Meet Rajashekhar, a 64-year-old retired executive from a pharmaceutical company. He has already repaid all his liabilities and his son’s family residing in the USA is doing well. With perhaps more than adequate retirement corpus to take care of his golden years, and negligible specific financial goals, he is thinking of intergenerational transfer of wealth. He has realised the importance of a diversified portfolio including equities to earn a decent risk-adjusted return. But he is unsure about how much to invest, when to invest and where to invest.

There are many such individuals around us. They have money and want to invest for the long term across various asset classes, but they do not know how to do that or do not have access to investment advice.

Multi Asset Investment Strategy

Investing across asset classes is like having a wholesome meal. Each food component plays a vital role, and regular consumption of judicious mix of these food components makes us healthy and helps our growth. Similarly, investing in shares, bonds and gold can help you earn decent risk-adjusted returns in the long term. Since these asset classes have low correlation with each other, the portfolio tends to limit downside during volatile phases. An example of a multi asset portfolio may help to understand this. However, investors should be aware that the risk associated with investing in multi asset class is generally high hence it is always advisable to consult their financial advisor before investing.

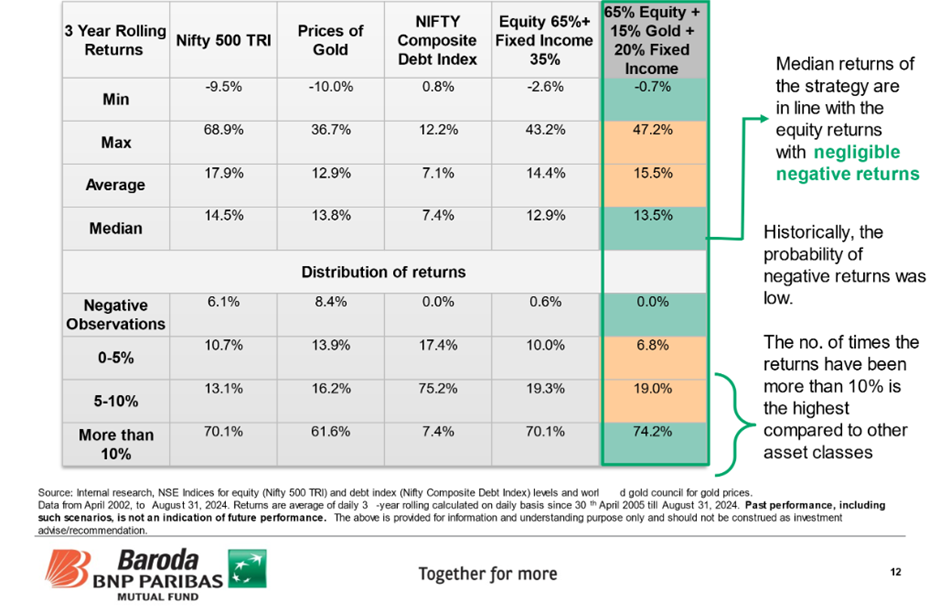

The table above depicts the performance of a multi-asset investment strategy using 65% equity through Nifty 500 TRI, 20% fixed income (bonds) represented by Nifty Composite Debt Index and 15% gold. Three-year rolling returns for the period between April 2002 and August 2024 are considered across these three assets and the multi-asset portfolio. The multi-asset strategy has participated meaningfully in the upside while limiting downside. The median three-year rolling returns of 13.5% is very close to the 14.5% delivered by Nifty 500 TRI. Importantly, the multi-asset strategy has never lost money, however has given more than 10 % returns in 74% of the observations.

Multi asset fund

These mutual fund schemes invest a minimum 10% each into at least three asset classes - equity, fixed income and gold - with the objective of generating capital appreciation in the long term. The fund manager decides allocation to each of these asset classes depending on their relative attractiveness within the permissible asset allocation of the scheme as mentioned in the Scheme Information Document. The fund manager can aim to build a diversified portfolio including shares, bonds, units of gold exchange traded funds (ETF), real estate investment trusts (REIT) and infrastructure investment trust (INVIT).

You should pay heed to the permissible asset allocation of the multi asset fund (MAF). For example, some schemes invest 65-80% in equities, 10%-25% in gold, 10-25% in fixed income and up to 10% in REIT and INVIT. Schemes investing minimum 65% in equity or equity related instruments are considered equity schemes for the purpose of taxation. This also means these schemes have the potential to generate better returns compared to those with relatively lower exposure to equities. A MAF offers a wide range of benefits as follows:

Convenience: Instead of identifying three different schemes to buy equities, fixed income and gold, you can simply buy one MAF and relax as per your risk appetite. This reduces the efforts required for monitoring multiple schemes and regularly rebalancing the asset allocation.

Diversification: Investment in a MAF gives you exposure to three different asset classes with low corelation with each other. This seeks for optimum risk-adjusted returns as all asset classes do not rise or fall together.

Tax-efficiency: If you are investing in a MAF with minimum 65% in equity, the gains booked are taxed as long-term capital gains at 12.5% if the units are held for one year. A MAF also helps tax-neutral rebalancing of asset allocation. Since mutual funds are pass-through vehicles, the fund manager’s actions of shifting from one asset class to another does not attract tax. However, if you do shift from an equity mutual fund to a debt fund or the other way round, each such transaction is considered a sale and attracts tax. As an investor in a mutual fund scheme (including a MAF), you are expected to pay tax only if you sell units and book profits.

Broad canvas: Among mutual fund schemes, a MAF offers the maximum freedom to the fund manager, by only defining the allocation limits to each asset class in the SID. Within each asset class there are no restrictions on the fund manager. For instance, the fund manager is not compelled to buy large cap or mid cap stocks in the equity portfolio, nor is he forced to invest in bonds within a certain duration basket or credit rating. The fund manager can weigh the relative attractiveness of securities across the spectrum while building the scheme’s portfolio. This approach may be potentially rewarding in the long term.

Active management: As the length of the business cycle shortens and investor participation increases, asset classes usually move quickly in both upward and downward directions. In addition to security selection, the allocation to each asset is crucial. A disciplined approach to actively managing allocation to each asset class can help to enhance the portfolio returns of a MAF. Most investors may find it difficult to achieve this on their own.

By now it should be clear that a MAF may be a good starting point if you are not sure about where to invest. A MAF can also be a core portfolio holding for savvy investors keen on investing for the long term. Ideally, start a systematic investment plan (SIP) in a MAF with a view to hold on to these investments for the long term. Keep increasing your SIP each year. If you receive a bonus or a large cashflow, you can invest it using a Systematic Transfer Plan (STP). A MAF may be one of theideal investment options to compound money over the long term to achieve financial goals like creation of a retirement corpus.

An investor education & awareness initiative.

The above is only for understanding purpose and shouldn’t be construed as investment advice provided by the AMC. Consult your financial/tax advisor before taking investment decisions. The % of return, if any, mentioned in this article will depend upon various factors including the tenure of investment, type of scheme, prevailing market conditions, view of Fund Manager on the market etc.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.