Dividend Yield is the dividend paid out by a company divided by the market price of the company. Dividend Yield Funds are equity funds which tend to invest in equity and equity instruments of dividend paying companies.

We are upgrading our transaction portal and will be back soon.

Dividends are a part of a company’s profits that are paid out. Companies that pay out dividends regularly tend to be less volatile, better managed, and relatively more stable than their non-dividend paying peers.

So, if you are someone who wants to invest in equity with exposure to quality and reliable companies with less volatility, you may consider investing in Dividend Yield Funds.

These companies tend to focus on cashflows, leading to better financial management.

They are better at generating Return on Capital Employed (ROCE) as idle cash is distributed.

They tend to generate higher returns as they payout dividends and provide capital appreciation.

They are likely to fall less during crisis, thereby protecting the investor’s money.

The investment objective is to provide medium to long-term appreciation by predominantly investing in a well-diversified portfolio of equity and equity related instruments of dividend yielding companies.

The C-H-A-M-P companies:

Companies that have a track record of regularly^ paying dividends (including buybacks).

High free cash flows: businesses that have a history of having high free cash flows.

Avoid Dividend Traps: Companies With high dividend yields but falling market price, higher debt and overall weak fundamentals.

Market Agnostic Portfolio: Looking for dividend paying companies across all market caps.

Price: Looking for reasonably priced growing companies (GARP).

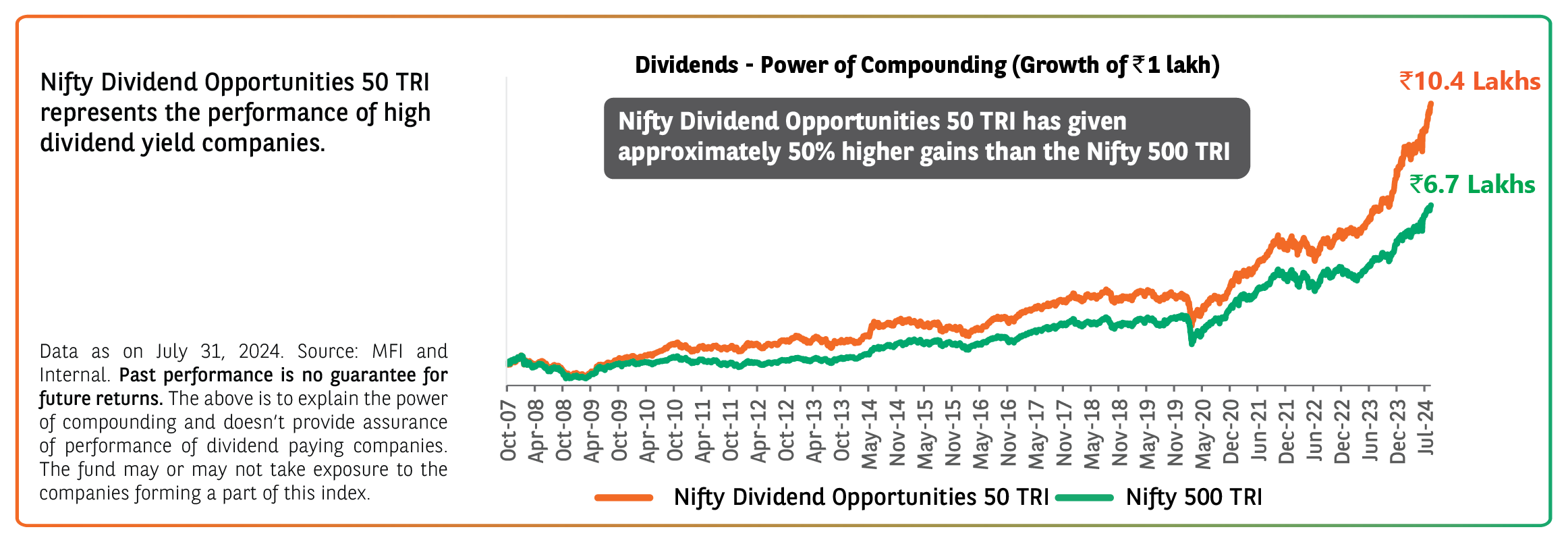

| Benchmark | Nifty 500 TRI |

| Load Structure | Entry Load: Not applicable

Exit Load: If units of the Scheme are redeemed or switched out up to 10% of the units within 1 year from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 1 year from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 1 year from the date of allotment - Nil. |

| Fund Manager~ | Mr. Shiv Chanani (Experience: 24 years) |

| Minimum Amount for Application during the NFO & Ongoing Offer | Lumpsum Details: A minimum of Rs. 1,000 per application and in multiples of Rs.1

Minimum Additional Application Amount: Rs. 1,000 and in multiples of Rs. 1 thereafter. |

| SIP Details: Minimum Application Amount | (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Rs. 1/- thereafter; (ii) Quarterly SIP: Rs. 1500/- and in multiples of Rs. 1/- thereafter |

~Dedicated Fund Manager for Overseas Investments: Mr. Miten Vora

Disclaimer

Offer of units at Rs. 10 each during the New Fund Offer period and continuous offer for units at NAV based prices. The risks associated with investments in equities include fluctuations in prices, as stock markets

can be volatile and decline in response to political, regulatory, economic, market and stock-specific development etc. Please refer to Scheme Information Document for detailed risk factors, asset allocation,

investment strategy etc. Further, to the extent the Scheme invests in fixed income securities, the Scheme shall be subject to various risks associated with investments in Fixed Income Securities such as Credit and

Counterparty risk, Liquidity risk, Market risk, Interest Rate risk & Re-investment risk etc., Further, the Scheme may use various permitted derivative instruments and techniques which may increase the volatility

of Scheme’s performance. Also, the risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditional investments.

Please refer to Scheme Information Document available on our website (www.barodabnpparibasmf.in) for detailed Risk Factors, asset allocation, investment strategy etc.

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click HereProduct one pager

Click HereDividend Yield is the dividend paid out by a company divided by the market price of the company. Dividend Yield Funds are equity funds which tend to invest in equity and equity instruments of dividend paying companies.

Dividend Yield funds invest in companies which pay dividends. As such, they tend to maintain higher free cashflows, better cash management, and robust fundamentals. Thus, these companies are generally quality names with good governance and strong management. Moreover, the funds who invest in these companies are likely to have lower volatility and could fluctuate lesser compared to other equity funds.

Dividend Yield funds are equity funds investing in dividend paying companies. As such, these funds they do not promise nor are liable to pay regular dividends. These funds may pay dividends, only in the Income Distribution cum Capital Withdrawal option and only if the fund has surplus cash available.

We will pick C-H-A-M-P Companies:

Companies that have a track record of regularly^ paying dividends (including buybacks)

High free cash flows: businesses that have a history of having high free cash flows.

Avoid Dividend Traps: Companies With high dividend yields but falling market price, higher debt and overall weak fundamentals.

Market Agnostic Portfolio: Looking for dividend paying companies across all market caps.

Price: Looking for reasonably priced growing companies (GARP).

^Having paid dividend (or done a buyback) in atleast one of the three preceding financial years.

Lumpsum Details: A minimum of Rs. 1,000 per application and in multiples of Rs.1

SIP Details: Minimum Application Amount -

One should stay invested in for a minimum time horizon of 3 years in the Baroda BNP Paribas Dividend Yield Fund, as it is a sufficient time for one’s investments to compound and grow.

Yes, investors can redeem from the fund anytime, subject to an exit load. There is no lock-in period for the fund.

The Current Exit Load is: