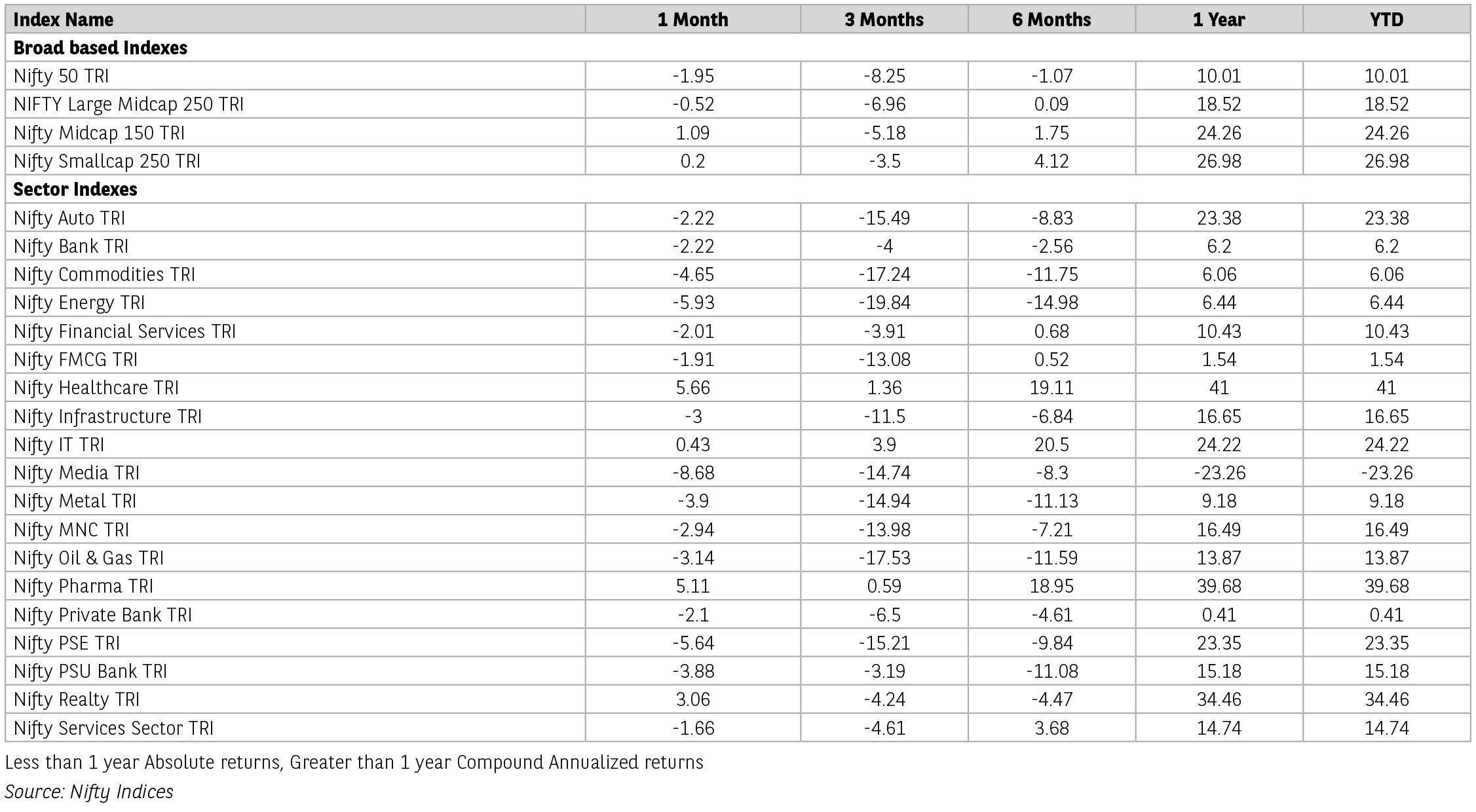

As Calendar Year (CY) 2024 wraps up, Indian markets have once again celebrated a year of gains, marking a historic milestone with nine consecutive years of

positive returns. The Nifty declined 2% in the month of December 2024 but gained 8.8% in calendar year (CY) 2024. On a full-year basis; NIFTY Midcap 150 was

up 24%; while NIFTY Smallcap 250 index was up 26%. Sector-wise, healthcare and realty were the best-performing sectors in the month of December 2024 and

in the year 2024. Power, metals and PSU indices declined 7%, 5.4% and 5.2% in December. Despite Foreign institutional investor (FII) selloffs causing market

jitters, strong domestic liquidity has dominated flows into the Indian equity market, reducing volatility. Foreign portfolio investor (FPIs) sold equity worth USD

130mn during Calendar Year (CY) 2024, while Domestic institutional investor(DIIs) bought equity worth USD 62bn during the same time.

US presidential election and India’s Lok Sabha election played a pivotal role in driving the markets through the year. Global markets ended on a mixed note for the month. Japan (+4.4%), Taiwan (+3.5%) and Hong Kong (+3.3%) were the major gainers, whereas the US Dow Jones, Brazil and US S&P 500 declined 5.2%, 4.3% and 2.4%, respectively. The US Fed cut the interest rate by 25 bps and indicated fewer rate cuts next year. US Nov’24 payroll data was better although unemployment moved up; Consumer confidence is at a sixteen-month high; strong retail sales underline robust consumer spending.

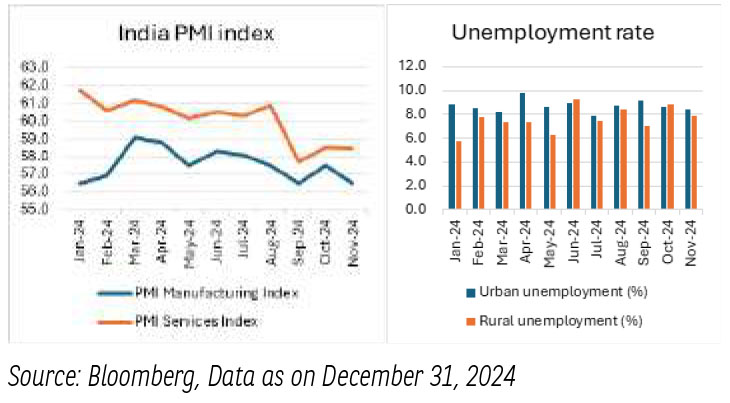

On the domestic front, following a strong FY 2024, 1st Half of the Financial Year 24-25 i.e. (April 2024-September 2024) experienced a slowdown in key macroeconomic indicators. Real GDP growth fell to 5.4% YoY in Q2 FY25, down from 8.2% YoY in FY24, due to lower government spending and reduced consumption. Total capital spending of the Central Government is down 13.5% YoY in 1 Half Financial Year 25, achieving only 39.1% of budget estimate in 1st Half of the Financial Year 24-25 i.e. (April 2024-September 2024)(vs. 50% each in the last two years), partly due to code of conduct. Consequently, consumption and earnings took a hit during 2Q FY25.

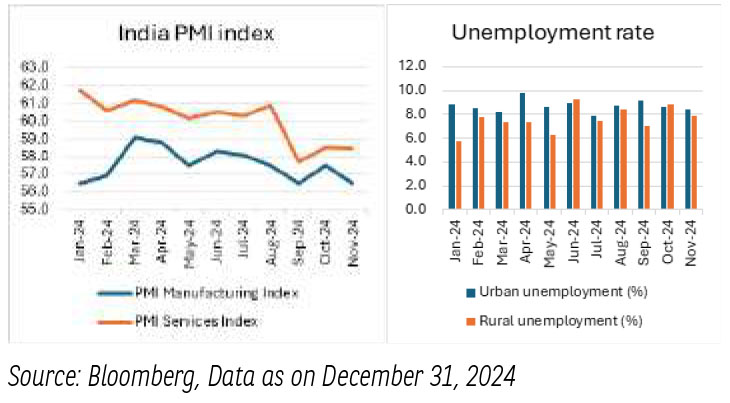

Economic activity has picked up in the Oct-Dec 2024 period. Index of Industrial Production (IIP) growth in October improved marginally to 3.5% yoy from 3.1% in September 2024. The output of eight core industries’ rose 4.3% YoY in November vs 3.7% in October, the highest pace in four months, primarily due to an uptick in production of coal, cement and steel. November 2024 Consumer Price Index (CPI) inflation decelerated to 5.5% YoY from 6.2% in October 2024. Wholesale Price Index (WPI) inflation eased to 1.9% in November 2024 compared to 2.4% in October 2024.

Consumption is seeing some revival. India's domestic air pax growth jumped to 12% YoY in Nov-24. Dec 2024 dispatches in car and CV segments were ahead of expectations while the performance in the two-wheeler segment disappointed. Vahan retail sales in Dec 2024 indicated a mixed YoY growth trend as tractors recorded sharp double-digit growth, Private Vehicle grew in high single digit while two-wheeler declined by high teens YoY. GST collections reached Rs.1.77 lakh crore in December 2024, marking the tenth consecutive month above the Rs. 1.7 lakh crore level. This figure reflects a 7.3% increase from Rs. 1.65 lakh crore in December 2023.

Despite global challenges, India continues to be the fastest-growing economy among major nations, reflecting its resilience. It has been a volatile market amidst Indian elections, escalating geo-political tensions, a new regime in the US, and a weak 1st Half of the Financial Year 24-25 i.e. (April 2024-September 2024)) earnings including Q2 being not so encouraging. Current quarter, the signals so far are mixed.

Nifty is trading at 1-year forward PE of 19.5x. In the coming year, the emphasis will be on evaluating the effects of Donald Trump's policies particularly potential tariff increases, on international commerce in the coming year. The market expects demand will revive in the fourth quarter. A busy marriage season, a good Rabi crop (due to high reservoir level) should help consumer demand. All hopes lie on Feb 2025 budget to boost consumption & GDP.

Source: Kotak Securities Ltd & Incred Research. . Data as of Dec 31, 2024. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual Fund for the month ended December 2024 for disclaimers.

US presidential election and India’s Lok Sabha election played a pivotal role in driving the markets through the year. Global markets ended on a mixed note for the month. Japan (+4.4%), Taiwan (+3.5%) and Hong Kong (+3.3%) were the major gainers, whereas the US Dow Jones, Brazil and US S&P 500 declined 5.2%, 4.3% and 2.4%, respectively. The US Fed cut the interest rate by 25 bps and indicated fewer rate cuts next year. US Nov’24 payroll data was better although unemployment moved up; Consumer confidence is at a sixteen-month high; strong retail sales underline robust consumer spending.

On the domestic front, following a strong FY 2024, 1st Half of the Financial Year 24-25 i.e. (April 2024-September 2024) experienced a slowdown in key macroeconomic indicators. Real GDP growth fell to 5.4% YoY in Q2 FY25, down from 8.2% YoY in FY24, due to lower government spending and reduced consumption. Total capital spending of the Central Government is down 13.5% YoY in 1 Half Financial Year 25, achieving only 39.1% of budget estimate in 1st Half of the Financial Year 24-25 i.e. (April 2024-September 2024)(vs. 50% each in the last two years), partly due to code of conduct. Consequently, consumption and earnings took a hit during 2Q FY25.

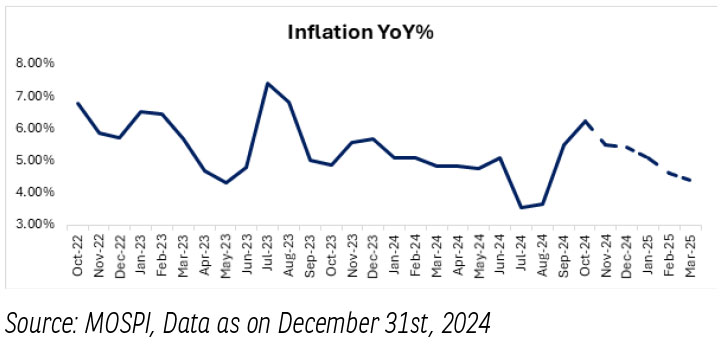

Economic activity has picked up in the Oct-Dec 2024 period. Index of Industrial Production (IIP) growth in October improved marginally to 3.5% yoy from 3.1% in September 2024. The output of eight core industries’ rose 4.3% YoY in November vs 3.7% in October, the highest pace in four months, primarily due to an uptick in production of coal, cement and steel. November 2024 Consumer Price Index (CPI) inflation decelerated to 5.5% YoY from 6.2% in October 2024. Wholesale Price Index (WPI) inflation eased to 1.9% in November 2024 compared to 2.4% in October 2024.

Consumption is seeing some revival. India's domestic air pax growth jumped to 12% YoY in Nov-24. Dec 2024 dispatches in car and CV segments were ahead of expectations while the performance in the two-wheeler segment disappointed. Vahan retail sales in Dec 2024 indicated a mixed YoY growth trend as tractors recorded sharp double-digit growth, Private Vehicle grew in high single digit while two-wheeler declined by high teens YoY. GST collections reached Rs.1.77 lakh crore in December 2024, marking the tenth consecutive month above the Rs. 1.7 lakh crore level. This figure reflects a 7.3% increase from Rs. 1.65 lakh crore in December 2023.

Despite global challenges, India continues to be the fastest-growing economy among major nations, reflecting its resilience. It has been a volatile market amidst Indian elections, escalating geo-political tensions, a new regime in the US, and a weak 1st Half of the Financial Year 24-25 i.e. (April 2024-September 2024)) earnings including Q2 being not so encouraging. Current quarter, the signals so far are mixed.

Nifty is trading at 1-year forward PE of 19.5x. In the coming year, the emphasis will be on evaluating the effects of Donald Trump's policies particularly potential tariff increases, on international commerce in the coming year. The market expects demand will revive in the fourth quarter. A busy marriage season, a good Rabi crop (due to high reservoir level) should help consumer demand. All hopes lie on Feb 2025 budget to boost consumption & GDP.

Source: Kotak Securities Ltd & Incred Research. . Data as of Dec 31, 2024. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual Fund for the month ended December 2024 for disclaimers.

Global Economy-

Global economic activity has remained resilient and steady. The global composite Purchasing Managers’ Index (PMI) rose to a three-month high in November, recording growth for the thirteenth consecutive month. The acceleration was largely driven by the services sector, which remained in the expansion zone for the twenty-second consecutive month.

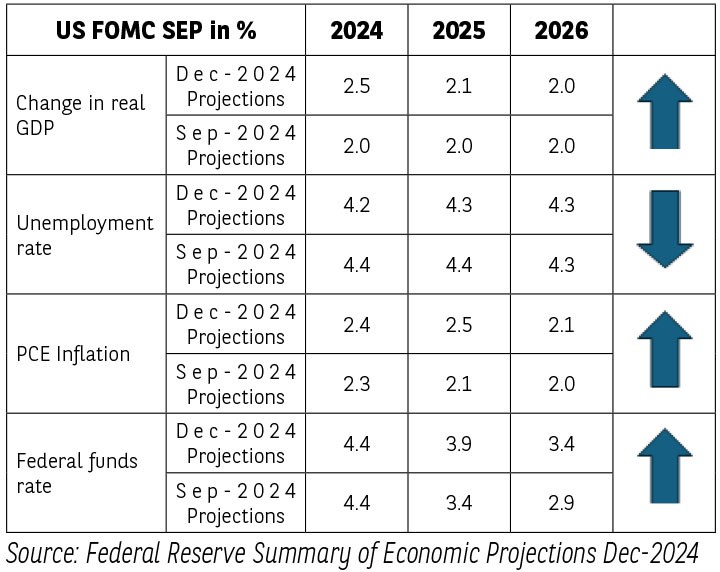

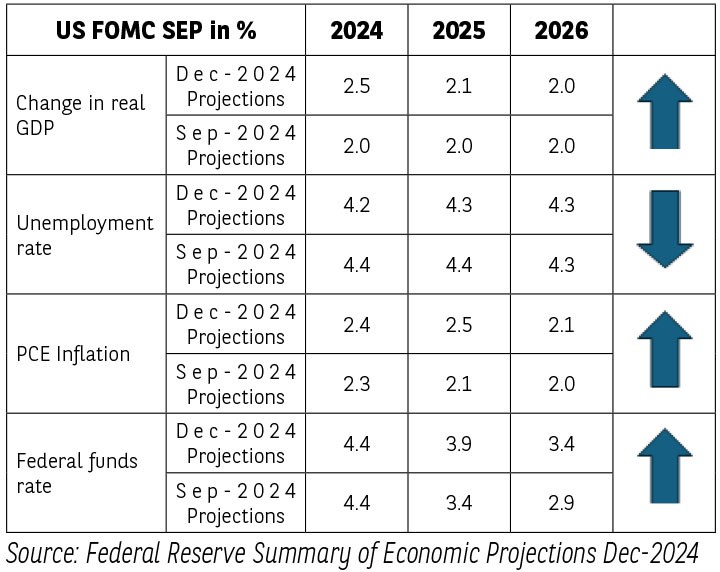

Supporting the same, advanced economies’ central banks like the US Federal Reserve decided to lower the target range for the federal funds rate by 25 bps to 4.25-4.50% on December 18, 2024 and indicated that the extent and timing of further adjustments to the target range for the federal funds rate will be based on a careful assessment of the incoming data and the evolving outlook.

The major mover remained the economic projections which saw revisions compared to the Sep-2024 economic projections. The market took the economic projections as hawkish.

This comes after the headline inflation in the United States accelerated for the second consecutive month. US CPI was up 2.7% in November from a year earlier. This was up from 2.6% in October and 2.5% in September 2024. The acceleration reflected an increase in energy prices (which previously had been declining) and an acceleration in food prices.

Following the FED’s decision, global financial markets are emitting mixed signals. Equity markets remained volatile, whereas bond yields have risen on the prospect of larger US fiscal imbalances and an anticipated slowdown in the pace of monetary easing. In the December policy, Bank of England (BOE) left its benchmark interest rate unchanged. The majority expressed concern that accelerating wages and prices added to the risk of inflation persistence. The decision means that the BOE is focused more on inflation than on economic growth.

Global commodity prices recorded divergent movements as gains in energy and agricultural commodity prices were offset by the decline in metal prices. Overall, the commodity prices have been driven down during much of 2024, reflecting a fall in global oil consumption with the declining energy intensity of global GDP.

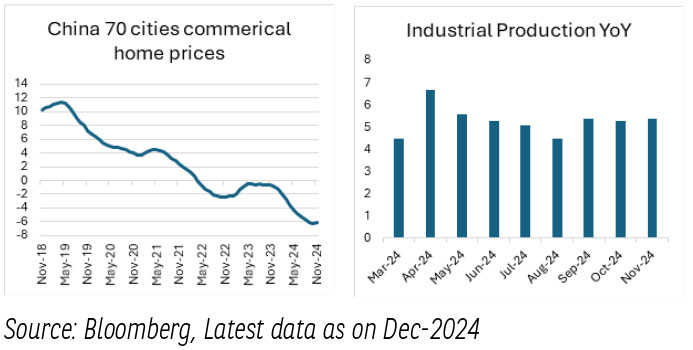

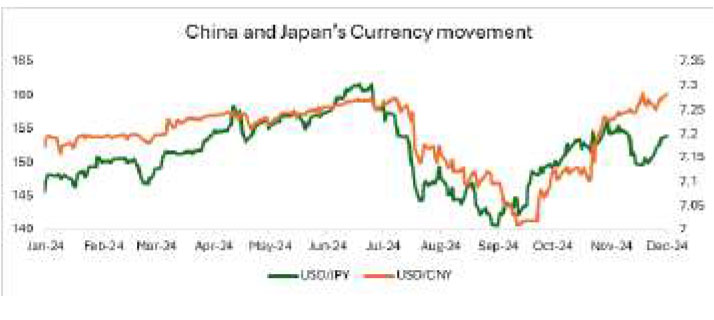

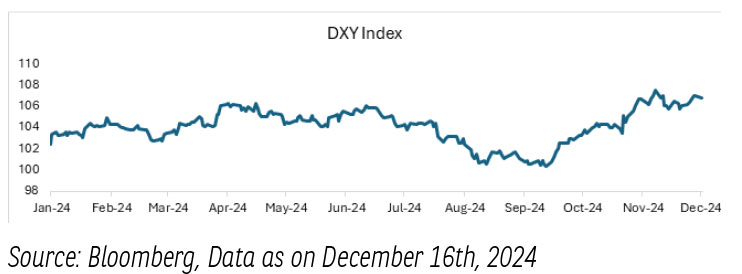

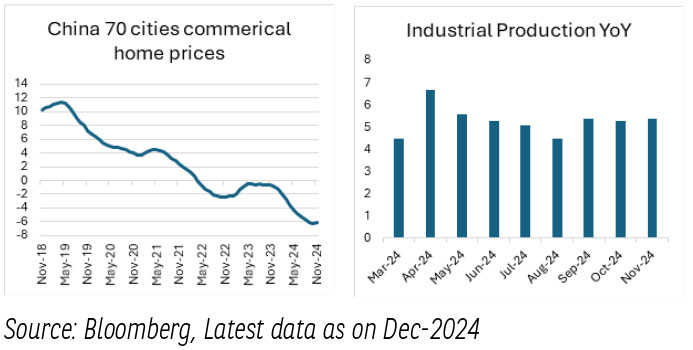

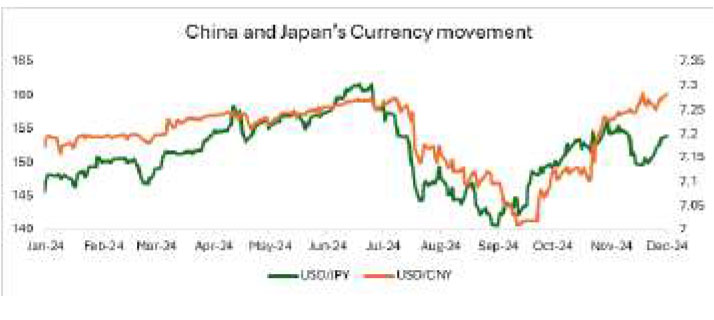

In Asia, the weakness in China’s economy persists. China’s government has signalled an intention to provide fiscal stimulus meant to boost domestic demand. This is expected to keep pressure on Yuan and other emerging market economies. The pressure on emerging market economies intensify as dollar index gains strength backed by strong growth signals.

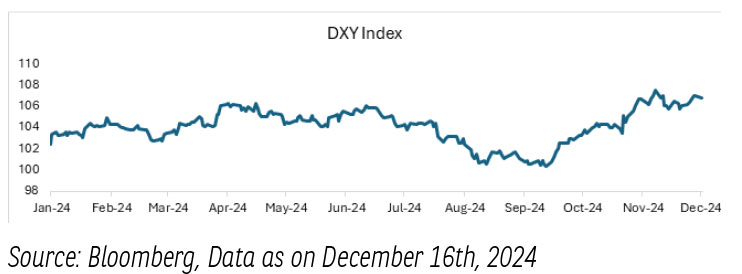

The dollar index remained above 108, remaining near its highest levels in two years as investors bet on US economic strength and fewer Federal Reserve rate cuts this year. The dollar index strength has pressured other emerging market and Asian currencies. Japan too has a dual problem of rising inflation and yields and depreciating currency given strong dollar index. Unless an action is taken by Bank of Japan(BOJ), yen is expected to remain under pressure.

Domestic Economy-

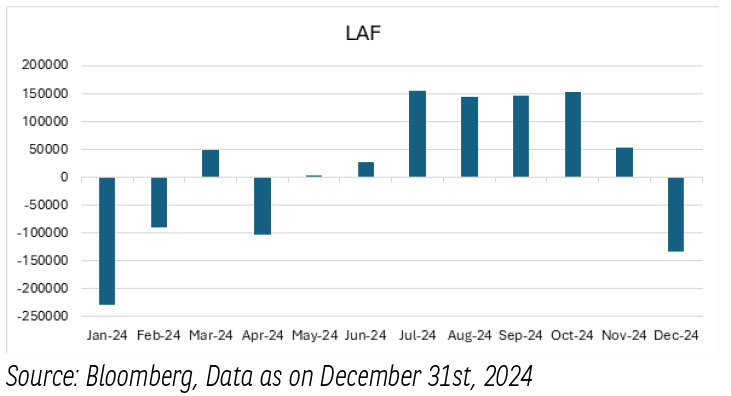

In December-2024’sRBI monetary policy, the focus has been on balancing the domestic growth and inflation dynamics while managing the liquidity conditions in the background of currency volatility. RBI kept the repo rate unchanged at 6.5% (with a vote of 4:2). The MPC also decided to continue with the neutral stance on unanimous basis. The key decision was the Cash Reserve Ratio (CRR) cut of 50bps from 4.5% to 4%. To ease the potential liquidity stress, RBI decided to reduce the cash reserve ratio (CRR) of all banks to 4.0% of Net Demand and Time Liabilities (NDTL) in two equal tranches of 25 bps each with effect from the fortnight beginning December 14, 2024 and December 28, 2024.

This will restore the CRR to 4.0% of NDTL, which was prevailing before the commencement of the policy tightening cycle in April 2022. The move is expected to infuse liquidity boost of ~Rs. 1.16 trn in the banking system. A liquidity decision aligning with the neutral stance.

Revision in Inflation and Growth projections - MPC took note of the recent slowdown in the growth momentum, which also translated into a downward revision in the growth forecast for the current year. RBI has revised down its FY25 GDP projection from 7.2% to now projected 6.6%. RBI has also revised its inflation projections upwards to 4.8% from earlier projected 4.5%. Both the revisions add to the argument for pause in the December-2024 policy and a more data-based approach in the upcoming meetings.

High frequency indicators (HFIs) for the third quarter of 2024- 25 indicate that the Indian economy is recovering from the slowdown in momentum witnessed in Q2, driven by strong festival activity and a sustained upswing in rural demand. The prospects for agriculture and hence rural consumption are looking up with brisk expansion of rabi sowing. On the contrary, India’s current account deficit has been facing some challenges led by depreciating INR and net FPI outflows in second half of 2024. The merchandise trade deficit widened to an all-time high of US$ 37.8 billion in November 2024. Oil deficit rose to US$ 12.4 billion in November-2024 from US$ 7.5 billion a year ago. The share of oil deficit in trade deficit, however, fell to 32.8% in November from 35.4% a year ago. Petroleum products were the largest source of the deficit, followed by gold. On the bright side, our services exports remain resilient and a soft-landing scenario for global growth is supportive of our export economy.

The Centre’s fiscal deficit on financial year to date (FYTD) basis remained under check at 52% of FY25BE, with expenditure growth remaining slow. Receipts were at 59% of FY25 budget estimates (BE), while expenditure was at 57% (capital expenditure at 46%) of FY25BE.

As per sectoral credit deployment data for Nov-24, non-food credit growth across segments showed similar trends as compared to Oct-24 with agriculture credit growing at 15.3% y/y in Nov-24 vs. 15.5% y/y in Oct-24; services growing at 13% y/y in Nov-24 vs. 12.7% y/y in Oct-24 Industry credit growth continued to be in single digits at 8% y/y in Nov- 24 vs. 7.9% y/y in Oct-24.

Domestic Inflation-

Liquidity and Rates -

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Global economic activity has remained resilient and steady. The global composite Purchasing Managers’ Index (PMI) rose to a three-month high in November, recording growth for the thirteenth consecutive month. The acceleration was largely driven by the services sector, which remained in the expansion zone for the twenty-second consecutive month.

Supporting the same, advanced economies’ central banks like the US Federal Reserve decided to lower the target range for the federal funds rate by 25 bps to 4.25-4.50% on December 18, 2024 and indicated that the extent and timing of further adjustments to the target range for the federal funds rate will be based on a careful assessment of the incoming data and the evolving outlook.

The major mover remained the economic projections which saw revisions compared to the Sep-2024 economic projections. The market took the economic projections as hawkish.

This comes after the headline inflation in the United States accelerated for the second consecutive month. US CPI was up 2.7% in November from a year earlier. This was up from 2.6% in October and 2.5% in September 2024. The acceleration reflected an increase in energy prices (which previously had been declining) and an acceleration in food prices.

Following the FED’s decision, global financial markets are emitting mixed signals. Equity markets remained volatile, whereas bond yields have risen on the prospect of larger US fiscal imbalances and an anticipated slowdown in the pace of monetary easing. In the December policy, Bank of England (BOE) left its benchmark interest rate unchanged. The majority expressed concern that accelerating wages and prices added to the risk of inflation persistence. The decision means that the BOE is focused more on inflation than on economic growth.

Global commodity prices recorded divergent movements as gains in energy and agricultural commodity prices were offset by the decline in metal prices. Overall, the commodity prices have been driven down during much of 2024, reflecting a fall in global oil consumption with the declining energy intensity of global GDP.

In Asia, the weakness in China’s economy persists. China’s government has signalled an intention to provide fiscal stimulus meant to boost domestic demand. This is expected to keep pressure on Yuan and other emerging market economies. The pressure on emerging market economies intensify as dollar index gains strength backed by strong growth signals.

The dollar index remained above 108, remaining near its highest levels in two years as investors bet on US economic strength and fewer Federal Reserve rate cuts this year. The dollar index strength has pressured other emerging market and Asian currencies. Japan too has a dual problem of rising inflation and yields and depreciating currency given strong dollar index. Unless an action is taken by Bank of Japan(BOJ), yen is expected to remain under pressure.

Domestic Economy-

In December-2024’sRBI monetary policy, the focus has been on balancing the domestic growth and inflation dynamics while managing the liquidity conditions in the background of currency volatility. RBI kept the repo rate unchanged at 6.5% (with a vote of 4:2). The MPC also decided to continue with the neutral stance on unanimous basis. The key decision was the Cash Reserve Ratio (CRR) cut of 50bps from 4.5% to 4%. To ease the potential liquidity stress, RBI decided to reduce the cash reserve ratio (CRR) of all banks to 4.0% of Net Demand and Time Liabilities (NDTL) in two equal tranches of 25 bps each with effect from the fortnight beginning December 14, 2024 and December 28, 2024.

This will restore the CRR to 4.0% of NDTL, which was prevailing before the commencement of the policy tightening cycle in April 2022. The move is expected to infuse liquidity boost of ~Rs. 1.16 trn in the banking system. A liquidity decision aligning with the neutral stance.

Revision in Inflation and Growth projections - MPC took note of the recent slowdown in the growth momentum, which also translated into a downward revision in the growth forecast for the current year. RBI has revised down its FY25 GDP projection from 7.2% to now projected 6.6%. RBI has also revised its inflation projections upwards to 4.8% from earlier projected 4.5%. Both the revisions add to the argument for pause in the December-2024 policy and a more data-based approach in the upcoming meetings.

High frequency indicators (HFIs) for the third quarter of 2024- 25 indicate that the Indian economy is recovering from the slowdown in momentum witnessed in Q2, driven by strong festival activity and a sustained upswing in rural demand. The prospects for agriculture and hence rural consumption are looking up with brisk expansion of rabi sowing. On the contrary, India’s current account deficit has been facing some challenges led by depreciating INR and net FPI outflows in second half of 2024. The merchandise trade deficit widened to an all-time high of US$ 37.8 billion in November 2024. Oil deficit rose to US$ 12.4 billion in November-2024 from US$ 7.5 billion a year ago. The share of oil deficit in trade deficit, however, fell to 32.8% in November from 35.4% a year ago. Petroleum products were the largest source of the deficit, followed by gold. On the bright side, our services exports remain resilient and a soft-landing scenario for global growth is supportive of our export economy.

The Centre’s fiscal deficit on financial year to date (FYTD) basis remained under check at 52% of FY25BE, with expenditure growth remaining slow. Receipts were at 59% of FY25 budget estimates (BE), while expenditure was at 57% (capital expenditure at 46%) of FY25BE.

As per sectoral credit deployment data for Nov-24, non-food credit growth across segments showed similar trends as compared to Oct-24 with agriculture credit growing at 15.3% y/y in Nov-24 vs. 15.5% y/y in Oct-24; services growing at 13% y/y in Nov-24 vs. 12.7% y/y in Oct-24 Industry credit growth continued to be in single digits at 8% y/y in Nov- 24 vs. 7.9% y/y in Oct-24.

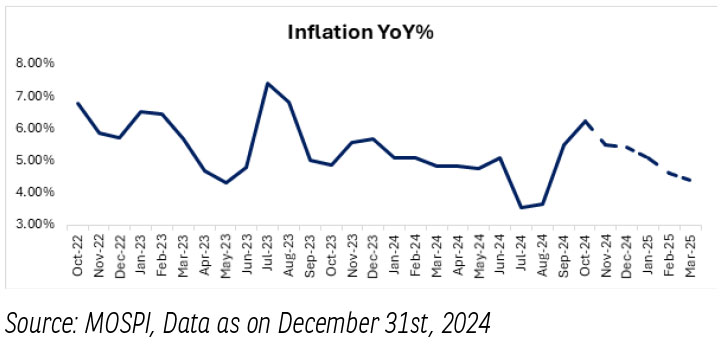

Domestic Inflation-

- Inflation moderated in Nov-24 at 5.48% from the high of above 6% in Oct-24 as vegetables inflation witnessed a M-o-M decline of 4.5%.

- A sequential decline of -0.15% M-o-M, after nine months brings a relief.

- Core inflation inched to 3.7% vs 3.5% last month with 0.5% M-o-M.

- We expect inflation to soften further in Q4 FY25 and slowly converse closer to 4.5% in Q4 FY25.

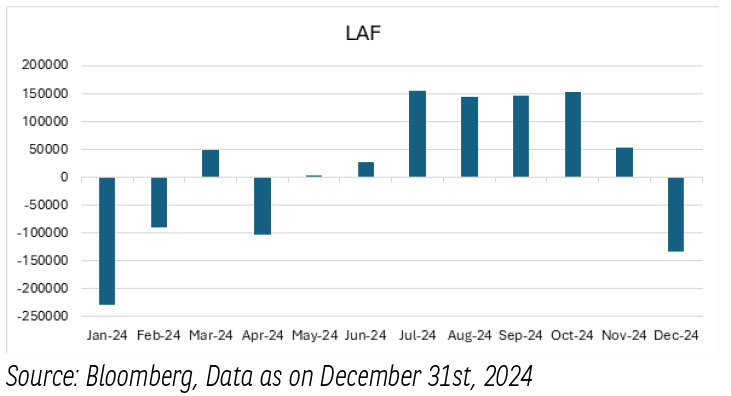

Liquidity and Rates -

- Liquidity conditions remained tight in December-2024 led by advance tax payments and RBI’s intervention in forex markets. The deficit, which crossed Rs. 2 trillion as on December 27, 2024 is down to ~Rs. 1 trillion led by second tranche of CRR cut coming into effect and government spending.

- Going forward, liquidity conditions will be attuned to the extent of government spending and RBI’s FX operation in an effort to support rupee.

- Global monetary policy dynamics have started witnessing bumps in their path to recalibrate the monetary rates. US FOMC’s shift in the forward guidance and the recent pickup in inflation must be carefully monitored.

- US policy actions by the newly elected government and resultant impact on inflation/growth and employment dynamics.

- The BOJ balancing of consistent inflation and thereby resultant rise in bond yields on one side and depreciating currency versus the dollar.

- The impact of the recently announced fiscal policies by China to support its economy and resultant impact on commodities.

- On the domestic front, Global headwinds are expected to pressure INR which will have spillovers over domestic liquidity. Recent moves by RBI gives us the confidence that liquidity will be managed in spirit of the stance.

- We expect RBI to use different methods of liquidity management to offset any major setback from global headwinds.

- On Growth, the dent of Q2 FY25 on domestic growth cannot be ignored. RBI itself has revised the GDP projection downward for the full year and this assumes greater significance going forward for policy action

- At the same time, inflation has seen significant relief in November-2024, and the forward trajectory also looks optimistic with projected inflation for Q1 FY26 converging to 4%.

- The fundamentals of India’s fiscal demand supply continue to remain balanced and that is expected to maintain a downside bias on yield over medium term.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.