Stock markets have remained volatile, with the Nifty declining by 6% in the month of Feb 2025, underperforming some developed markets like the US S&P 500 -1.4% and Nasdaq

-3.9%. Furthermore, India also underperformed emerging markets, which rose 5% in the same period. Despite recent underperformance, India's long-term performance over the

past decade has been strong, with a CAGR of 12% compared to the MSCI Emerging Markets' 4%.

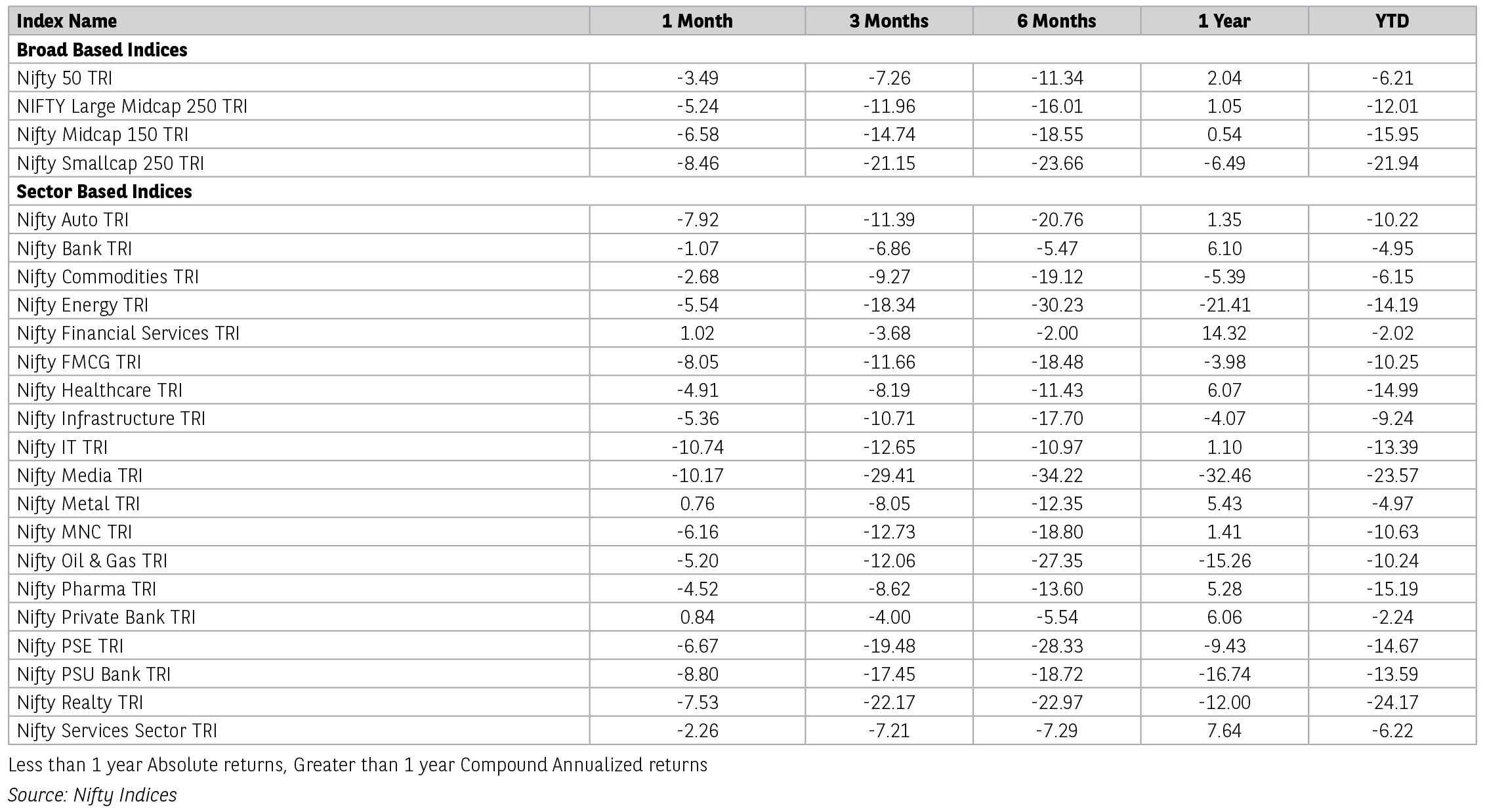

Nifty Small Cap 250 Index fell by 13% and Nifty Midcap 150 Index by 11% over the Feb month 2025. Sector-wise, most sectors ended in the red. Notable declines was witnessed in FMCG (10.9%) Realty (13.4%), Capital goods (14.4%), IT (12.5%), Oil and gas and PSU Banks (13.5%), Pharma (7%), and Metal (3%). Private banks were relatively resilient. Nifty index have corrected by 14 % over the last six months; Small Cap 250 Index down by 25%; Nifty 100 down 16% and Nifty Midcap down 20%.

Trump policies on tariff weighed on investor sentiments through the month. Globally, trade tensions persist, with the US imposing tariffs on several countries and considering reciprocal tariffs on India and China. The US trade deficit with India is significantly lower than with China, making the situation a "wait and watch" scenario. Dollar index (DXY) depreciated during the month, however, continues to be at elevated levels of 107.

Consequently, Foreign Portfolio Investor (FPI) flows have experienced their second consecutive month of outflows, with January seeing an outflow of approximately USD12.4 bn and February witnessing around USD2.3 bn, totalling about USD11.4 bn in 2025. This follows a net outflow of USD 0.8 bn in 2024. Notably, this trend is not unique to India, as other emerging markets like Brazil, Thailand, and Vietnam have also faced outflows, though India's were significantly higher. Domestic flows, however, remain strong, with the last two months' Domestic institutional investor (DII) flows reaching USD 17.5 bn.

Recent U.S. economic indicators have fallen short of expectations; US S&P Global Flash Composite PMI experienced a significant decline, dropping to 50.4 in February from 52.7 in January. While the S&P Global Flash Manufacturing PMI increased to 51.6 , up from 51.2, while the S&P Global Flash Services PMI fell sharply to 49.7, down from 52.9, which is negative for US. This situation has intensified pressure on the market. Additionally, existing home sales in the US decreased by 4.9% in January, reaching a seasonally adjusted annualized rate of 4.08 million, compared to a smaller decline of 2.9% in December.

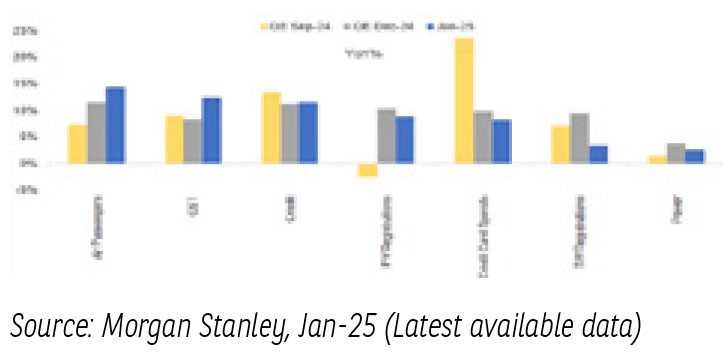

In India, recent high-frequency data indicates an urban economic slowdown as reflected by decline in housing sales. However, optimism arises from the Union Budget's announcement of a personal income tax cut worth Rs1 trillion for FY26, which could boost urban consumption. Additionally, easing inflation provides the Reserve Bank of India (RBI) flexibility to continue reducing repo rates in FY26, further supporting recovery.

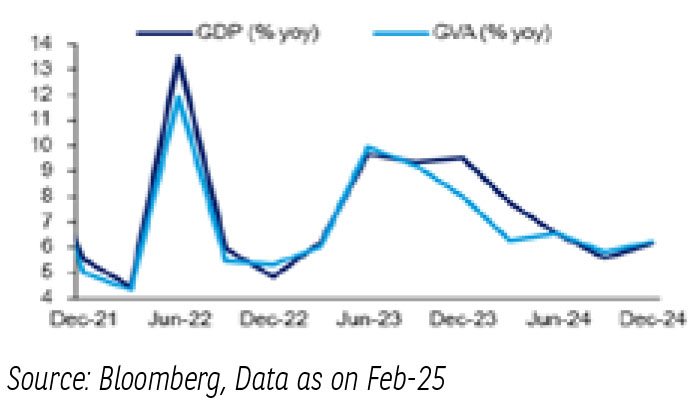

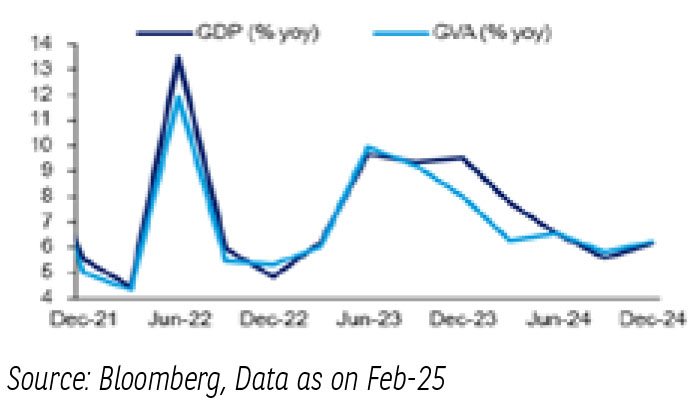

Meanwhile, India’s Q3FY25 GDP growth rebounded to 6.2% YoY, up from 5.4% in Q2FY25. Amongst high frequency indicators, inflation (CPI) eased to 4.3% in January vs 5.2% in Dec 2024; Industrial Production (IIP) slowed to 3.2% in Dec 2024.

Earnings season just concluded. 3Q FY25 Earnings for Nifty 500 Companies witnessed some uptick in earnings with YoY growth of 8% as compared to the previous two quarters with Earnings growth of 4% in 1Q FY25 and -1% in 2Q FY25. Amongst these large cap companies reported 7% growth, midcap companies grew earnings by 27%, while small cap companies earnings declined by 2% YoY. Key sectors driving growth included BFSI, IT, telecom, healthcare, and capital goods.

Looking ahead, earnings growth expectations are set at 15% for the next two years, with consumption recovery, monsoons, and capex spending being crucial factors to watch. Sectors like cement, capital goods, metals, telecom, and financials are poised for strong growth, while IT is expected to maintain steady growth.

In January 2025, India's consumer sentiment improved, with the Index of Consumer Sentiments (ICS) rising by 1.1%. Both urban and rural areas saw gains, with rural areas experiencing a stronger recovery due to increased optimism about current and future economic conditions. Domestic demand is likely to improve led by lower food inflation, 25bps rate cut by RBI and higher liquidity infusion, personal tax cuts and continued focus on capex in select sectors.

The Indian equity markets faced a turbulent month, with heightened volatility and geopolitical concerns impacting global sentiment. The continued correction since mid-September 2024 has pushed Nifty-50 valuations below the 10-year average of 20x one-year forward P/E. Policy measures by the Government of India and the RBI offer hope for a consumptiondriven recovery in FY26F, though global policies and currency fluctuations remain risks. Softer crude oil prices and global geopolitical stability (assuming resolution of the Russia- Ukraine conflict) augurs well for Emerging Markets(EM) in general and India in particular.

Source: Kotak Securities Ltd, Bloomberg & Incred Research.. Data as of Feb 28th, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas mutual fund for the month ending February 2025 for disclaimers.

Nifty Small Cap 250 Index fell by 13% and Nifty Midcap 150 Index by 11% over the Feb month 2025. Sector-wise, most sectors ended in the red. Notable declines was witnessed in FMCG (10.9%) Realty (13.4%), Capital goods (14.4%), IT (12.5%), Oil and gas and PSU Banks (13.5%), Pharma (7%), and Metal (3%). Private banks were relatively resilient. Nifty index have corrected by 14 % over the last six months; Small Cap 250 Index down by 25%; Nifty 100 down 16% and Nifty Midcap down 20%.

Trump policies on tariff weighed on investor sentiments through the month. Globally, trade tensions persist, with the US imposing tariffs on several countries and considering reciprocal tariffs on India and China. The US trade deficit with India is significantly lower than with China, making the situation a "wait and watch" scenario. Dollar index (DXY) depreciated during the month, however, continues to be at elevated levels of 107.

Consequently, Foreign Portfolio Investor (FPI) flows have experienced their second consecutive month of outflows, with January seeing an outflow of approximately USD12.4 bn and February witnessing around USD2.3 bn, totalling about USD11.4 bn in 2025. This follows a net outflow of USD 0.8 bn in 2024. Notably, this trend is not unique to India, as other emerging markets like Brazil, Thailand, and Vietnam have also faced outflows, though India's were significantly higher. Domestic flows, however, remain strong, with the last two months' Domestic institutional investor (DII) flows reaching USD 17.5 bn.

Recent U.S. economic indicators have fallen short of expectations; US S&P Global Flash Composite PMI experienced a significant decline, dropping to 50.4 in February from 52.7 in January. While the S&P Global Flash Manufacturing PMI increased to 51.6 , up from 51.2, while the S&P Global Flash Services PMI fell sharply to 49.7, down from 52.9, which is negative for US. This situation has intensified pressure on the market. Additionally, existing home sales in the US decreased by 4.9% in January, reaching a seasonally adjusted annualized rate of 4.08 million, compared to a smaller decline of 2.9% in December.

In India, recent high-frequency data indicates an urban economic slowdown as reflected by decline in housing sales. However, optimism arises from the Union Budget's announcement of a personal income tax cut worth Rs1 trillion for FY26, which could boost urban consumption. Additionally, easing inflation provides the Reserve Bank of India (RBI) flexibility to continue reducing repo rates in FY26, further supporting recovery.

Meanwhile, India’s Q3FY25 GDP growth rebounded to 6.2% YoY, up from 5.4% in Q2FY25. Amongst high frequency indicators, inflation (CPI) eased to 4.3% in January vs 5.2% in Dec 2024; Industrial Production (IIP) slowed to 3.2% in Dec 2024.

Earnings season just concluded. 3Q FY25 Earnings for Nifty 500 Companies witnessed some uptick in earnings with YoY growth of 8% as compared to the previous two quarters with Earnings growth of 4% in 1Q FY25 and -1% in 2Q FY25. Amongst these large cap companies reported 7% growth, midcap companies grew earnings by 27%, while small cap companies earnings declined by 2% YoY. Key sectors driving growth included BFSI, IT, telecom, healthcare, and capital goods.

Looking ahead, earnings growth expectations are set at 15% for the next two years, with consumption recovery, monsoons, and capex spending being crucial factors to watch. Sectors like cement, capital goods, metals, telecom, and financials are poised for strong growth, while IT is expected to maintain steady growth.

In January 2025, India's consumer sentiment improved, with the Index of Consumer Sentiments (ICS) rising by 1.1%. Both urban and rural areas saw gains, with rural areas experiencing a stronger recovery due to increased optimism about current and future economic conditions. Domestic demand is likely to improve led by lower food inflation, 25bps rate cut by RBI and higher liquidity infusion, personal tax cuts and continued focus on capex in select sectors.

The Indian equity markets faced a turbulent month, with heightened volatility and geopolitical concerns impacting global sentiment. The continued correction since mid-September 2024 has pushed Nifty-50 valuations below the 10-year average of 20x one-year forward P/E. Policy measures by the Government of India and the RBI offer hope for a consumptiondriven recovery in FY26F, though global policies and currency fluctuations remain risks. Softer crude oil prices and global geopolitical stability (assuming resolution of the Russia- Ukraine conflict) augurs well for Emerging Markets(EM) in general and India in particular.

Source: Kotak Securities Ltd, Bloomberg & Incred Research.. Data as of Feb 28th, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas mutual fund for the month ending February 2025 for disclaimers.

Global Economy-

The Global dynamics is filled with uncertainty and markets are dancing on the edge. Looking carefully, the fundamentals have improved since 2022, be it inflation which has come down for major economies as well as growth has found a stable ground, but still the markets are repricing especially Emerging Market Economies (EMEs) are witnessing selling pressures from foreign portfolio investors and currency depreciation. All the hysteria stems out from recent US tariffs and trade policy. A US first approach has set a changing dynamic between US and countries, even the closet allies for years are facing the heat.

The immediate reaction of current geopolitical tensions has been visible in currency markets with dollar index strength leading to depreciation of emerging market currencies. Overall global yields remained attuned to movement in US treasury yields.

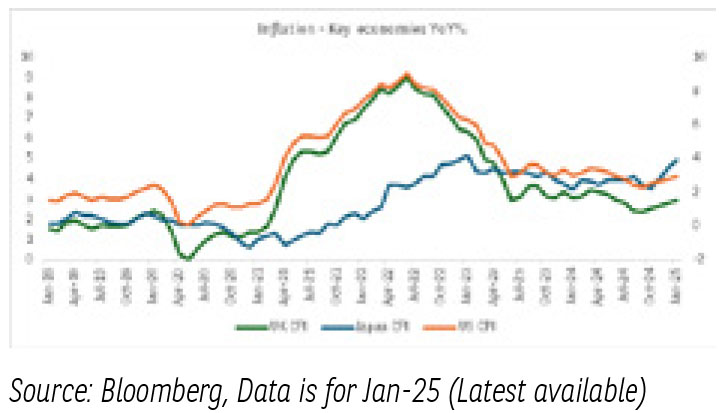

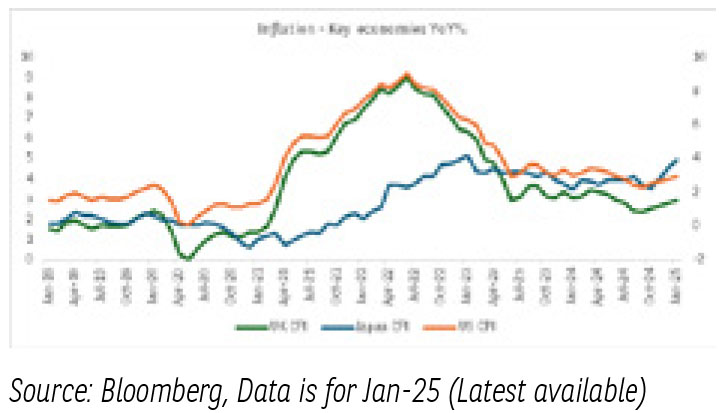

Another key development globally was visible in inflation numbers. Japan’s inflation climbed to 4% y/y in Jan-2025. Whereas US inflation remained at 3% with sticky core. Along with US, eurozone inflation is also seeming to inch up with Germany at 4% in Jan-25, highest since Aug-23. The divergent macroeconomic conditions are reflected in monetary policy actions across countries. With US keeping its policy rate unchanged, Japan, however, hiked its policy rate by 25 bps.

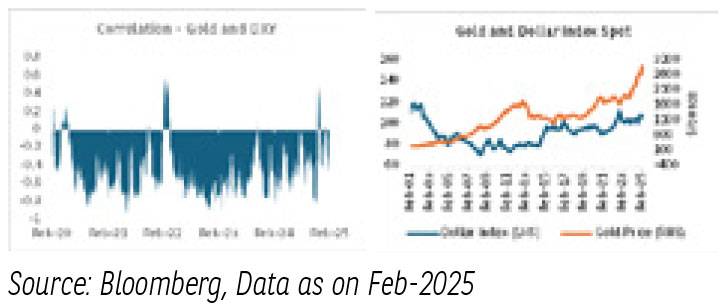

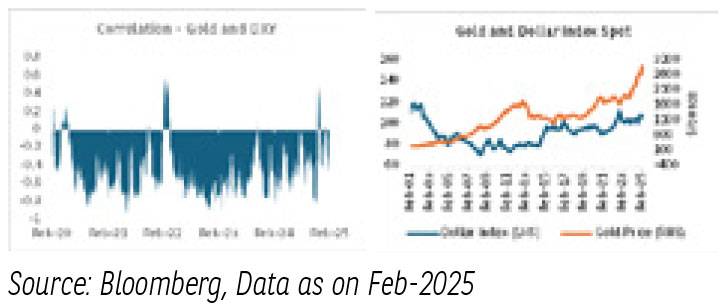

The commodities have an interesting twist. Gold prices have been trading at its all time high in Feb-2025, trading as high as 2950$/ounce. The interesting part is that historically rise of both gold and dollar index is an unlikely event. Historically, gold has a shown a negative correlation with the dollar, except for a few instances such as during the Russia Ukraine war. The gold market has undergone fundamental changes over the last few years, ultimately leading to one of the biggest rises in prices in the last decade. On the contrary, brent prices continued to remain range bound hovering around 72-75$/bl.

China’s economic policies have been in light to support its ailing economy. Last two years China’s Government and Central Bank have laid out supportive measures with loose monetary and fiscal policies. The fiscal and monetary impetus can reflect in growth recovery and should be a key watch.

Domestic Economy-

The Indian economy is regaining its growth momentum driven by recovery in consumption demand and overall investment. The Q3 FY25 numbers reflected India’s GDP growth to have bottomed out and has seen modest improvement relatively to Q2 FY25. Real GDP growth in Q3 FY25 stood at 6.2% y/y. Nominal GDP growth stood at 9.9% y/y. More importantly the future trajectory has seen some positive revisions. The second advanced estimates have projected FY25 GDP growth at 6.5% y/y better than first advance estimates of 6.4% y/y. This implies that the worst of India’s growth reflected in Q2 FY25 is behind us.

RBI Monetary Policy Committee (MPC) after a span of 5 years unanimously delivered a rate cut of 25bps. Economic Growth to have taken precedence over inflation. Currency concerns were evident in this monetary policy. RBIs commitment to provide sufficient liquidity to the banking system was re iterated and was encouraging.

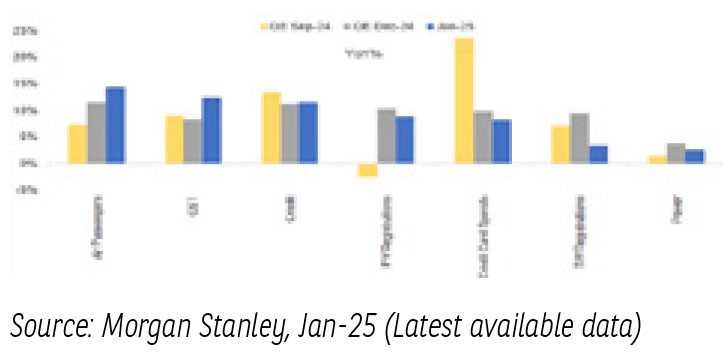

High frequency indicators suggest that demand economy is recovering from the slowdown witnessed in H1 FY25. E-way bills growth accelerated to 23.1% in Jan-25. The two-wheeler segment saw a recovery, primarily driven by a surge in scooter sales. Tractor sales recorded double digit growth for the second consecutive month.

India’s Manufacturing Purchasing Managers Index registered 56.3 in Feb-25, down from 57.7 in Jan-25 but still indicative of a further robust improvement in the health of the manufacturing sector. The survey highlighted new export orders rose strongly in Feb-25, as manufacturers continued to capitalise on robust global demand for their goods

On the fiscal front, fiscal deficit touched 76% of Budget estimates. Income tax remains strong at 22% y/y on YTD basis. Indirect taxes including GST collections grew by 9% y/y in line with budget estimates.

Domestic Inflation-

Domestic Liquidity –

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

The Global dynamics is filled with uncertainty and markets are dancing on the edge. Looking carefully, the fundamentals have improved since 2022, be it inflation which has come down for major economies as well as growth has found a stable ground, but still the markets are repricing especially Emerging Market Economies (EMEs) are witnessing selling pressures from foreign portfolio investors and currency depreciation. All the hysteria stems out from recent US tariffs and trade policy. A US first approach has set a changing dynamic between US and countries, even the closet allies for years are facing the heat.

The immediate reaction of current geopolitical tensions has been visible in currency markets with dollar index strength leading to depreciation of emerging market currencies. Overall global yields remained attuned to movement in US treasury yields.

Another key development globally was visible in inflation numbers. Japan’s inflation climbed to 4% y/y in Jan-2025. Whereas US inflation remained at 3% with sticky core. Along with US, eurozone inflation is also seeming to inch up with Germany at 4% in Jan-25, highest since Aug-23. The divergent macroeconomic conditions are reflected in monetary policy actions across countries. With US keeping its policy rate unchanged, Japan, however, hiked its policy rate by 25 bps.

The commodities have an interesting twist. Gold prices have been trading at its all time high in Feb-2025, trading as high as 2950$/ounce. The interesting part is that historically rise of both gold and dollar index is an unlikely event. Historically, gold has a shown a negative correlation with the dollar, except for a few instances such as during the Russia Ukraine war. The gold market has undergone fundamental changes over the last few years, ultimately leading to one of the biggest rises in prices in the last decade. On the contrary, brent prices continued to remain range bound hovering around 72-75$/bl.

China’s economic policies have been in light to support its ailing economy. Last two years China’s Government and Central Bank have laid out supportive measures with loose monetary and fiscal policies. The fiscal and monetary impetus can reflect in growth recovery and should be a key watch.

Domestic Economy-

The Indian economy is regaining its growth momentum driven by recovery in consumption demand and overall investment. The Q3 FY25 numbers reflected India’s GDP growth to have bottomed out and has seen modest improvement relatively to Q2 FY25. Real GDP growth in Q3 FY25 stood at 6.2% y/y. Nominal GDP growth stood at 9.9% y/y. More importantly the future trajectory has seen some positive revisions. The second advanced estimates have projected FY25 GDP growth at 6.5% y/y better than first advance estimates of 6.4% y/y. This implies that the worst of India’s growth reflected in Q2 FY25 is behind us.

RBI Monetary Policy Committee (MPC) after a span of 5 years unanimously delivered a rate cut of 25bps. Economic Growth to have taken precedence over inflation. Currency concerns were evident in this monetary policy. RBIs commitment to provide sufficient liquidity to the banking system was re iterated and was encouraging.

High frequency indicators suggest that demand economy is recovering from the slowdown witnessed in H1 FY25. E-way bills growth accelerated to 23.1% in Jan-25. The two-wheeler segment saw a recovery, primarily driven by a surge in scooter sales. Tractor sales recorded double digit growth for the second consecutive month.

India’s Manufacturing Purchasing Managers Index registered 56.3 in Feb-25, down from 57.7 in Jan-25 but still indicative of a further robust improvement in the health of the manufacturing sector. The survey highlighted new export orders rose strongly in Feb-25, as manufacturers continued to capitalise on robust global demand for their goods

On the fiscal front, fiscal deficit touched 76% of Budget estimates. Income tax remains strong at 22% y/y on YTD basis. Indirect taxes including GST collections grew by 9% y/y in line with budget estimates.

Domestic Inflation-

- Headline inflation has softened to 4.3% in January-25 led by favourable base effect and sharper decline in vegetable prices.

- The estimate for Feb-25 inflation is tracking around 4.1%, after account for continued decline in food prices.

- The daily food price data by department of consumer affairs indicates further decline in vegetable prices in February-25 led by improving supplies and seasonal winter crop arrival.

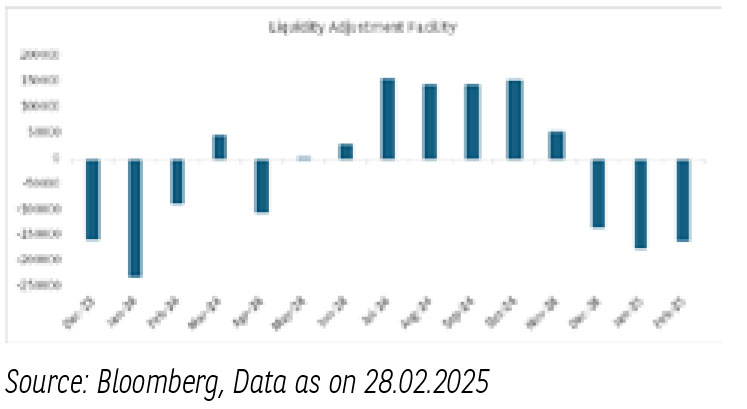

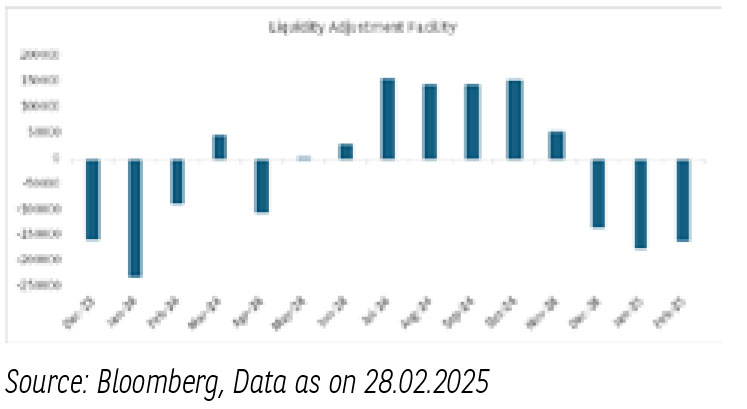

Domestic Liquidity –

- Liquidity continued to remain in the deficit zone, but the tightness eased driven by Cash reserve ratio (CRR) drawdown, Open market operations (OMO) purchases and RBI’s Forex (FX) swap auctions.

- Following the liquidity conditions, overnight rates declined to 6.2%.

- The year-end government spending is expected to offset the tightness by end-March.

- Any forex intervention remains a risk to our expectations.

- Global monetary policy dynamics have started witnessing bumps in their path to recalibrate the monetary rates.

- US Fed’s shift in the forward guidance and the recent pickup in inflation must be carefully monitored.

- Trumps tariff threats and spillovers on currencies is the existing risk that is driving the markets volatile.

- Going forward RBI may remain pro-growth especially as inflation aligns with the targeted levels.

- RBI has been and is expected to continue infusing liquidity through OMO, FX swap in essence of the monetary policy stance.

- Irrespective of the tools, liquidity measures are expected to have an impact on the short end of the curve.

- The spreads on the short end are already elevated and attractive and a rate cut going forward may compress the current spreads.

- Having said that, the fundamentals of India’s fiscal demand supply remain balanced and that is expected to maintain a downside bias on yields.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.