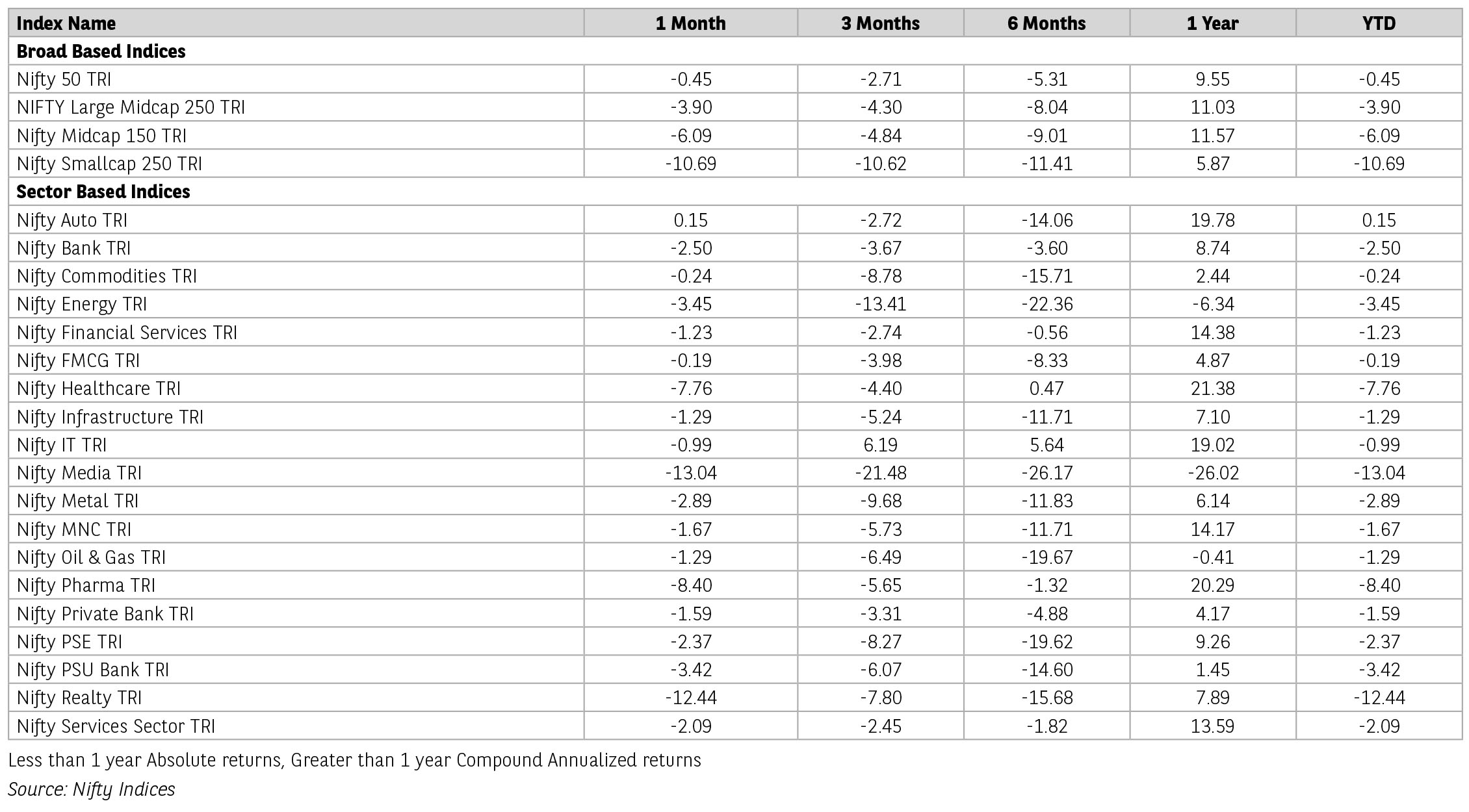

The Nifty Index declined 0.6% in the month of January 2025, registering its fourth consecutive monthly loss. Mid-cap and small-cap indices experienced sharper declines,

falling 6% and 10%, respectively. Sector-wise, all sectors ended in red, with real estate, consumer durables and healthcare declining 13%, 10% and 8%, respectively.

Concerns about US trade policies, geopolitical tensions; depreciating rupee and high crude oil prices during the month weighed on investor sentiment. Global markets ended

mixed. The Philippines (-10%), Thailand (-6%) and Malaysia (-5%) declined the most, whereas Germany (+9%), France (+8%) and the UK (+6%) gained the most. Foreign

Portfolio Investor (FPI’s) sold USD8.6 bn of Indian equities in the secondary market, whereas Domestic institutional investor(DIIs) bought USD 10 bn (until Jan 31, 2025).

The US Fed maintained status quo on policy rates. As feared US imposed tariffs on three major exporters to the US. The US administration’s decision to impose 25% import tariffs on imports of goods from Canada (10% on oil and related items) and Mexico and an additional 10% import tariff on imports of goods from China will likely lead to a sharp increase in global macroeconomic uncertainty (growth, inflation), micro-level uncertainty for US companies and exporters affected by the tariffs and risk-off sentiment among global markets.

Locally, the high-frequency data improvement seen till Nov 2024 in the Index of Industrial Production, vehicle sales, and consumer sentiment has started to fizzle, as seen in Dec 2024 data points on Goods and Services Tax collections, rising channel inventory and credit growth slowdown. On the economy front, Consumer Price Index (CPI) inflation for December 2024 softened to 5.2% from 5.5% in November 2024. Wholesale Price Index (WPI) inflation for December 2024 was at 2.4% YoY compared to 1.9% in November 2024.

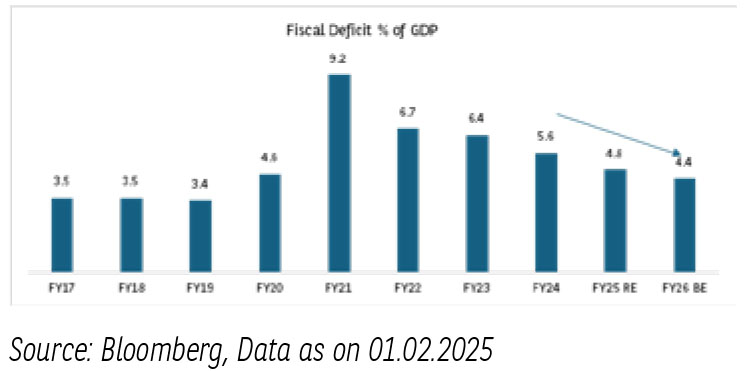

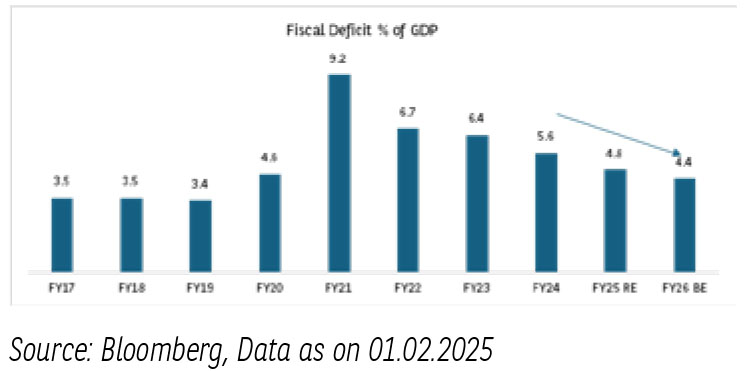

The FY2026 Union Budget reflected government’s continued focus on gradual consolidation, while providing a boost to consumption. The government budgeted Gross Fiscal Deficit (GFD)/GDP at 4.4%, led by a 10.8% increase in gross tax revenues, a 6.7% increase in revenue expenditure and a 10% increase in capex. The government left corporate tax rates unchanged but raised the exemption and upper limit of various tax slabs for individual income tax. Addressing the urban consumption demand slowdown challenges by reducing income-tax rates across tax slabs is a good move. This should help improve the credit rating of individuals, improve discretionary spending, help fill capacities and drive private capex in the coming quarters. Improving the quality of Fiscal Deficit (FD) by cutting subsidies provide comfort.

The large Rs1tn income-tax concession spread across brackets is a bold move; however, expecting a 14% collection growth looks ambitious. The capital expenditure is projected to rise by 9.8% YoY, driven by spending on defence while the flattish trend for road and railway sectors disappoints. Policy initiatives to allow 100% Foreign direct investment (FDI) in the insurance sector, new income-tax code and incentives for the labour-intensive Micro, Small, and Medium Enterprises (MSME) sector provide comfort.

The government did not make any major changes to customs duty rates or taxation policies for sectors, with minor changes in a few emerging sectors. Other sectorspecific announcements are supporting urban housing, supporting the manufacturing of emerging technologies, incentivizing states to undertake power sector reforms, custom duty changes for a few sectors and higher outlay for metro projects, among others. At the same time, moderation in capex intensity is visible across a number of sectors such as railways and roads.

133 companies in BSE200 (73% of market cap) have reported their Q3 FY25 results so far. IT, Energy, Banks and NBFC are largely done. Net sales growth held up at 5.5% YoY vs 4.6% in Q3 FY 25, while EBIT growth improved to 9% YoY vs a decline of 4% in Q2 FY 25. Ex-Energy/ Metals, the trend is better with sales growth at 10% and EBIT growth at 13% in Q3 FY 25(12% in Q2 FY 25). EBIT margin was up 60 bps QoQ in FY 25 (50 bps YoY) but declined 10 bps QoQ in ex-Oil/ Metals (up 70 bps YoY). Nifty indices have corrected over the last one month, underperforming emerging markets over the last one year. Valuations are below averages on one year forward basis. While FY25 earnings have disappointed, FY26 earnings are estimated to grow in double digits. Remain cautiously optimistic on markets.

Source: Kotak Securities Ltd & Incred Research. Data as of Jan 31st, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual Fund for the month ending January 2025 for disclaimers.

The US Fed maintained status quo on policy rates. As feared US imposed tariffs on three major exporters to the US. The US administration’s decision to impose 25% import tariffs on imports of goods from Canada (10% on oil and related items) and Mexico and an additional 10% import tariff on imports of goods from China will likely lead to a sharp increase in global macroeconomic uncertainty (growth, inflation), micro-level uncertainty for US companies and exporters affected by the tariffs and risk-off sentiment among global markets.

Locally, the high-frequency data improvement seen till Nov 2024 in the Index of Industrial Production, vehicle sales, and consumer sentiment has started to fizzle, as seen in Dec 2024 data points on Goods and Services Tax collections, rising channel inventory and credit growth slowdown. On the economy front, Consumer Price Index (CPI) inflation for December 2024 softened to 5.2% from 5.5% in November 2024. Wholesale Price Index (WPI) inflation for December 2024 was at 2.4% YoY compared to 1.9% in November 2024.

The FY2026 Union Budget reflected government’s continued focus on gradual consolidation, while providing a boost to consumption. The government budgeted Gross Fiscal Deficit (GFD)/GDP at 4.4%, led by a 10.8% increase in gross tax revenues, a 6.7% increase in revenue expenditure and a 10% increase in capex. The government left corporate tax rates unchanged but raised the exemption and upper limit of various tax slabs for individual income tax. Addressing the urban consumption demand slowdown challenges by reducing income-tax rates across tax slabs is a good move. This should help improve the credit rating of individuals, improve discretionary spending, help fill capacities and drive private capex in the coming quarters. Improving the quality of Fiscal Deficit (FD) by cutting subsidies provide comfort.

The large Rs1tn income-tax concession spread across brackets is a bold move; however, expecting a 14% collection growth looks ambitious. The capital expenditure is projected to rise by 9.8% YoY, driven by spending on defence while the flattish trend for road and railway sectors disappoints. Policy initiatives to allow 100% Foreign direct investment (FDI) in the insurance sector, new income-tax code and incentives for the labour-intensive Micro, Small, and Medium Enterprises (MSME) sector provide comfort.

The government did not make any major changes to customs duty rates or taxation policies for sectors, with minor changes in a few emerging sectors. Other sectorspecific announcements are supporting urban housing, supporting the manufacturing of emerging technologies, incentivizing states to undertake power sector reforms, custom duty changes for a few sectors and higher outlay for metro projects, among others. At the same time, moderation in capex intensity is visible across a number of sectors such as railways and roads.

133 companies in BSE200 (73% of market cap) have reported their Q3 FY25 results so far. IT, Energy, Banks and NBFC are largely done. Net sales growth held up at 5.5% YoY vs 4.6% in Q3 FY 25, while EBIT growth improved to 9% YoY vs a decline of 4% in Q2 FY 25. Ex-Energy/ Metals, the trend is better with sales growth at 10% and EBIT growth at 13% in Q3 FY 25(12% in Q2 FY 25). EBIT margin was up 60 bps QoQ in FY 25 (50 bps YoY) but declined 10 bps QoQ in ex-Oil/ Metals (up 70 bps YoY). Nifty indices have corrected over the last one month, underperforming emerging markets over the last one year. Valuations are below averages on one year forward basis. While FY25 earnings have disappointed, FY26 earnings are estimated to grow in double digits. Remain cautiously optimistic on markets.

Source: Kotak Securities Ltd & Incred Research. Data as of Jan 31st, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual Fund for the month ending January 2025 for disclaimers.

Global Economy-

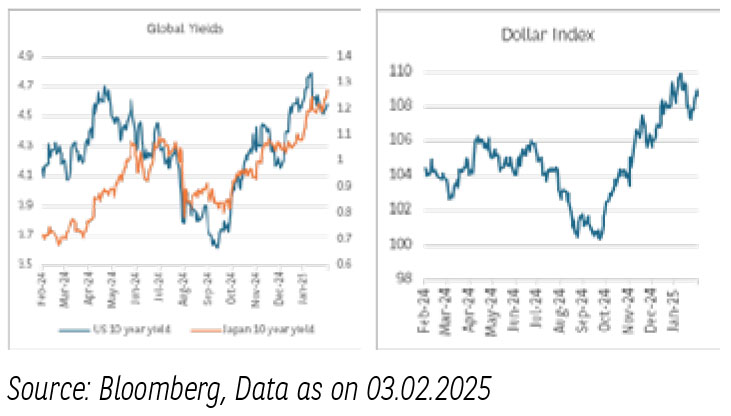

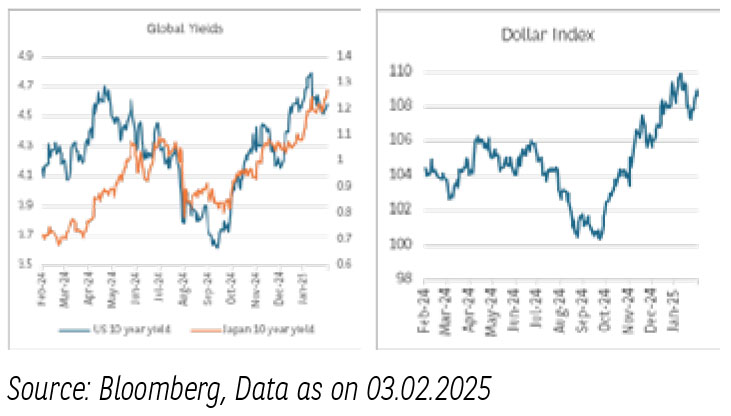

The year 2025 has begun with global economic landscape navigating jittery waters, with the lingering fears of Trump-era tariff threats. The situation feels uneasy as these tariff threats are not the only alarming situation today. Stronger growth momentum in US and interest rate differential across emerging markets are redirecting the capital flows. Both Trump tariff threats and stronger US economy have added to the dollar strength. The dollar index surpassed 110 at start of January 2025 and is trading closer to 108 by end of it. The dollar strength and any tariffs announcement by the Trump government send shock waves across the currency markets.

Global monetary policy dynamics are no longer sailing in the same boat. Economies like US, UK have changed their outlook on rates and have continued with pause starting 2025. Whereas Japan went with an expected rate hike given higher inflation. China’s Central Bank continues with an expansionary monetary policy keeping the yields at historic lows. The divergence in global monetary policy dynamics have widened.

Global commodity prices have been the behaving elements in the turbulent global economy. Brent prices continue to hover around 75-76 $/bl. Gold prices have reached an all-time high of $2,810 per ounce as tariff jitters prompted safe-haven spending.

Rising inflationary pressures, and faltering growth momentum converge to create a perfect storm of uncertainty. With major economies teetering on the brink of stagnation, and trade tensions simmering just below the surface, policymakers and investors alike are bracing for a potentially turbulent ride ahead.

Domestic Economy-

Union Budget 2025-26 is the key event of the month. The budget was about stimulating growth through consumption and investments. The significant announcements were related to personal income tax; no income tax payable for total incomes up to Rs.12 Lacs and the upward revision in the slabs of income tax. Secondly, the rationalization of TDS / TCS - both rates and thresholds, is also a welcome step for the individual tax payer

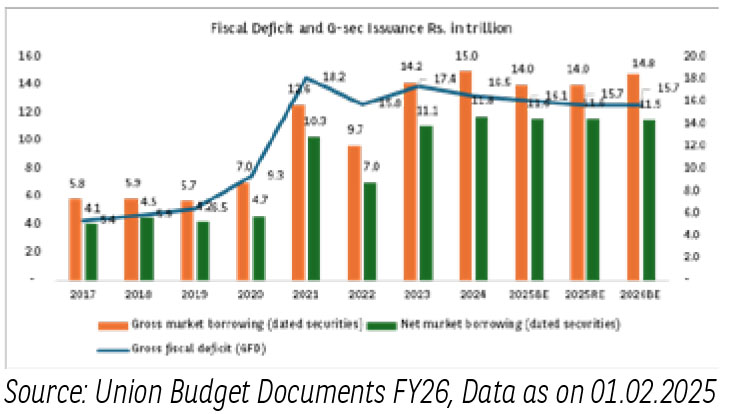

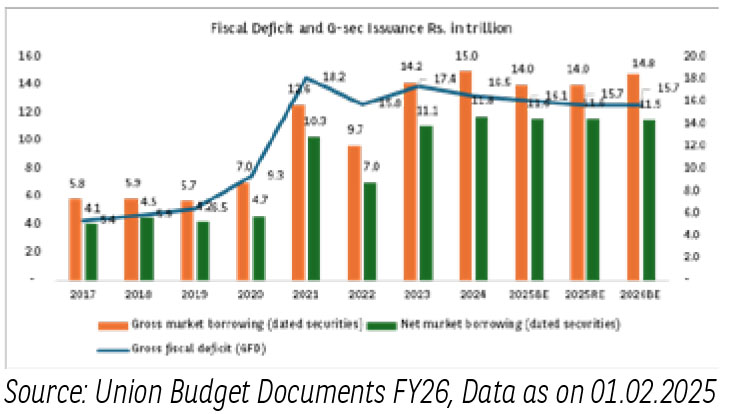

In FY26, Centre has projected the fiscal deficit at 4.4% of the GDP. In absolute terms, the fiscal deficit is projected at Rs 15.68 lac crore tad lower than Rs. 15.69 lac crore in FY25 revised estimates. The net borrowing numbers in FY26 to be tad lower by ~1% from FY25 revised estimates. Whereas the gross borrowing numbers for FY26 are higher by 6% from FY25 revised estimates. The centre’s fiscal math has highlighted an increase in direct tax collections of about 12.7% from FY25 revised budget estimates. This comes after foregoing ~Rs.1 lac crore of direct tax revenue through income tax exemptions. The expectations for corporate tax collections remain stagnant compared to the last two fiscals with an average growth rate of 9%. Income tax collections after adjusting for the tax exemptions is expected to grow by 14% from FY25 revised budget estimates.

The key concerns have started emerging out for domestic growth outlook and the same have reflected in increasing expectations of rate cut in Feb-2025 monetary policy. The key arguments are around slowing growth in certain areas of economy, even thought the economic survey has highlighted healthy growth expectations for FY26 and notes that the focus should be on grassroots-level structural reforms to unleash productivity growth and push medium-term growth higher. The survey pegs real GDP growth at 6.3-6.8% in FY 2026, and expects growth at 6.4% in F2025. The survey highlights that the economic fundamentals remain robust, but the need to be watchful of risks from external factors. Therefore the confusion regarding domestic growth persists and the Feb-2025 RBI policy remains a key watch.

Domestic Inflation-

Domestic Liquidity –

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

The year 2025 has begun with global economic landscape navigating jittery waters, with the lingering fears of Trump-era tariff threats. The situation feels uneasy as these tariff threats are not the only alarming situation today. Stronger growth momentum in US and interest rate differential across emerging markets are redirecting the capital flows. Both Trump tariff threats and stronger US economy have added to the dollar strength. The dollar index surpassed 110 at start of January 2025 and is trading closer to 108 by end of it. The dollar strength and any tariffs announcement by the Trump government send shock waves across the currency markets.

Global monetary policy dynamics are no longer sailing in the same boat. Economies like US, UK have changed their outlook on rates and have continued with pause starting 2025. Whereas Japan went with an expected rate hike given higher inflation. China’s Central Bank continues with an expansionary monetary policy keeping the yields at historic lows. The divergence in global monetary policy dynamics have widened.

Global commodity prices have been the behaving elements in the turbulent global economy. Brent prices continue to hover around 75-76 $/bl. Gold prices have reached an all-time high of $2,810 per ounce as tariff jitters prompted safe-haven spending.

Rising inflationary pressures, and faltering growth momentum converge to create a perfect storm of uncertainty. With major economies teetering on the brink of stagnation, and trade tensions simmering just below the surface, policymakers and investors alike are bracing for a potentially turbulent ride ahead.

Domestic Economy-

Union Budget 2025-26 is the key event of the month. The budget was about stimulating growth through consumption and investments. The significant announcements were related to personal income tax; no income tax payable for total incomes up to Rs.12 Lacs and the upward revision in the slabs of income tax. Secondly, the rationalization of TDS / TCS - both rates and thresholds, is also a welcome step for the individual tax payer

In FY26, Centre has projected the fiscal deficit at 4.4% of the GDP. In absolute terms, the fiscal deficit is projected at Rs 15.68 lac crore tad lower than Rs. 15.69 lac crore in FY25 revised estimates. The net borrowing numbers in FY26 to be tad lower by ~1% from FY25 revised estimates. Whereas the gross borrowing numbers for FY26 are higher by 6% from FY25 revised estimates. The centre’s fiscal math has highlighted an increase in direct tax collections of about 12.7% from FY25 revised budget estimates. This comes after foregoing ~Rs.1 lac crore of direct tax revenue through income tax exemptions. The expectations for corporate tax collections remain stagnant compared to the last two fiscals with an average growth rate of 9%. Income tax collections after adjusting for the tax exemptions is expected to grow by 14% from FY25 revised budget estimates.

The key concerns have started emerging out for domestic growth outlook and the same have reflected in increasing expectations of rate cut in Feb-2025 monetary policy. The key arguments are around slowing growth in certain areas of economy, even thought the economic survey has highlighted healthy growth expectations for FY26 and notes that the focus should be on grassroots-level structural reforms to unleash productivity growth and push medium-term growth higher. The survey pegs real GDP growth at 6.3-6.8% in FY 2026, and expects growth at 6.4% in F2025. The survey highlights that the economic fundamentals remain robust, but the need to be watchful of risks from external factors. Therefore the confusion regarding domestic growth persists and the Feb-2025 RBI policy remains a key watch.

Domestic Inflation-

- Inflation has shown signs of moderation led by the decline in food prices.

- Looking at the trajectory of inflation, Q4 FY25 monthly inflation is expected to track lower than 5% led by favourable base and continued decline in food prices led by winter crop arrival.

- We expect domestic inflation at 4.8% y/y in FY25.

- Going forward, Domestic inflation is expected to align progressively with the target, as per RBI estimates.

- Further, for long-term price stability focus on managing food inflation through measures to improve agriculture productivity and robust data collection/monitoring mechanics.

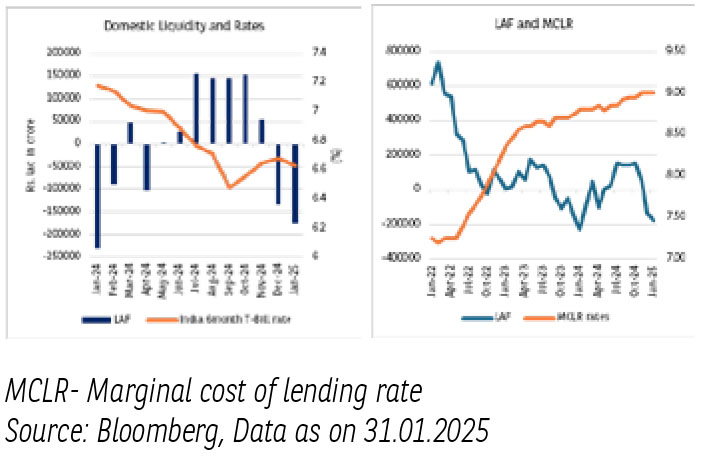

Domestic Liquidity –

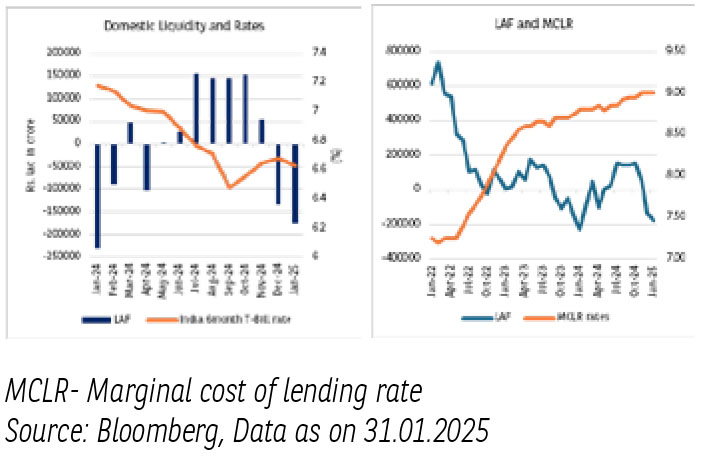

- Liquidity continued to remain in the deficit zone but the deficit narrowed by end of Jan-25 due to month-end government spending alongside RBI’s Open Market Operations (OMOs). US FOMC’s shift in the forward guidance and the recent pickup in inflation must be carefully monitored.

- Net LAF deficit eased to Rs1.8 tn at the end of last week as compared to ~Rs2.82 tn at the end of the week prior.

- Overnight rates fell by 5bps to 6.54%, aided by RBI’s liquidity easing measures.

- Going forward, we expect liquidity to continue to remain in deficit zone, but the tightness should moderate amid buy/sell swap related liquidity and government spending.

- Global monetary policy dynamics have started witnessing bumps in their path to recalibrate the monetary rates. US economic strength needs to be carefully monitored as it will be driving the course of US FED going ahead.

- US FOMC’s shift in the forward guidance and the recent pickup in inflation must be carefully monitored.

- Trumps tariff threats and spillovers on currencies is the existing risk that is driving the markets volatile.

- On the domestic front, evolving growth dynamics have taken center stage. The expectations of rate cut in the Feb-2025 policy have started to increase as some pockets of the economy have witnessed slowing growth.

- The recent Union Budget FY26 has tried to boost consumption through tax exemptions without foregoing fiscal discipline.

- The overall fiscal math remains credible in terms of tax collection and has followed the path towards disciplined fiscal consolidation.

- When an economy takes measures to boost economy with out upsetting the debt discipline, it aligns with an optimistic debt market outlook in the long term.

- Having said that external headwinds continue weigh on INR which will have spillovers over domestic liquidity.

- Recent moves by RBI give us confidence that liquidity will be managed in spirit of the stance.

- We expect RBI to use different methods of liquidity management to offset any major set back from global headwinds.

- Having said that, the fundamentals of India’s fiscal demand supply remain balanced and that is expected to maintain a downside bias on yields.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.