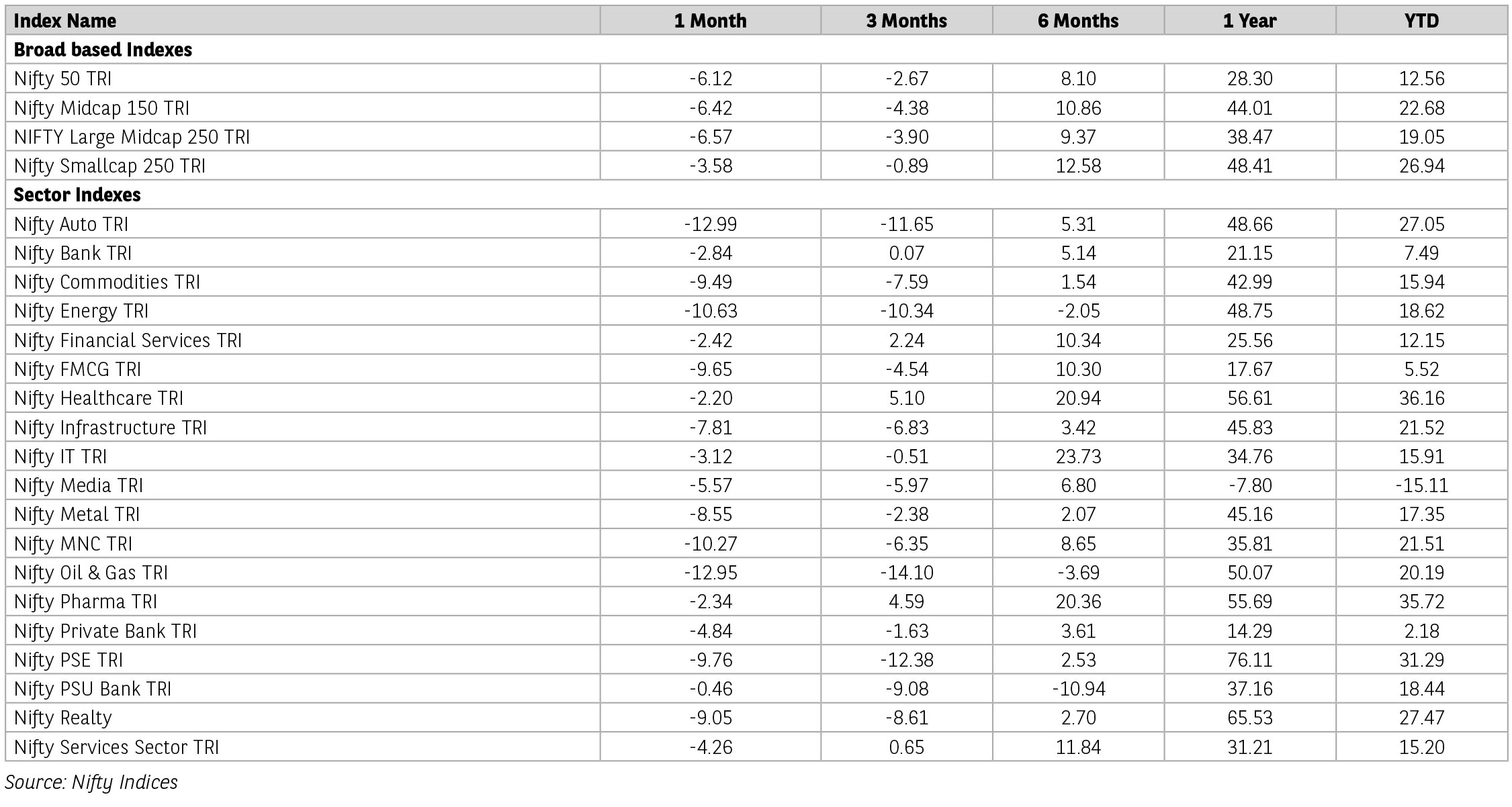

The Nifty ended with a loss of 6.2% in month of October 2024- largest monthly decline since March 2020. Mid-cap and small-cap fell 6.7% and 3%. Oil & gas (-14%) was the

worst-performing sector, followed by auto (-12%) and consumer durables (-10%). Geopolitical conflicts in Middle East, China stimulus, caution ahead of US elections weighed

on investors mind. India saw massive FPI (Foreign Portfolio Investment) outflows. Globally, India was the worst-performing market, followed by France (-4%), Hong Kong (-4%)

and Mexico (-3.5%). US S&P 500 Index and Dow Jones declined around 1% each. FPIs sold USD12.4 bn (until Oct 30) of Indian equities in the secondary market, whereas DII s

(Domestic Institutional Investors) bought USD12.8 bn (until Oct 31).

Economic data points in US deteriorated for the latest month. The US economy grew by an annualized 2.8% in the third quarter of CY24, lower than market expectations of 3%. This was largely led by slower growth in consumer spending and business investment. On the other hand, the inflation for the United States was in the US Federal Reserve target range. US PCE (Personal Consumption Expenditure) inflation for September came in at 0.2% mom (2.1% yoy), in line with expectations and accelerating from 0.1% in August. 12,000 jobs were added in October, weaker than consensus expectations. The Bank of Japan (BoJ) unanimously held rates at 0.25%, amid domestic political uncertainty.

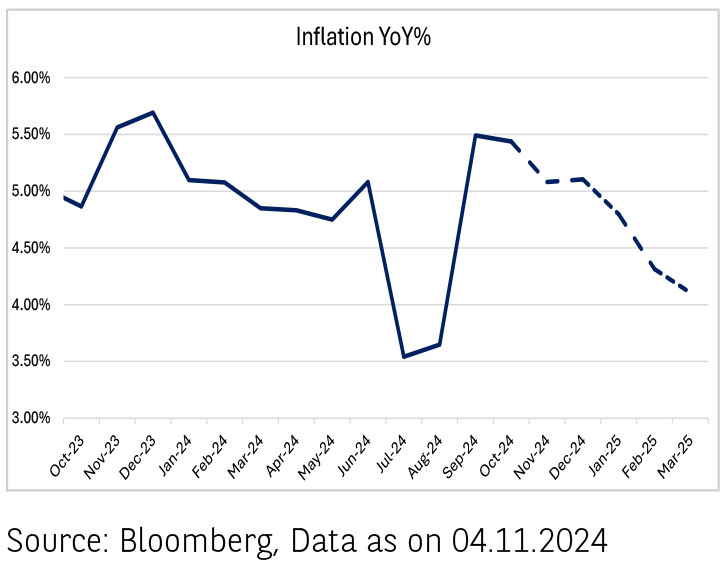

Economic data points for India too saw weakening. September CPI (Consumer Price Index) inflation rose to 5.5% Y-o-Y compared to 3.6% in August, WPI (Wholesale Price Index) rose to 1.8% in September from 1.3% in August. August IIP (Index of Industrial Production) witnessed a contraction of 0.1% against a growth of 4.7% in July. Non-food credit growth moderated to +12.8% Y-o-Y (+1.2% M-o-M) in Sep’24; slowdown seen across major segments. Retail loan growth moderated to 13.4% Y-o-Y in September 2024 compared to 13.9% Y-o-Y in August 2024, largely driven by slower growth in housing, credit cards and unsecured personal loans.

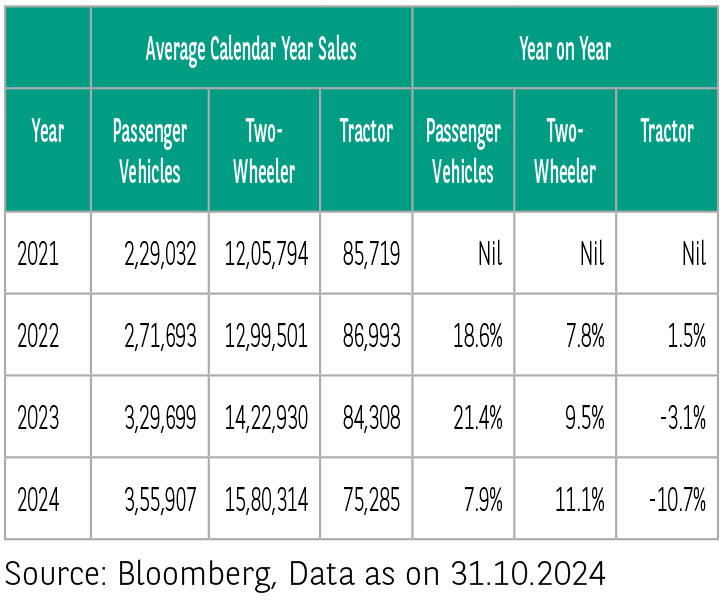

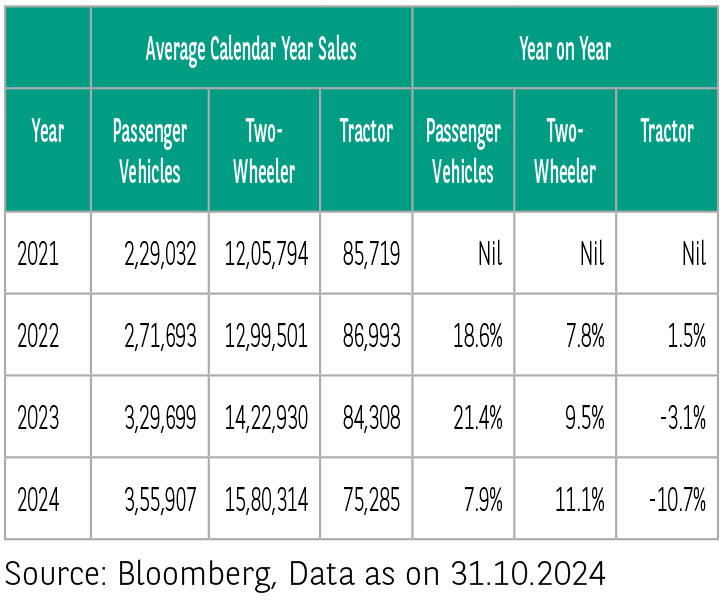

Consumer sentiments were mixed with some recovery in rural spends countered by deterioration in urban spends. Festive season retail sales (Navratri-Diwali) surprised positively for passenger vehicles, growing 9% y-o-y; 2-Wheeler maintained momentum and grew by 14% y-o-y. Demand was subdued for the urban market, while rural growth contributed positively to overall growth. GST collection for September was at Rs1,873 bn (August: Rs1,732 bn) and 8.9% higher than September 2023.

We are amid 2Q FY25 results season. Results declared so far suggest a broad-based slowdown. For 34 out of Nifty-50 companies results reported so far, net income increased 1.9% yoy compared to market expectations of a 4.5% yoy increase. While the number of companies reporting below expectation versus above expectation was almost evenly placed, the magnitude of miss in earnings was much higher. About 15 companies reported in-line results. The modest earnings growth was driven once again by BFSI, with positive contributions from Technology, Real Estate, Utilities, Telecom and Healthcare. Conversely, earnings growth was weighed down by global cyclicals, such as Oil & Gas, which saw a dip of 58% YoY, along with Metals ; Cement; Chemicals, and Consumer (+3%).

The outlook for the coming two months is positive for two-wheelers and tractors due to rural demand and weddings, while passenger vehicles are expected to see minimal growth as most sales made during the festival were due to discounting. Key events to watch out for are the festive demand trend and assembly election results in some states in coming weeks.

Nifty-50 index has corrected by 6% with valuations now in fair range. The focus is on near term earnings which is likely to be weak and recovery in 2H led by festive spends. Near term recovery in China economy and FPI outflows can be headwind to Indian markets. Long-term markets are likely to track earnings growth, which may see continued growth over next 2-3 years.

Sourcing: Kotak and Incred research, Report as of October 31, 2024

Economic data points in US deteriorated for the latest month. The US economy grew by an annualized 2.8% in the third quarter of CY24, lower than market expectations of 3%. This was largely led by slower growth in consumer spending and business investment. On the other hand, the inflation for the United States was in the US Federal Reserve target range. US PCE (Personal Consumption Expenditure) inflation for September came in at 0.2% mom (2.1% yoy), in line with expectations and accelerating from 0.1% in August. 12,000 jobs were added in October, weaker than consensus expectations. The Bank of Japan (BoJ) unanimously held rates at 0.25%, amid domestic political uncertainty.

Economic data points for India too saw weakening. September CPI (Consumer Price Index) inflation rose to 5.5% Y-o-Y compared to 3.6% in August, WPI (Wholesale Price Index) rose to 1.8% in September from 1.3% in August. August IIP (Index of Industrial Production) witnessed a contraction of 0.1% against a growth of 4.7% in July. Non-food credit growth moderated to +12.8% Y-o-Y (+1.2% M-o-M) in Sep’24; slowdown seen across major segments. Retail loan growth moderated to 13.4% Y-o-Y in September 2024 compared to 13.9% Y-o-Y in August 2024, largely driven by slower growth in housing, credit cards and unsecured personal loans.

Consumer sentiments were mixed with some recovery in rural spends countered by deterioration in urban spends. Festive season retail sales (Navratri-Diwali) surprised positively for passenger vehicles, growing 9% y-o-y; 2-Wheeler maintained momentum and grew by 14% y-o-y. Demand was subdued for the urban market, while rural growth contributed positively to overall growth. GST collection for September was at Rs1,873 bn (August: Rs1,732 bn) and 8.9% higher than September 2023.

We are amid 2Q FY25 results season. Results declared so far suggest a broad-based slowdown. For 34 out of Nifty-50 companies results reported so far, net income increased 1.9% yoy compared to market expectations of a 4.5% yoy increase. While the number of companies reporting below expectation versus above expectation was almost evenly placed, the magnitude of miss in earnings was much higher. About 15 companies reported in-line results. The modest earnings growth was driven once again by BFSI, with positive contributions from Technology, Real Estate, Utilities, Telecom and Healthcare. Conversely, earnings growth was weighed down by global cyclicals, such as Oil & Gas, which saw a dip of 58% YoY, along with Metals ; Cement; Chemicals, and Consumer (+3%).

The outlook for the coming two months is positive for two-wheelers and tractors due to rural demand and weddings, while passenger vehicles are expected to see minimal growth as most sales made during the festival were due to discounting. Key events to watch out for are the festive demand trend and assembly election results in some states in coming weeks.

Nifty-50 index has corrected by 6% with valuations now in fair range. The focus is on near term earnings which is likely to be weak and recovery in 2H led by festive spends. Near term recovery in China economy and FPI outflows can be headwind to Indian markets. Long-term markets are likely to track earnings growth, which may see continued growth over next 2-3 years.

Sourcing: Kotak and Incred research, Report as of October 31, 2024

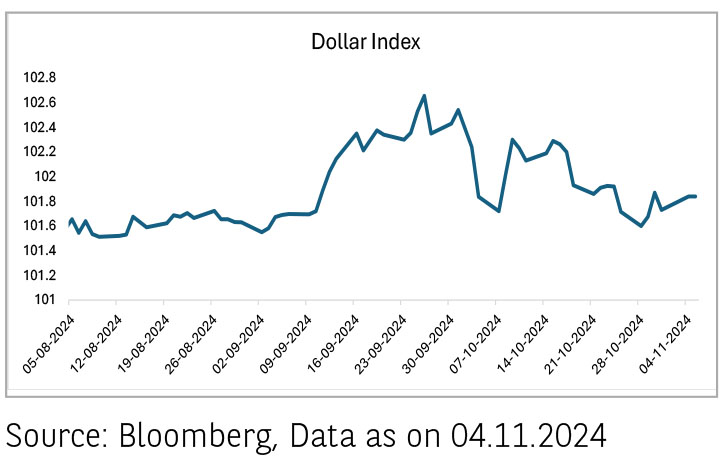

Global Economy-

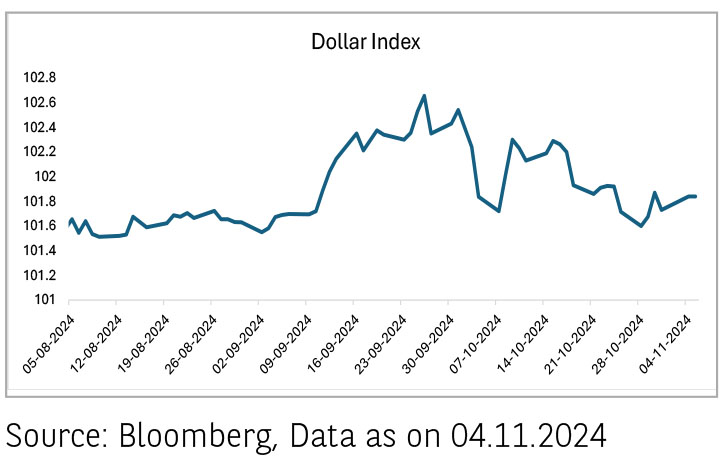

Global economic growth remained resilient in the cusp of raging wars and stingy geopolitical situations. Stable growth amidst declining inflation has been supportive of easing monetary policy conditions. Economic conditions specific to each and individual countries have been driving the global financial conditions and have led to heightened volatility in global financial markets. A stronger economic pulse from US raises the fear of inflationary pressures but on the other an aggressive rate cut by FED questions the underlying economic conditions. US elections add to the uncertainty of post-election economic policies around trade which and its subsequent impact on US yields.

As US growth remains upbeat implying a stronger USD, problems for Japan remains steady with yen depreciating again back to 153 levels. Source: Bloomberg, Data as on 04.11.2024

On the other side of the world there is China, using double edged sword of fiscal and monetary expansion, an attempt to support its fragile economy.

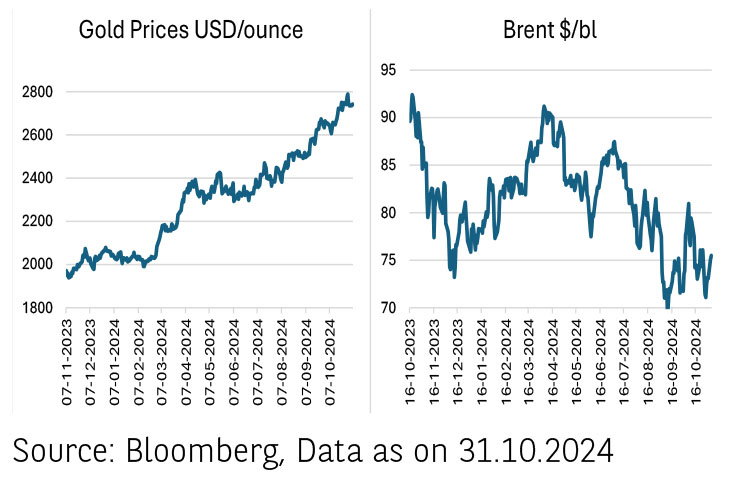

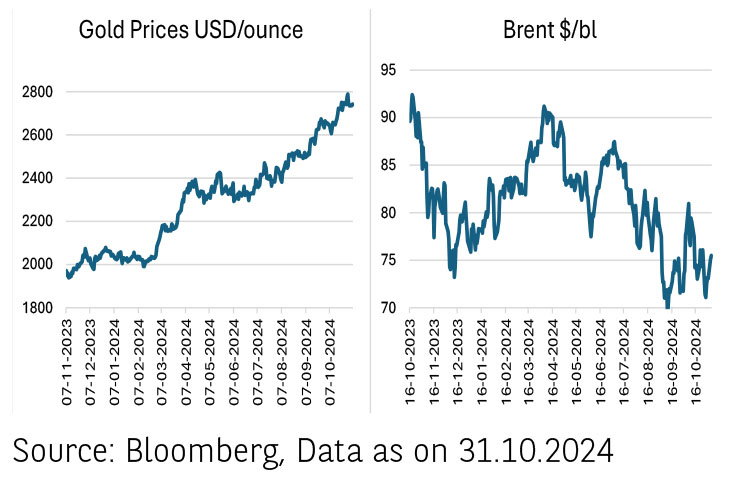

Amidst changing global sentiments and expectations, global commodity prices have seen a shift. Gold prices have reached all-time highs on bullish market sentiment combined with geopolitical tensions. Whereas brent prices continue to stay stable and reflecting the global demand and supply dynamics. Crude supply and demand forecast showcases lower demand in 2025.

Domestic Economy-

October marks the onset of festive season in India. This year macro indicators reflected some cyclical slack in Aug-2024 and September-2024. High frequency growth indicators have offset any slack visible earlier. PMI index for services and manufacturing rose from September's eight-month low of 56.5 to 57.5 in October, indicating a substantial and accelerated improvement in manufacturing activity. Despite recent geopolitical tensions, India’s growth outlook is supported by robust domestic engines.

India's auto industry witnessed divergent growth trends across segments in October, with wholesales growing a strong ~29% YoY for tractors and rising ~10% YoY for 2Ws but growing just ~1% YoY for PVs and declining ~4% YoY for trucks. During the festive period, registrations grew 13% YoY for 2Ws and 8% for PVs.

On the fiscal front, GST collections grew by 8.9% y/y in October-24 tracking ~Rs. 1.87 lac crore. Centre is comfortably positioned with its fiscal arithmetic, with net tax revenue touching ~50% of FY25 Budget estimates.

Domestic Inflation-

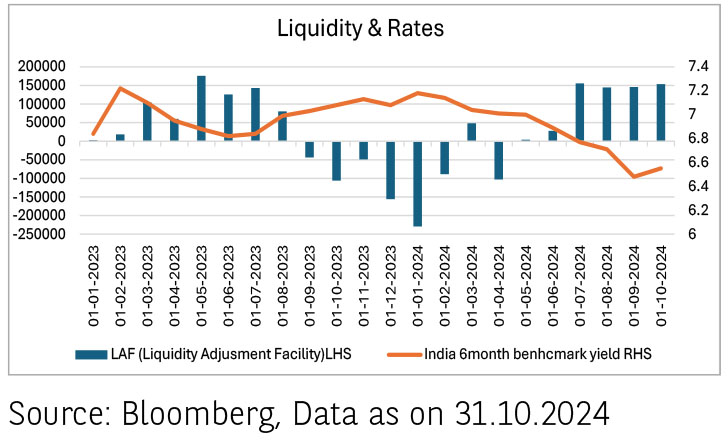

Liquidity and Rates –

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Global economic growth remained resilient in the cusp of raging wars and stingy geopolitical situations. Stable growth amidst declining inflation has been supportive of easing monetary policy conditions. Economic conditions specific to each and individual countries have been driving the global financial conditions and have led to heightened volatility in global financial markets. A stronger economic pulse from US raises the fear of inflationary pressures but on the other an aggressive rate cut by FED questions the underlying economic conditions. US elections add to the uncertainty of post-election economic policies around trade which and its subsequent impact on US yields.

As US growth remains upbeat implying a stronger USD, problems for Japan remains steady with yen depreciating again back to 153 levels. Source: Bloomberg, Data as on 04.11.2024

On the other side of the world there is China, using double edged sword of fiscal and monetary expansion, an attempt to support its fragile economy.

Amidst changing global sentiments and expectations, global commodity prices have seen a shift. Gold prices have reached all-time highs on bullish market sentiment combined with geopolitical tensions. Whereas brent prices continue to stay stable and reflecting the global demand and supply dynamics. Crude supply and demand forecast showcases lower demand in 2025.

Domestic Economy-

October marks the onset of festive season in India. This year macro indicators reflected some cyclical slack in Aug-2024 and September-2024. High frequency growth indicators have offset any slack visible earlier. PMI index for services and manufacturing rose from September's eight-month low of 56.5 to 57.5 in October, indicating a substantial and accelerated improvement in manufacturing activity. Despite recent geopolitical tensions, India’s growth outlook is supported by robust domestic engines.

India's auto industry witnessed divergent growth trends across segments in October, with wholesales growing a strong ~29% YoY for tractors and rising ~10% YoY for 2Ws but growing just ~1% YoY for PVs and declining ~4% YoY for trucks. During the festive period, registrations grew 13% YoY for 2Ws and 8% for PVs.

On the fiscal front, GST collections grew by 8.9% y/y in October-24 tracking ~Rs. 1.87 lac crore. Centre is comfortably positioned with its fiscal arithmetic, with net tax revenue touching ~50% of FY25 Budget estimates.

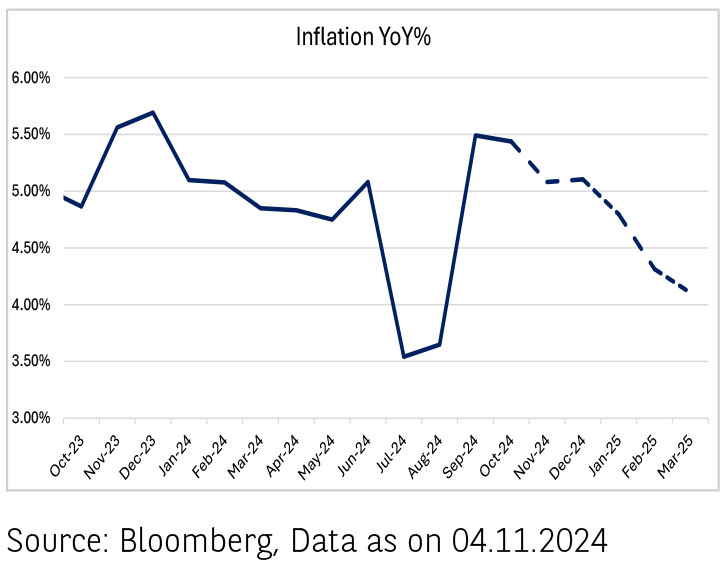

Domestic Inflation-

- Shocks to headline inflation in September-2024 led by pickup in food prices, disrupts the expected softening of the inflation trajectory and complicates the policy outlook.

- Following the uptick in food prices, which is expected to stay in October as well, the expectations of headline inflation in Q3 FY25 are tracking above 5%, diminishing any expectations of rate cut in December-2024.

- Having said that, we expect the volatility in perishable food prices to continue and the decline to be sharper in Q4 FY25 with the arrival of winter crops

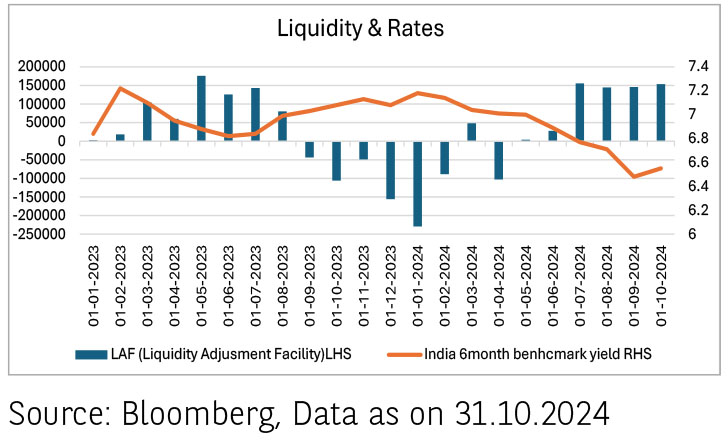

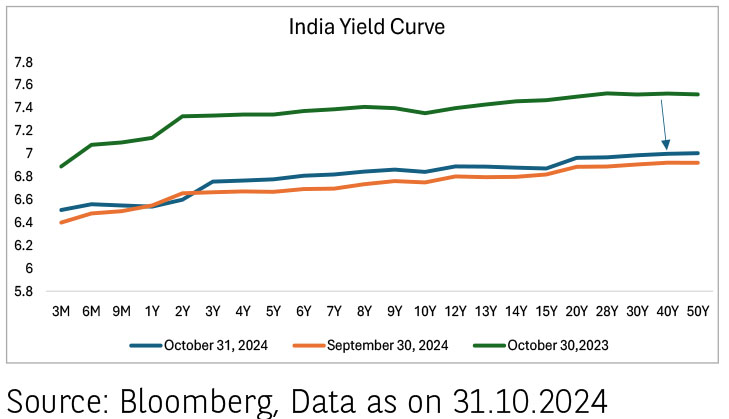

Liquidity and Rates –

- System liquidity was driven by month-end government spending and CRR drawdown.

- The average net surplus rose to Rs1.03 trillion. from Rs895 billion in the week prior.

- Tracking the liquidity conditions, the weighted average overnight rates fell sharply by 30 bps.

- Going ahead, we expect liquidity surplus to improve driven by heavy redemption, normalisation in CIC leakage and limited net auctions outflow. However, we remain watchful of RBI FX interventions.

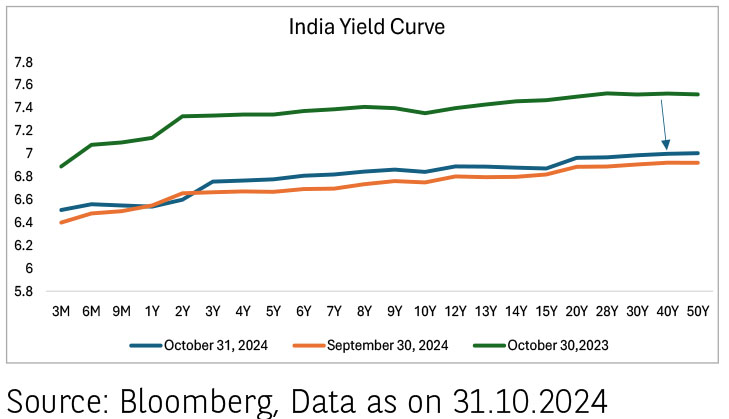

- India Fixed Income outlook has been driven by two key fundamentals.

- Firstly, Global Monetary policy dynamics will be the key trigger for global liquidity and flows. India is placed as an favorable destination amongst other emerging market economies. Also, we have already started to witness robust flows in both equity and debt segments.

- Secondly, domestic inflation remains a key watch for RBI’s monetary policy decision making.

- Headline inflation is expected to remain above 4% for entire fiscal FY25, with some headroom of inflation’s closest call to 4% in Feb-2024.

- Recent food shocks to inflation has disrupted the softening of inflation trajectory.

- Our base case scenario of rate cut expectations remains the same. We expect RBI MPC policy to follow the inflation trajectory and any space for a domestic pivot is expected in Q4 FY25, where we expect inflation to be closer to RBI’s 4% target driven by winter food crop arrival.

- Our view on rates remain optimistic with fundamentals aligning with fixed income outlook expectations of softening across the curve.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.