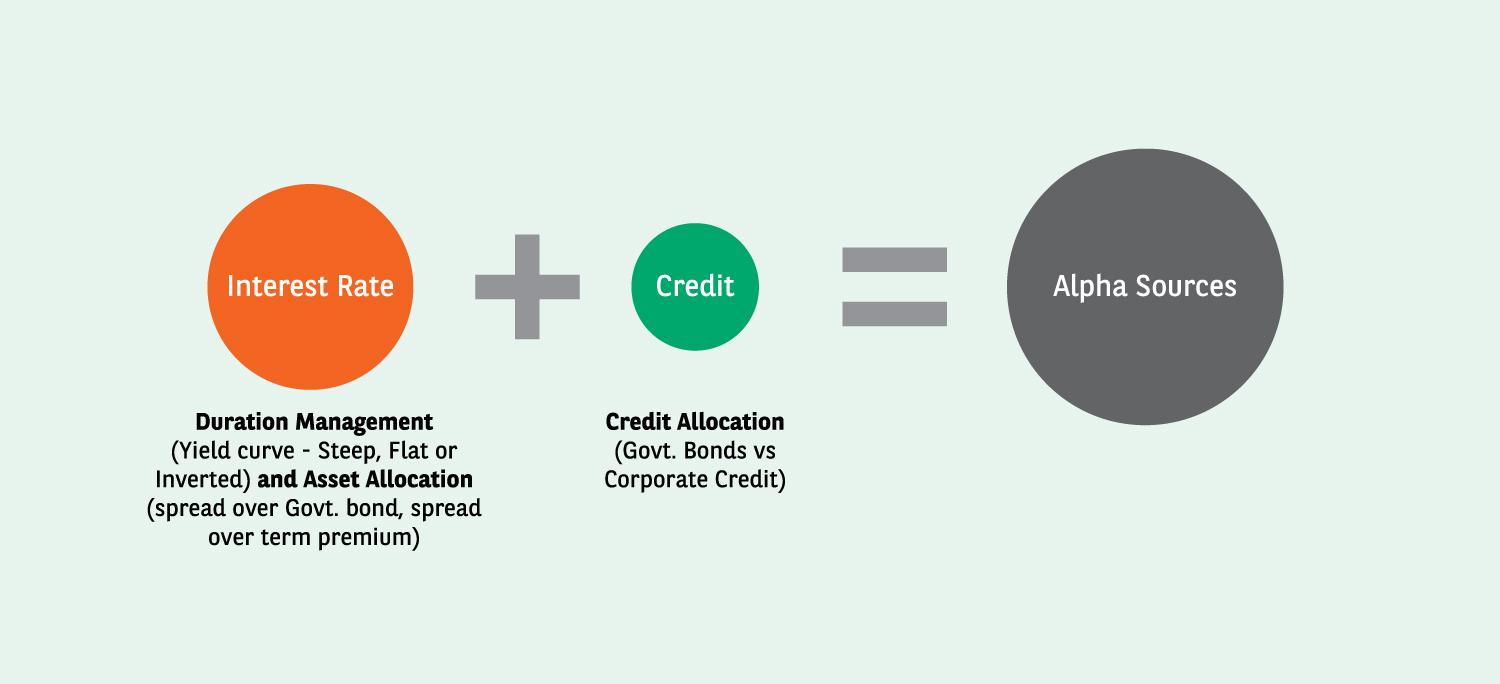

While we aim for superior performance, we recognize that mitigating losses is crucial in fixed income. Given the asymmetric nature of credit investing, thorough credit research is central to our process. We meticulously apply a well-defined investment framework to manage interest rate risk and align with our investment objectives.

Our interest rate outlook and strategy are shaped by comprehensive analysis of various domestic and international economic factors. We position our funds along the expected yield curve based on their duration mandates and available opportunities.

In assessing a company's creditworthiness, we conduct rigorous evaluations encompassing financial analysis and scrutiny of internal/external factors affecting creditworthiness.

Risk management is integral to our fixed income process, encompassing analysis and monitoring of credit, interest rate, and liquidity risks at both individual security and portfolio levels.

After considering all the above factors we allocate individual portfolios as per their mandates in terms of duration and credit ratings into CORE portfolio and TACTICAL portfolio. The Core portion of the portfolio will reflect our medium to long term view and will reflect on the majority of the portfolio. The Tactical portion will superimpose the Core strategy and try to generate alpha using short term opportunities in the market. This portion will comprise of a small allocation of overall portfolio.