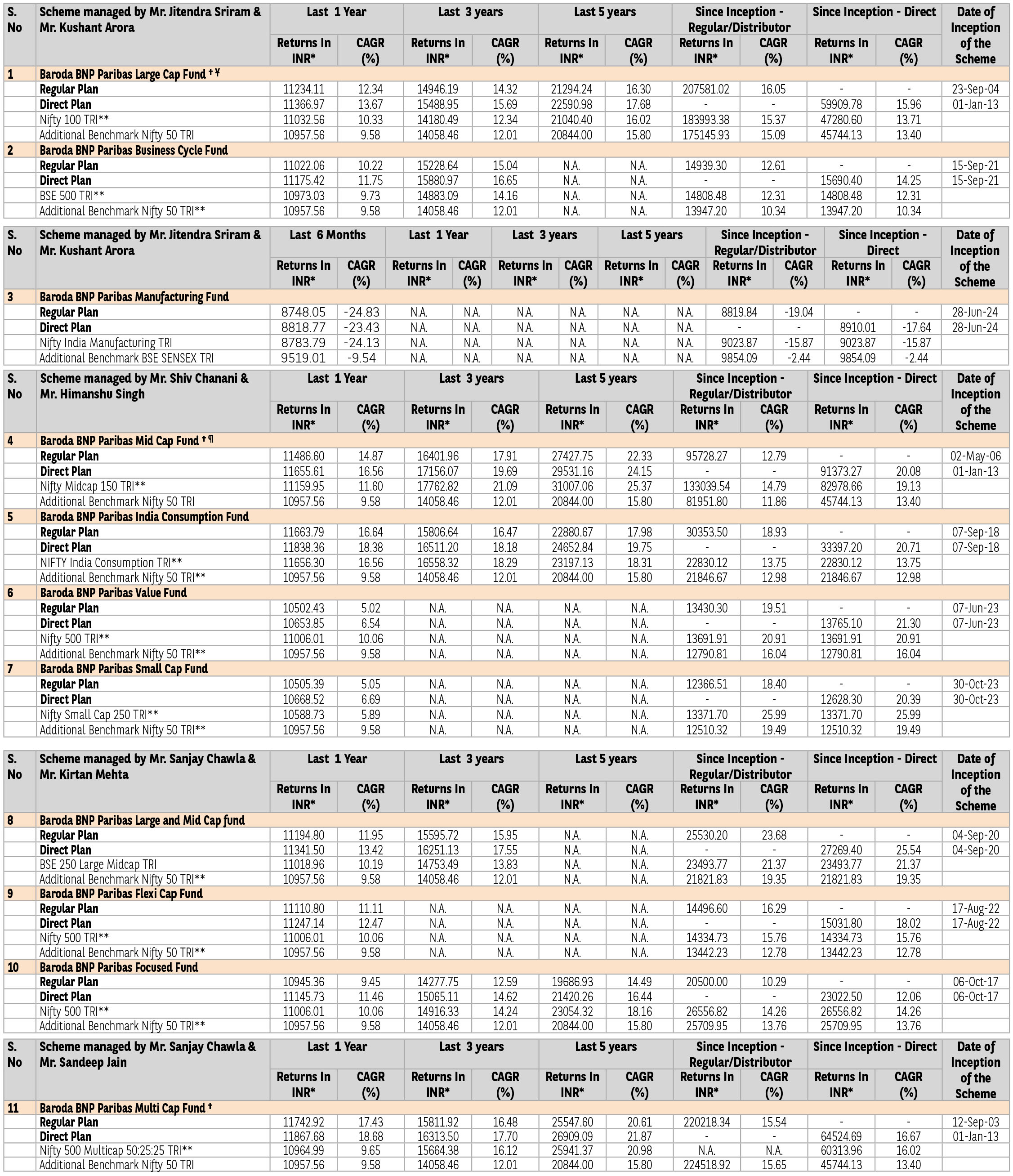

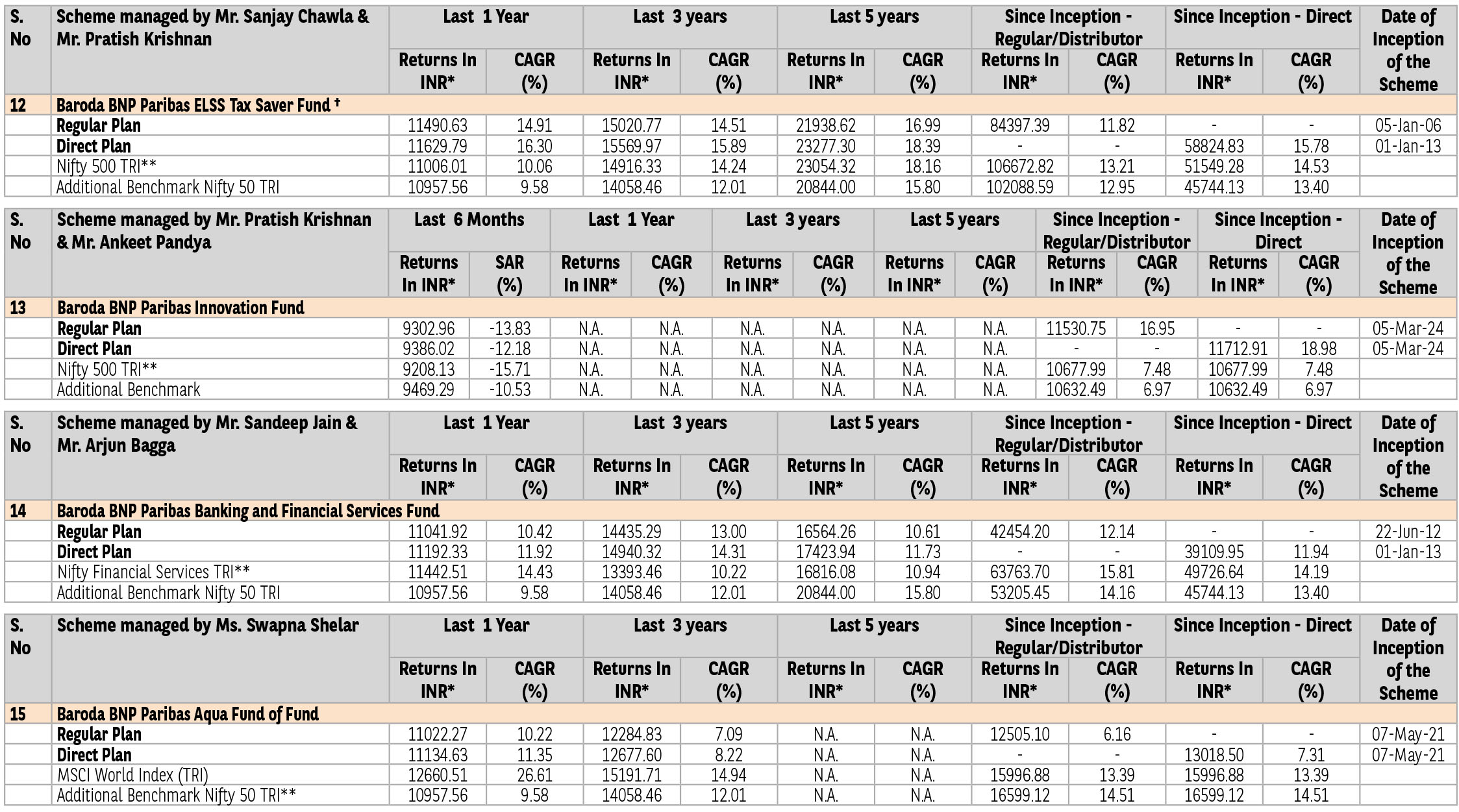

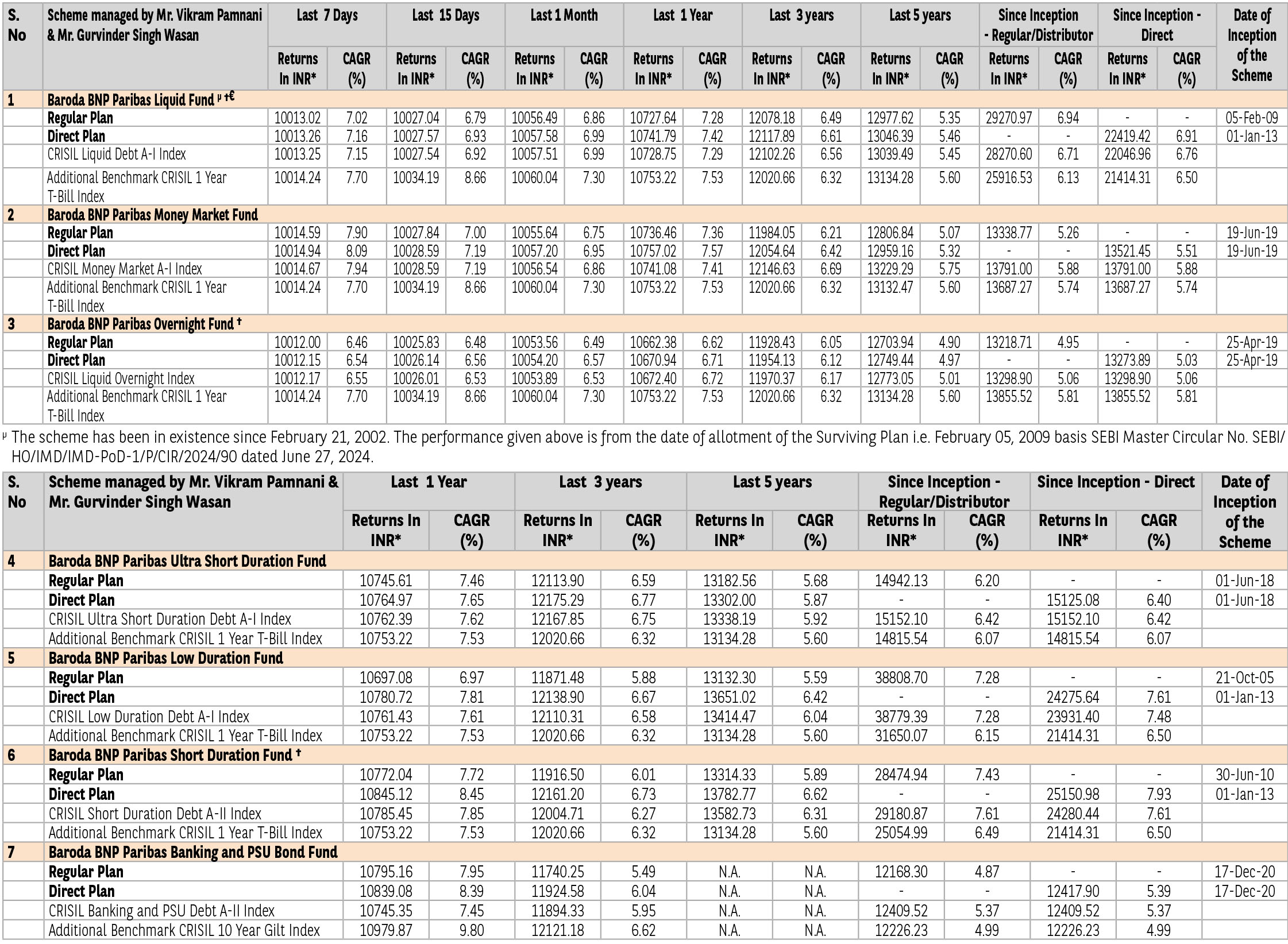

Performance of Schemes

(as on January 31, 2025)

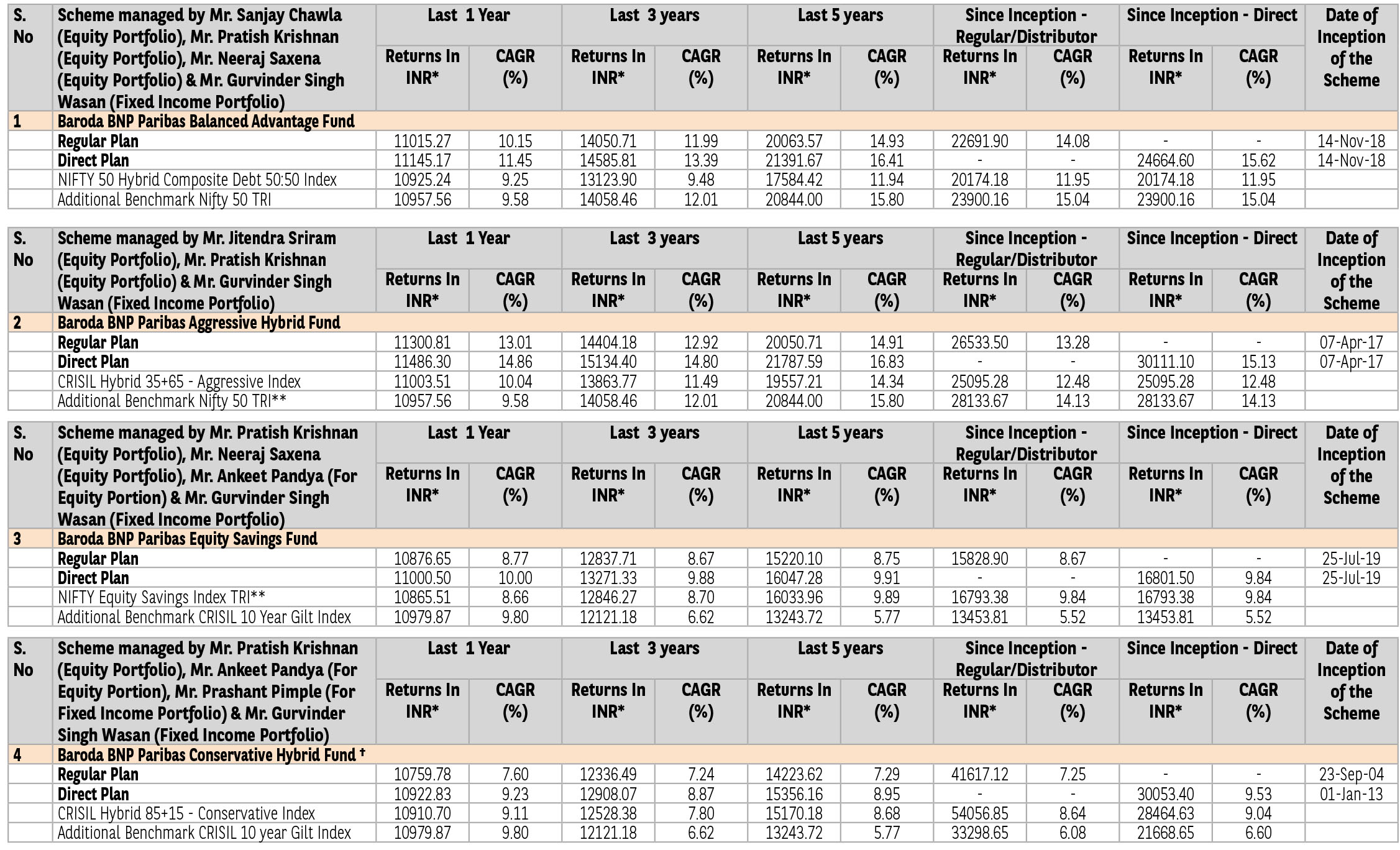

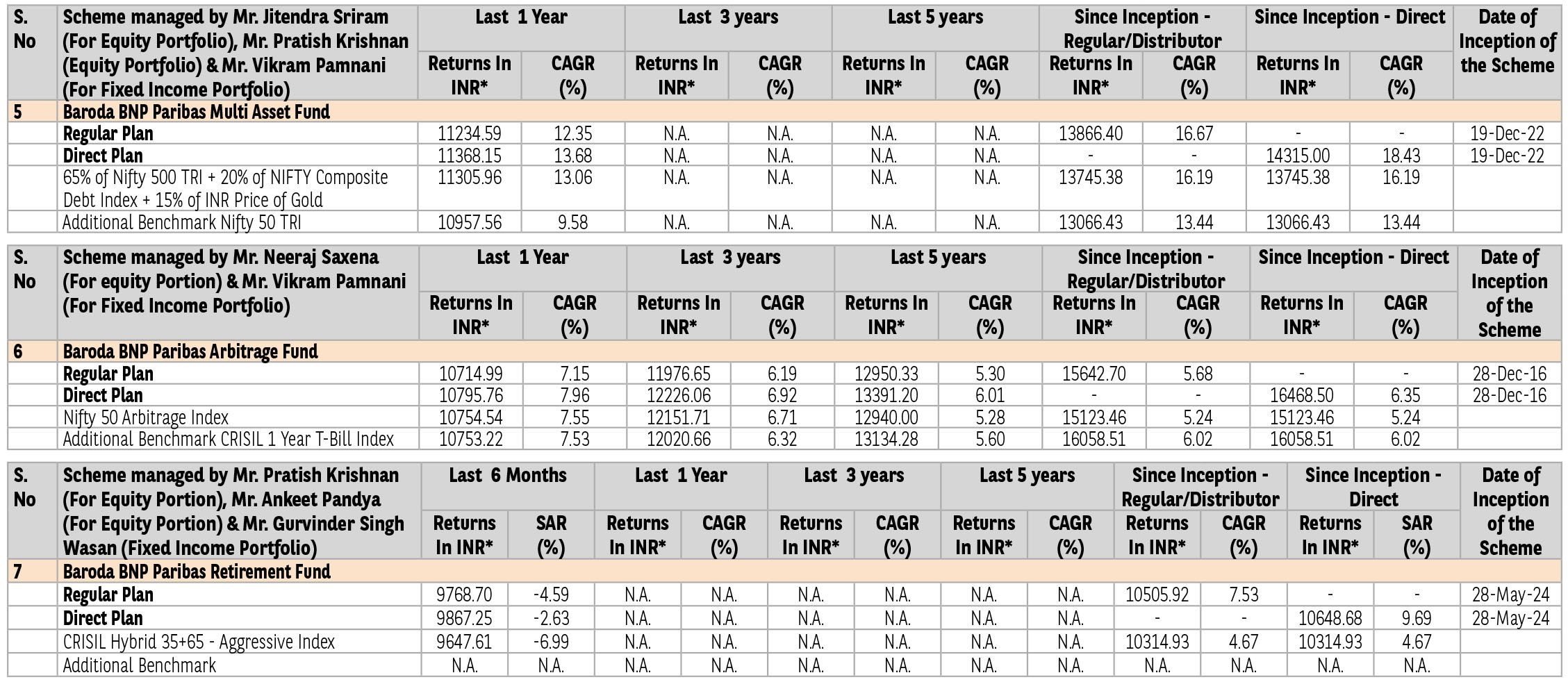

Performance of Schemes

(as on January 31, 2025)

Where scheme performance for last 3 and 5 years is not available, the same has not been shown. Performance of Baroda BNP Paribas Dividend Yield Fund, Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund, Baroda BNP Paribas Nifty Midcap 150 Index Fund

& Baroda BNP Paribas Children's Fund is not provided as the scheme has not completed 6 months.

$ Impact of segregation Fall in NAV - Mar 6, 2020 v/s Mar 5, 2020 : -21.82%

$ $ Impact of segregation Fall in NAV - Mar 6, 2020 v/s Mar 5, 2020 : -2.24%

μμ The inception date of Baroda BNP Paribas Corporate Bond Fund is November 8, 2008. However, since there was no continuous NAV history available for this plan prior to May 10, 2010, the point to point return from since inception may not be the true

representation of the performance of the scheme. Hence the returns since May 10, 2010 have been considered for calculating performance for the since inception.

† The scheme is a ‘Transferee Scheme’, and accordingly, the performance is being provided in accordance with para 13.4 of SEBI Master Circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 whereby the weighted average performance of

both the Transferor Scheme and Transferee Scheme has been considered.

* Returns in INR show the value of 10,000/- invested for last 1 year, last 3 years, last 5 years and since inception respectively.

** Total Return Index: Total Return Index: The total return index is a type of equity index that tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. Looking

at an index’s total return displays a more accurate representation of the index’s performance. By assuming dividends are reinvested, you effectively account for stocks in an index that do not issue dividends and instead, reinvest their earnings within the

underlying company. For example, an investment may show an annual yield of 4% along with an increase in share price of 6%. While the yield is only a partial reflection of the growth experienced, the total return includes both yields and the increased value

of the shares to show a growth of 10%.

Difference between total return index & price index: A total return index (TRI) is different from a price index. A price index only considers price movements (capital gains or losses) of the securities that make up the index, while a total return index includes

dividends, interest, rights offerings and other distributions realized over a given period of time.

¥ The scheme has been in existence since September 23, 2004. The performance given above is the blended performance of erstwhile BNP Paribas Large Cap Fund and erstwhile Baroda Large Cap Fund in accordance with para 13.4 of SEBI Master Circular No.

SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024. The performance has been blended from Oct 03, 2016, i.e., the effective date of the change in the fundamental attribute of Baroda Infrastructure Fund to convert it to Baroda Large Cap Fund.

¶ The scheme has been in existence since May 02, 2003. The performance given above is the blended performance of erstwhile BNP Paribas Mid cap Fund and erstwhile Baroda Mid cap Fund in accordance with para 13.4 of SEBI Master Circular No. SEBI/HO/

IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024. The performance has been blended from Oct 03, 2016, i.e., the effective date of the change in the fundamental attribute of Baroda PSU Equity Fund to convert it to Baroda Mid Cap Fund.

Click here for fund manager and managing since details.