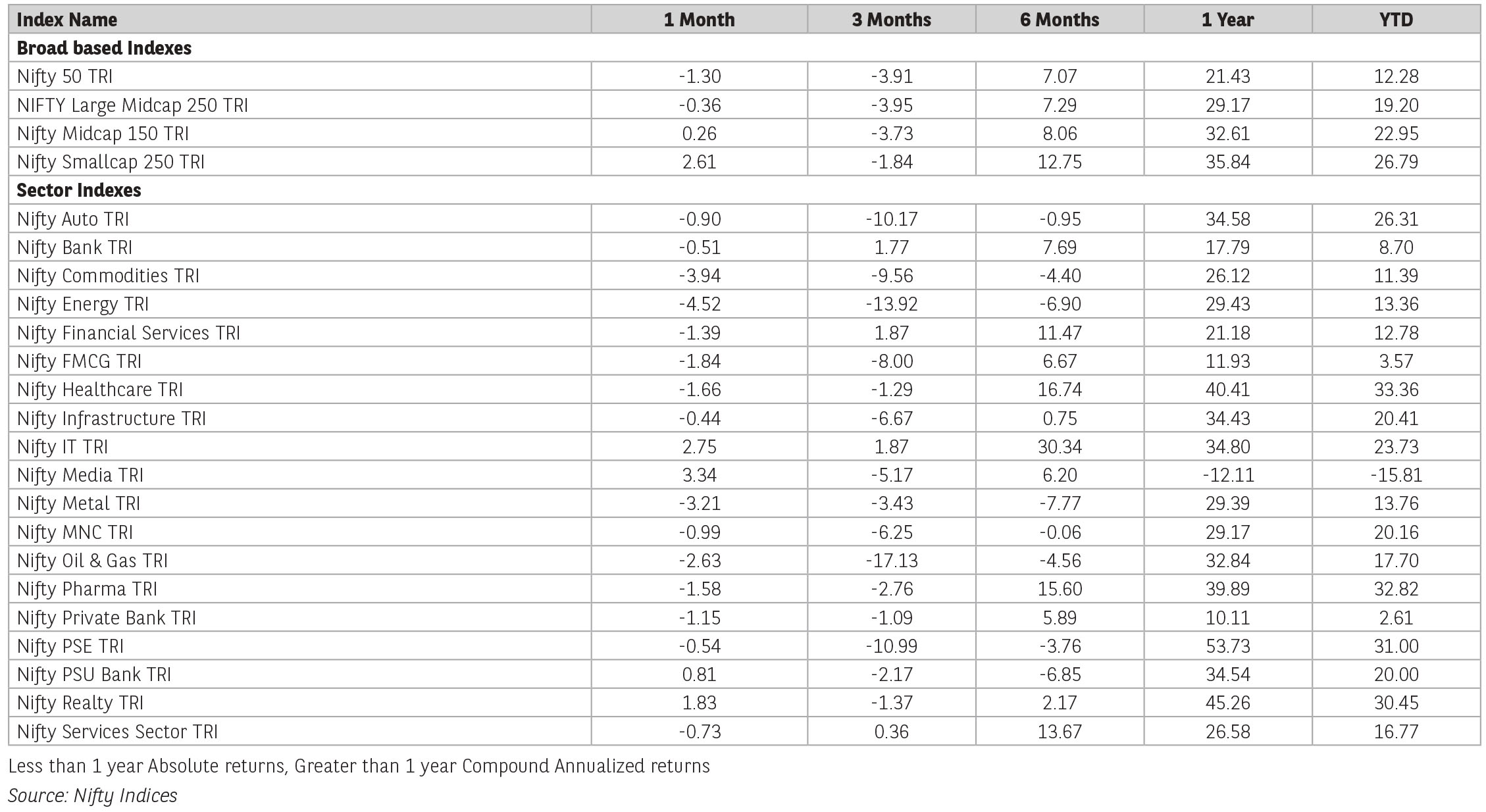

Indian equity markets remained volatile in the month of November 2024. The Nifty 50 Index managed to close above the 24,100 level after falling below

23,400 level during the month. It made a minor loss of 0.3% in this month, outperforming the emerging markets index. Sector-wise IT (+6%) was one of the

best-performing sector, followed by consumer durables (+3%) and capital goods (+2.3%). Power, metals and oil & gas indices declined 4.3%, 2.4% and 2.3%

respectively. Foreign Portfolio Investors (FPIs) sold USD 4.7 bn of Indian equities in the secondary market, whereas Domestic Institutional Investors (DIIs)

bought USD5.3 bn. In Nov 2024, the INR weakened significantly against the USD. FPI flows were negative for most of the emerging markets.

In US both Nasdaq and S&P 500 rallied by 3% each led by positive sentiments around Donald Trump winning the US presidential elections. US Core PCE (Personal Consumption Expenditure) Index based inflation rose 2.8% YoY in October – the highest since April. This was driven by services and core services ex-housing components, indicating inflationary pressures moderating but remaining alive. The unemployment rate has settled at 4 -4.1% for the past six months. US Federal Reserve cut interest rates by 25 bps. President Donald Trump intends to impose a 25% tariff on all goods coming from Mexico and Canada and an additional 10% tariff on China, until they clamped down on drugs, particularly fentanyl, and migrants crossing the border.

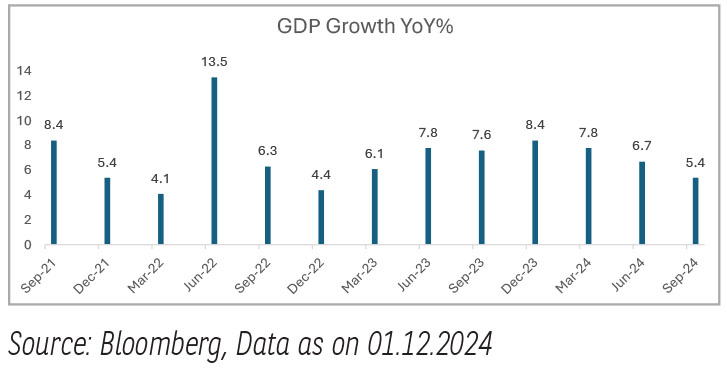

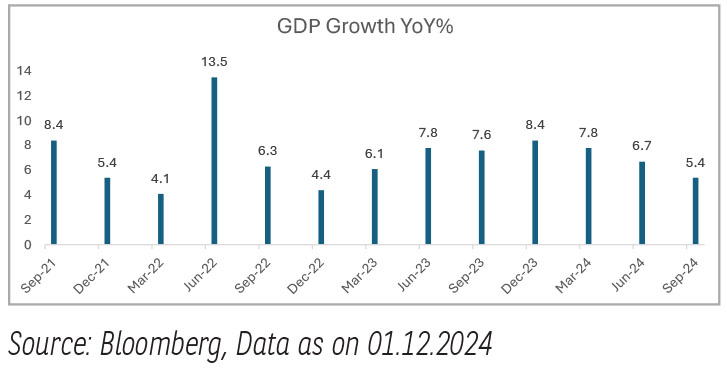

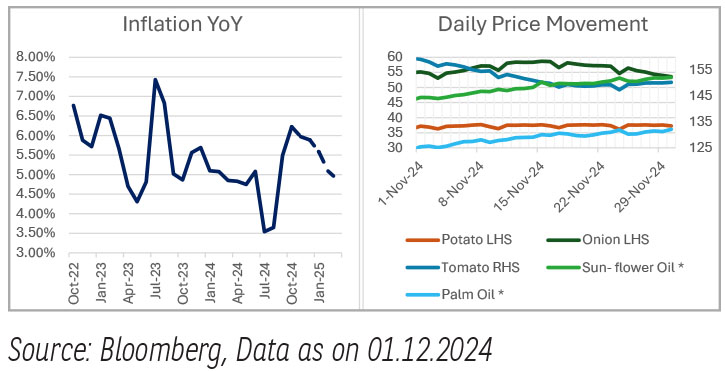

India’s CPI (Consumer Price Index) inflation came in at 6.2% in October 2024, crossing the upper limit of 6% of the RBI’s inflation band. WPI (Wholesale Price Index) accelerated to 2.4% in October as against 1.8% in September. Industrial activity slowed down to 3.9% YoY vs 8.4% YoY in Q1. This dragged down overall GDP (Gross Domestic Product) growth in Q2FY25. GDP growth slowed to a near two years low of 5.4% YoY in Q2FY25. Sluggish manufacturing & mining growth and weak urban consumption were key components impacting GDP growth. Decline in Government capex and lower credit growth impacted GDP numbers too. Economic indicators like electricity consumption, Index of Industrial Production or IIP, Purchasing Managers’ Index or PMI and loan growth show that India is witnessing a cyclical slowdown, with urban consumption slowing down and the recovery in rural markets being gradual.

Domestic economic activity picked up momentum around the festival weeks at the end of Oct/early Nov 2024, as seen from indicators like automobile retail sales, and online sales GMV (gross merchandise value) scaling a new peak during the festivals. The improvement in the consumer sentiment around Oct 2024 festivals as highlighted by RBI data, especially in rural areas helped drive good festive retail demand across segments, albeit with a trend of rising discounts.

The 2QFY25 Nifty-50 EPS posted a 4% rise YoY, lower than consensus estimates. High single-digit EBITDA growth was seen in telecom, financials, IT and FMCG sectors. In the last two months of the results season, Nifty-50 Bloomberg consensus EPS (Earnings Per Share) witnessed a 3-4% cut for FY25F-26F while the reduction in Nifty-200 was limited to 2%. Major downgrades are in commodity, FMCG and capital goods sectors while upgrades are restricted to utilities and pharmaceutical sectors.

Focus now likely to shift to upcoming RBI policy and whether Governor will cut rates given weak GDP print. There are challenges, however: inflation is still running hot at over 6% and the DXY (US Dollar Index) strength puts the RBI in a tricky spot for the next 1-2 quarters. Weak 2QFY25 corporate results season, ongoing geopolitical tensions and potential policy shifts under the incoming US administration are likely to weigh on investor sentiments. Bright spots seem to be on higher water reservoir levels which can help drive rural growth. A potential increase in Government Capex in 2H may aid economic recovery in coming quarters.

Source : Kotak Securities Ltd & Incred Research . Data as of Nov 29, 2024. Kindly refer the last page of the factsheet for disclaimers.

In US both Nasdaq and S&P 500 rallied by 3% each led by positive sentiments around Donald Trump winning the US presidential elections. US Core PCE (Personal Consumption Expenditure) Index based inflation rose 2.8% YoY in October – the highest since April. This was driven by services and core services ex-housing components, indicating inflationary pressures moderating but remaining alive. The unemployment rate has settled at 4 -4.1% for the past six months. US Federal Reserve cut interest rates by 25 bps. President Donald Trump intends to impose a 25% tariff on all goods coming from Mexico and Canada and an additional 10% tariff on China, until they clamped down on drugs, particularly fentanyl, and migrants crossing the border.

India’s CPI (Consumer Price Index) inflation came in at 6.2% in October 2024, crossing the upper limit of 6% of the RBI’s inflation band. WPI (Wholesale Price Index) accelerated to 2.4% in October as against 1.8% in September. Industrial activity slowed down to 3.9% YoY vs 8.4% YoY in Q1. This dragged down overall GDP (Gross Domestic Product) growth in Q2FY25. GDP growth slowed to a near two years low of 5.4% YoY in Q2FY25. Sluggish manufacturing & mining growth and weak urban consumption were key components impacting GDP growth. Decline in Government capex and lower credit growth impacted GDP numbers too. Economic indicators like electricity consumption, Index of Industrial Production or IIP, Purchasing Managers’ Index or PMI and loan growth show that India is witnessing a cyclical slowdown, with urban consumption slowing down and the recovery in rural markets being gradual.

Domestic economic activity picked up momentum around the festival weeks at the end of Oct/early Nov 2024, as seen from indicators like automobile retail sales, and online sales GMV (gross merchandise value) scaling a new peak during the festivals. The improvement in the consumer sentiment around Oct 2024 festivals as highlighted by RBI data, especially in rural areas helped drive good festive retail demand across segments, albeit with a trend of rising discounts.

The 2QFY25 Nifty-50 EPS posted a 4% rise YoY, lower than consensus estimates. High single-digit EBITDA growth was seen in telecom, financials, IT and FMCG sectors. In the last two months of the results season, Nifty-50 Bloomberg consensus EPS (Earnings Per Share) witnessed a 3-4% cut for FY25F-26F while the reduction in Nifty-200 was limited to 2%. Major downgrades are in commodity, FMCG and capital goods sectors while upgrades are restricted to utilities and pharmaceutical sectors.

Focus now likely to shift to upcoming RBI policy and whether Governor will cut rates given weak GDP print. There are challenges, however: inflation is still running hot at over 6% and the DXY (US Dollar Index) strength puts the RBI in a tricky spot for the next 1-2 quarters. Weak 2QFY25 corporate results season, ongoing geopolitical tensions and potential policy shifts under the incoming US administration are likely to weigh on investor sentiments. Bright spots seem to be on higher water reservoir levels which can help drive rural growth. A potential increase in Government Capex in 2H may aid economic recovery in coming quarters.

Source : Kotak Securities Ltd & Incred Research . Data as of Nov 29, 2024. Kindly refer the last page of the factsheet for disclaimers.

Global Economy-

As we mark the end of November and begin the countdown to the upcoming year, during an average or a normal year this month would have been about Thanksgiving in the west coupled with Black Friday sales and of course International Men’s Day. But this time November-2024 has been more about riding the tides of election anxieties both in anticipation and then on actual realization of US elections results. Its not about international men’s day, its about the Man itself this time. The newly elected US President Donald Trump, a man, or ‘The Man’, has been driving the markets crazy or must say keeping the markets excited with his intentions of ‘America First’ and resultant changes in US trade and fiscal policies. These may be potent enough to disrupt the global flows and trades which in hindsight have not been that stable for quite some time. Fears of fiercer trade wars hung over the outlook on tariff proposals and potential retaliation – the International Monetary Fund (IMF) cautioned in its World Economic Outlook that higher tariffs could wipe out 0.8% of output in 2025 and 1.3% in 2026.

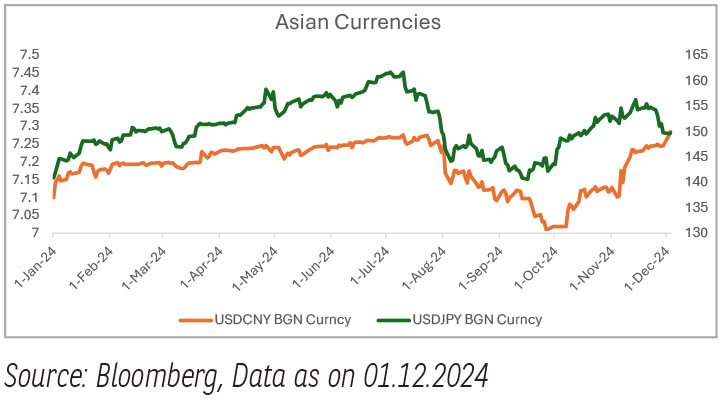

Looking deeper into November, post US elections and economic releases in US, Japan, China etc. the world markets, be it currency, commodity, equities and bonds, all have had their share of volatilities. Therefore, the level of uncertainty surrounding the outlook remained elevated.

US yields have been swinging both ways post releases of US economic data points. Reflecting the issues of soaring debt levels, alongside a stronger economy but normalising labor market conditions and fear of inflation resurgence. Similarly DXY got stronger initially before correcting from the highs pricing in stronger US economy and likely impact on Euro and CNY (once actual Tariff War play out)

On the flip side, China continues to face economic challenges. The challenges warranted economic measures, which therefore weighed on the currencies. China’s expansionary fiscal policies along with dollar strength has been weighing on other emerging market currencies.

On commodities front, gold prices touched its all-time high in November, whereas brent prices remained range bound irrespective of global geopolitical tensions. Majorly the fundamentals of demand supply dynamics keeping a cap at the volatility.

Domestic Economy-

Certain momentum loss and earnings downgrades along with lower-than-expected Q2 FY25 GDP added to the worries of slowing economic activity. Previously the concerns were visible in the rural economy and eventually an industrial output drag in Q2, resulted in a sharper drag on growth. India’s GDP growth came at 5.4% y/y in Q2 FY25 vs market expectations ranging between 6.3% -6.5%. The growth rate slowed from 6.7% in Q1 FY25 and long-term trend of 6.6%. The divide in expectations was led by slowed manufacturing and mining activity.

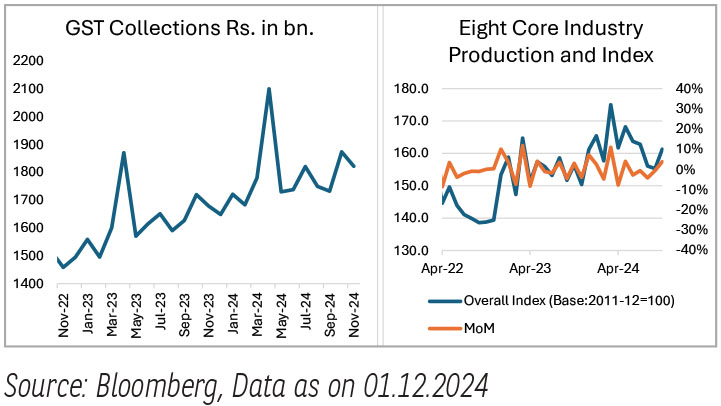

After a slow Q2 FY25, the trend in high frequency indicators for the month of Oct/Nov have again reflected a pickup in economic activity. The pickup was led by festive boost, strong rural recovery, and improving industrial output.

India’s Composite Output PMI Index posted 58.6 in Nov-24, down only marginally from 59.1 in October-24 and therefore indicating a sharp rate of expansion. The Purchasing managers index (PMI )surveys highlighted cost pressures to have weighed on domestic sales, but international order growth remained strong.

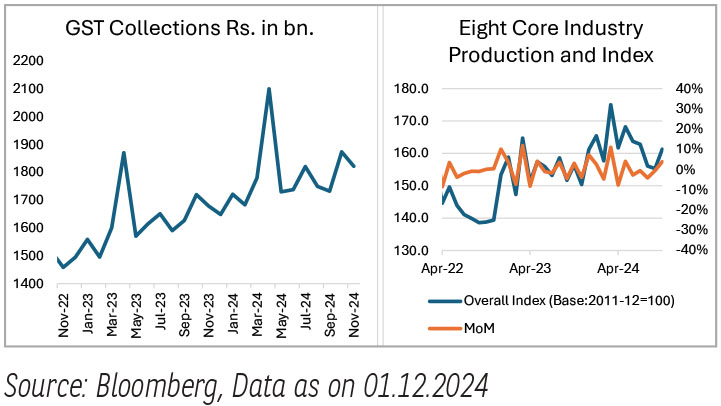

Industrial activity too reflected an upturn, with eight core industries sequentially growing by 4.2% after declining for four consecutive months.

Along with the pickup in economic activity, the uptick in government spending, improving rural demand & easing financial conditions are likely to be key drivers to sustain the growth recovery in the second half of FY25.

On the fiscal front, fiscal deficit touched 46.5% of budget estimates with internals showing a robust revenue collection despite the big state transfer to states in Oct-24. Revenues remained supported on back of strong income taxes (53% of budget estimates and 20% y/y) and indirect taxes (56% of budget estimates and 10% y/y). On the expenditure side, revenue is getting more focus (54% of budget estimates and 9% y/y). In contrast, capex is distinctly lagging (42% of BE and -15% y-o-y). Overall, while fiscal deficit in control is a good sign, it is not if it is at the cost of capex.

Domestic Inflation-

Domestic Liquidity –

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

As we mark the end of November and begin the countdown to the upcoming year, during an average or a normal year this month would have been about Thanksgiving in the west coupled with Black Friday sales and of course International Men’s Day. But this time November-2024 has been more about riding the tides of election anxieties both in anticipation and then on actual realization of US elections results. Its not about international men’s day, its about the Man itself this time. The newly elected US President Donald Trump, a man, or ‘The Man’, has been driving the markets crazy or must say keeping the markets excited with his intentions of ‘America First’ and resultant changes in US trade and fiscal policies. These may be potent enough to disrupt the global flows and trades which in hindsight have not been that stable for quite some time. Fears of fiercer trade wars hung over the outlook on tariff proposals and potential retaliation – the International Monetary Fund (IMF) cautioned in its World Economic Outlook that higher tariffs could wipe out 0.8% of output in 2025 and 1.3% in 2026.

Looking deeper into November, post US elections and economic releases in US, Japan, China etc. the world markets, be it currency, commodity, equities and bonds, all have had their share of volatilities. Therefore, the level of uncertainty surrounding the outlook remained elevated.

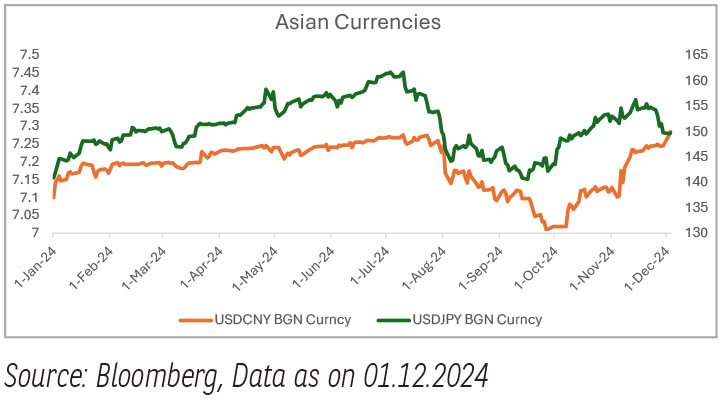

US yields have been swinging both ways post releases of US economic data points. Reflecting the issues of soaring debt levels, alongside a stronger economy but normalising labor market conditions and fear of inflation resurgence. Similarly DXY got stronger initially before correcting from the highs pricing in stronger US economy and likely impact on Euro and CNY (once actual Tariff War play out)

On the flip side, China continues to face economic challenges. The challenges warranted economic measures, which therefore weighed on the currencies. China’s expansionary fiscal policies along with dollar strength has been weighing on other emerging market currencies.

On commodities front, gold prices touched its all-time high in November, whereas brent prices remained range bound irrespective of global geopolitical tensions. Majorly the fundamentals of demand supply dynamics keeping a cap at the volatility.

Domestic Economy-

Certain momentum loss and earnings downgrades along with lower-than-expected Q2 FY25 GDP added to the worries of slowing economic activity. Previously the concerns were visible in the rural economy and eventually an industrial output drag in Q2, resulted in a sharper drag on growth. India’s GDP growth came at 5.4% y/y in Q2 FY25 vs market expectations ranging between 6.3% -6.5%. The growth rate slowed from 6.7% in Q1 FY25 and long-term trend of 6.6%. The divide in expectations was led by slowed manufacturing and mining activity.

After a slow Q2 FY25, the trend in high frequency indicators for the month of Oct/Nov have again reflected a pickup in economic activity. The pickup was led by festive boost, strong rural recovery, and improving industrial output.

India’s Composite Output PMI Index posted 58.6 in Nov-24, down only marginally from 59.1 in October-24 and therefore indicating a sharp rate of expansion. The Purchasing managers index (PMI )surveys highlighted cost pressures to have weighed on domestic sales, but international order growth remained strong.

Industrial activity too reflected an upturn, with eight core industries sequentially growing by 4.2% after declining for four consecutive months.

Along with the pickup in economic activity, the uptick in government spending, improving rural demand & easing financial conditions are likely to be key drivers to sustain the growth recovery in the second half of FY25.

On the fiscal front, fiscal deficit touched 46.5% of budget estimates with internals showing a robust revenue collection despite the big state transfer to states in Oct-24. Revenues remained supported on back of strong income taxes (53% of budget estimates and 20% y/y) and indirect taxes (56% of budget estimates and 10% y/y). On the expenditure side, revenue is getting more focus (54% of budget estimates and 9% y/y). In contrast, capex is distinctly lagging (42% of BE and -15% y-o-y). Overall, while fiscal deficit in control is a good sign, it is not if it is at the cost of capex.

Domestic Inflation-

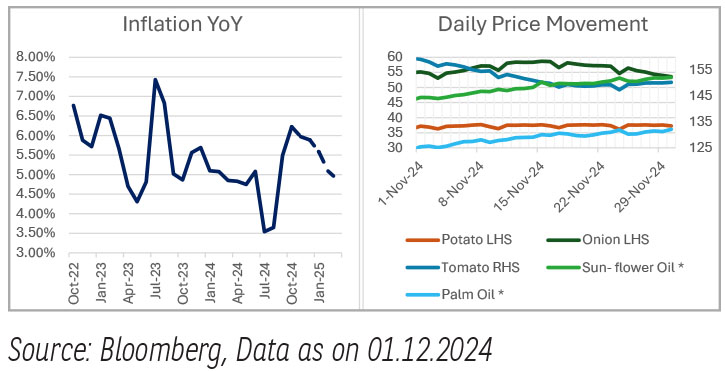

- Headline inflation picked up sharply from 5.5% in Sep-2024 to 6.21% in Oct-2024. The pickup has been attributed to shocks to food inflation which became sharper in Oct-24.

- The expectations of headline inflation in Q3 FY25 is tracking above 5.5%, diminishing any expectations of rate cut in December-2024.

- Having said that, we expect the volatility in perishable food prices to continue and the decline to be sharper in Q4 FY25 with the arrival of winter crops. Bloomberg, Data as on 01.12.2024

- But the question is whether the decline might be able to offset the current shocks to headline inflation.

- Over the coming months, we could see core trending back to 4% plus into FY25 as super core (ex. precious metals) is also rising. Which means it is critical for food inflation to come down, to get to a durable 4% target.

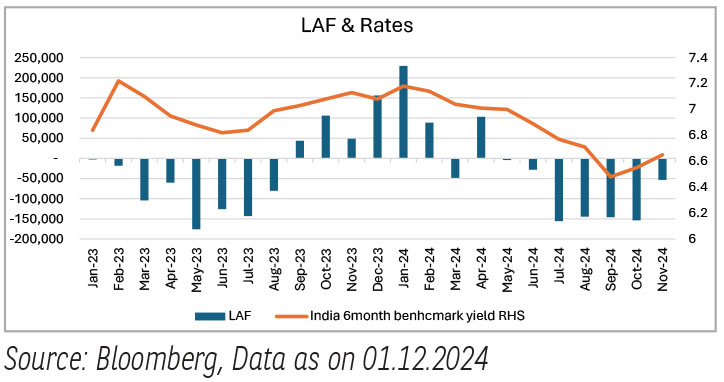

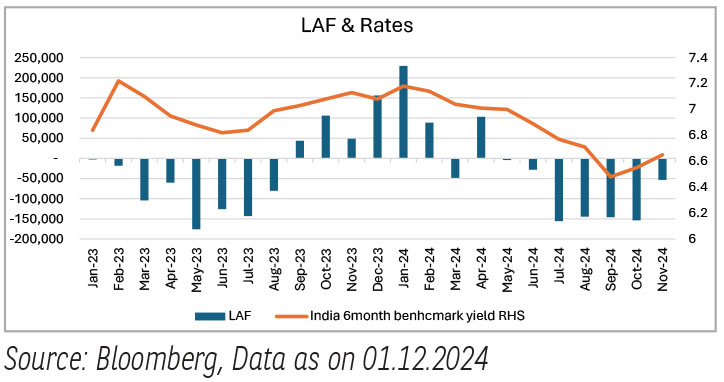

Domestic Liquidity –

- India’s interbank liquidity turned into a deficit by end of November-24.

- The expectations that liquidity could worsen heading into end-FY25 (ends March 2025) have risen led by expectations of increase in Currency In Circulation (CIC) and an increase in banks’ CRR requirement. Additionally volatile FPI flows have added to concerns on BOP.

- The above acts as a counter to the RBI’s ‘neutral’ monetary policy stance. As a result, market expectations of liquidity injection measures may have picked up ahead of 6 December Monetary Policy Committee (MPC) announcement.

- Global headwinds have been weighing on INR and will be a key watch.

- On the domestic front inflation remains a key watch for RBI’s monetary policy decision making. With October print higher than 6%, and expectations of November inflation to be closer to 6% number.

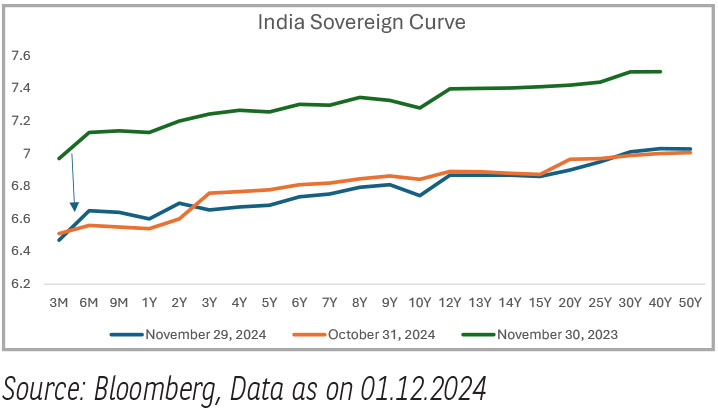

- Recent weakness in growth indicators have once again raised the need and expectations of rate cuts. The key here is the dynamics between inflation and growth.

- We expect RBI to continue with the pause in December policy and the policy language to focus more on liquidity conditions through potential reduction in CRR.

- Our base case scenario of rate cut expectations remains the same. We expect RBI MPC policy to follow the inflation trajectory and any space for a domestic pivot is expected in Q4 FY25.

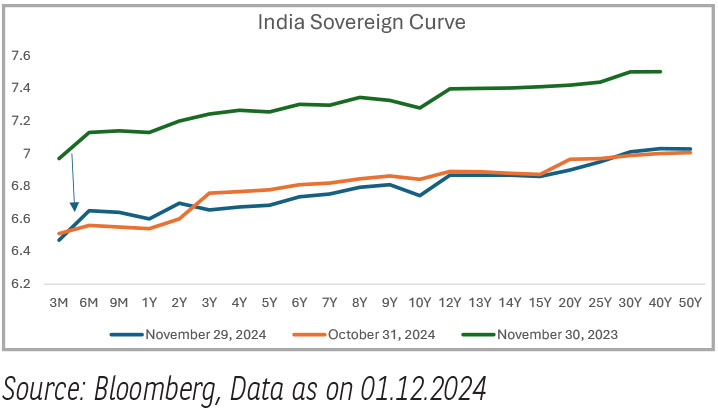

- Our view on rates remain constructive on account of favorable demand supply dynamics as well as positive real rate conditions.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.