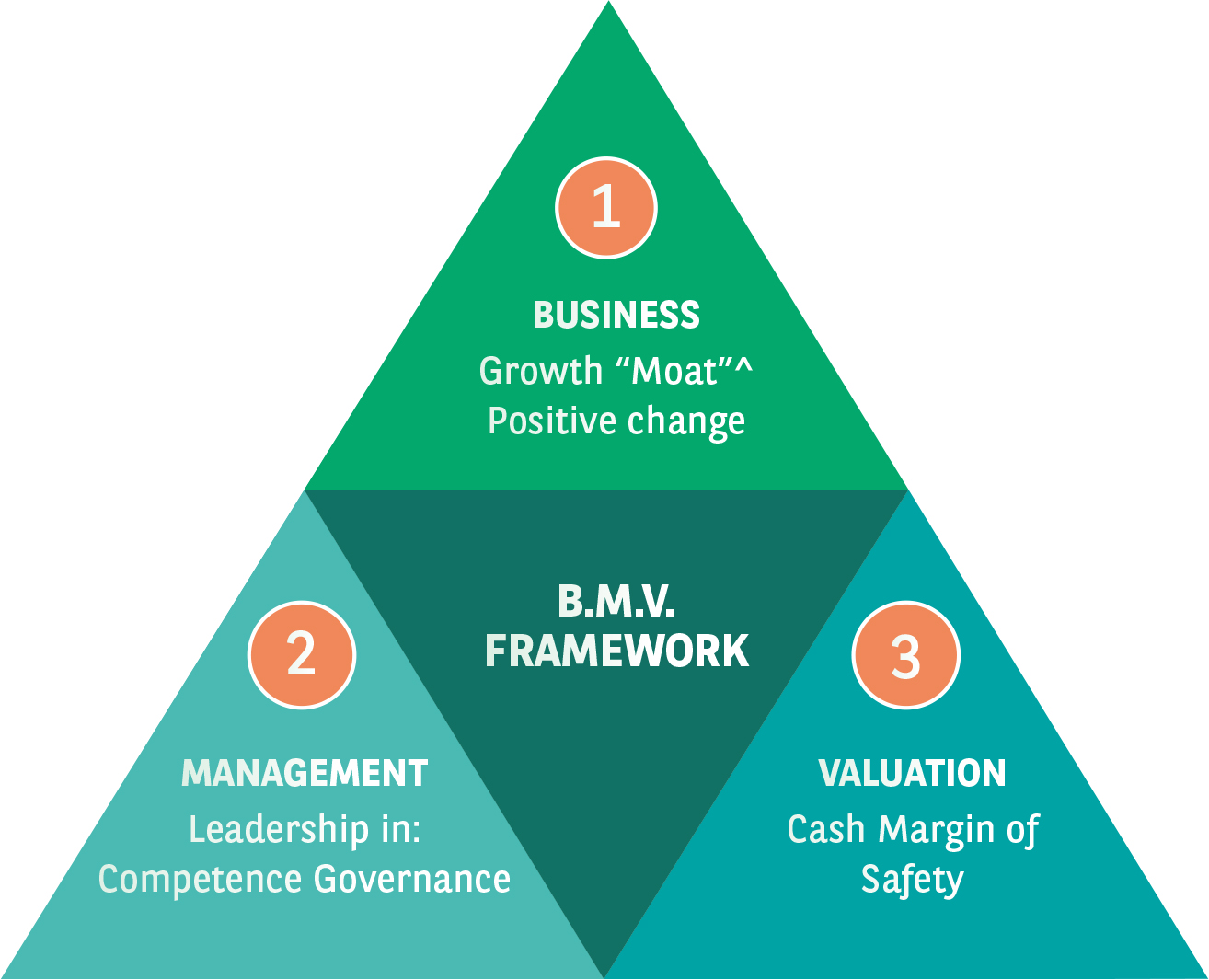

EQUITY Investment Philosophy - Business,

Management, Valuation (B.M.V.)

EQUITY Investment Philosophy - Business,

Management, Valuation (B.M.V.)

We believe that “companies create wealth and not markets” and thus the focus is on identifying businesses which could grow

earnings at a faster rate for significantly long periods of time. Our in-house investment framework BMV (Business – Management

- Valuation) helps us in identifying these companies. Thus, while investing we focus on all aspects of the company viz. quality of

business, sustainability of growth, governance and price being paid for the company. All the companies which are part of the scheme

portfolio have to pass through each of the BMV filters. And for us, all aspects are important. This drives the portfolio construction

process and helps us identify stock picking opportunities across market cycles .

In search of companies with superior and sustainable earnings growth with strong management, at reasonable

valuations.

BUSINESS

Growth:

- Company growing faster than industry, industry growing faster than market

- Structural and long-term sustainable growth

- Focused and simple to understand

Moat: a sustainable competitive advantage arising from brand franchise, cost advantage, industry structure, technology/patents, distribution, etc.

Change: Positive change in sector, receding competitive intensity

MANAGEMENT

Leadership in:

- Competency basis management through market cycles (trend of sales, margins, capital allocation, etc.)

- Corporate Governance factors such as interest alignment with minority shareholders, Conduct and govern business with Transparency, Ethics and Accountability, organization structure, track record with respect to all shareholders

VALUATION

- Cash flow is central to the way we think about a company’s value

- Valuations: Intrinsic value, DCF (Discounted Cash Flow), Dividend Yield, Operating Cash Yield, etc.

- The narrower the ‘moat’ or weaker the management, the greater is the margin of safety required

- Superior risk-reward profile

^A sustainable competitive advantage