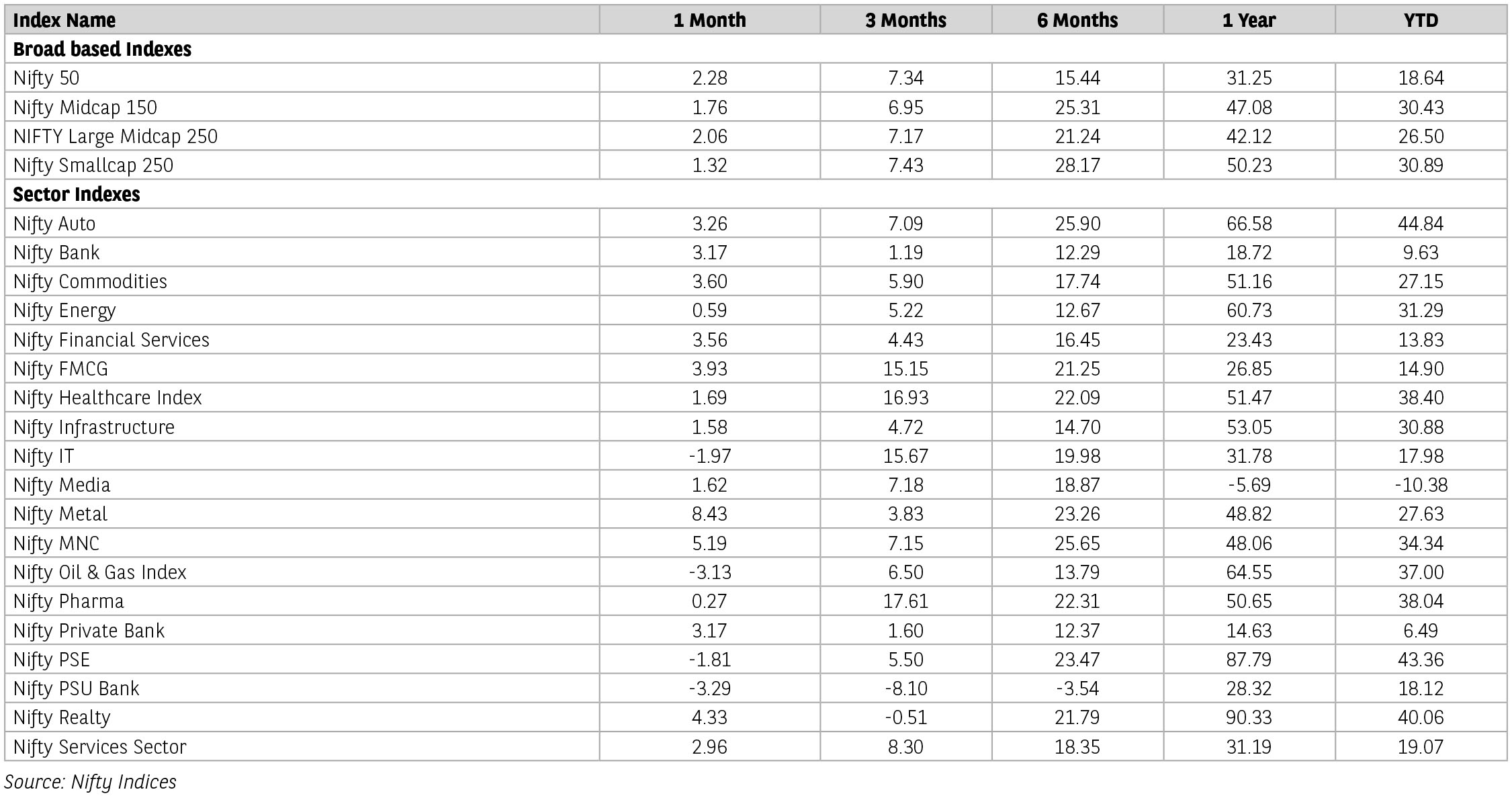

The Nifty 50 Index ended the month with a 2.3% gain. The metals sector emerged as the top-performing sector, rising 7% in the month, followed by consumer

durables and power sectors that were up 6% and 5%, respectively. Oil & gas, PSU and IT sectors declined 4%, 3% and 3%. Mid-cap (+1.5%) and small-cap (-0.7%)

indices underperformed large-cap Indices. Globally, Hang Seng and Shanghai Composite soared 18% each. Thailand, the Philippines and Singapore were up

7%, 5% and 4%, respectively. Brazil, South Korea and Japan declined 3%, 3% and 2%, respectively. Foreign Portfolio Investors bought USD 5.4 billion (until Sep

27, 2024) of Indian equities in the secondary market, whereas Domestic Institutional Investor’s bought USD3.8 billion (until Sep 30, 2024).

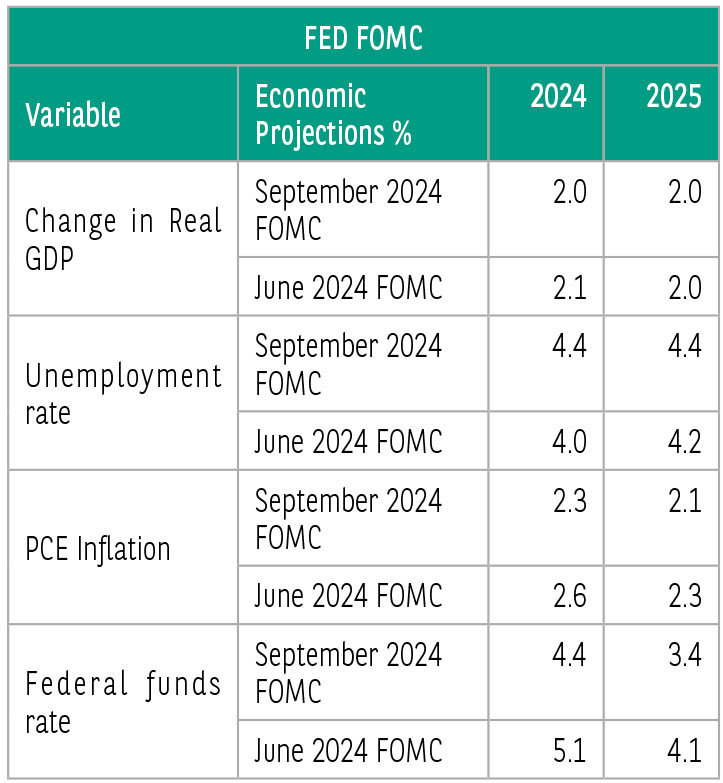

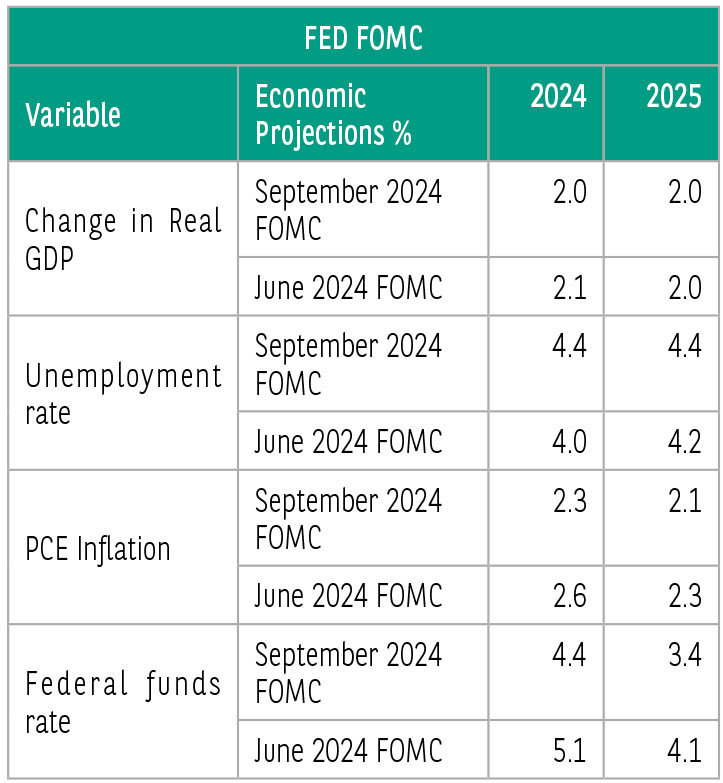

At the beginning of the month, investors remained cautious ahead of the key US economy data release. An aggressive interest rate cut by the US Federal Reserve and long-awaited stimulus measures from China helped to boost investor mood in the second half of the month. The Federal Reserve began its rate cut cycle with a 50-bps rate cut, with the Fed fund rate now at 4.75-5%. China also announced various stimulus packages to support the economy.

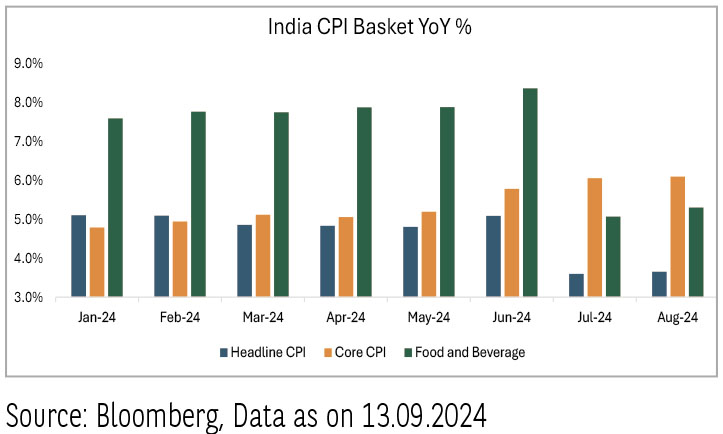

Indian economy is on a strong footing. Moody’s revised its CY2024 Gross Domestic Product growth forecast for India to 7.1% from its earlier estimates of 6.8%; S&P retained India's FY2025 growth forecast at 6.8%. August Consumer Price Index in ation inched up marginally to 3.7% from 3.5% in July. India’s Wholesale Price Index dropped to a four-month low of 1.3% in August. Index of Industrial Production growth in July rmed up to 4.8% compared to an upwardly revised June reading of 4.7%. The index of eight core industries grew by 6.1% year on year in Jul 2024. The strong growth was anchored by electricity generation, steel and re nery production. India’s Quarter 1 FY25 current account de cit (CAD) widened to USD 9.7bn (1.1% of GDP) from a surplus of USD4.6bn (0.5% of GDP) in Quarter 4 FY24, led by increase in goods trade de cit.

With above-average monsoon rains, all eyes are on festive demand recovery. Monsoon progress improved further in September 2024. Cumulative rainfall improved to 7% above normal as of 27th September 2024. Corporate pro ts remain in an up-cycle, and the market expects a recovery in earnings from a weak June quarter, which was adversely affected by the elections. Government spending has picked up, and private spending also appears to be on a recovery path, led by rural consumption.

In September 2024, two-wheelers saw strong Year on Year growth, while commercial vehicles experienced a double-digit decline, and cars had mixed results due to the inauspicious period affecting retail sales. Inventory build-up occurred as festivals bunched in October, leading to selective volume growth and increased discounts.

Consumer sentiment in India marginally improved in Aug 2024, after easing from its July 2024 peak. After the heat wave and torrential rains hurt consumer foot falls, there is hope due to the better spending trend in the current year for both essential and discretionary goods ahead of the festive season. The onset of the holiday season in the southern and western regions will be closely observed, as it will offer preliminary indicators of the trend in festive demand for the next two months. Nifty is trading at 20x FY26E which is in line with 5-year averages. Focus will shift to corporate earnings and there are hopes of a rural & festival-led recovery in coming months. Normal monsoon in Sep’24, pick up in government spending and robust investment trajectory is expected to boost the economy.

Source: Kotak and Incred research; date: 30th September 2024

At the beginning of the month, investors remained cautious ahead of the key US economy data release. An aggressive interest rate cut by the US Federal Reserve and long-awaited stimulus measures from China helped to boost investor mood in the second half of the month. The Federal Reserve began its rate cut cycle with a 50-bps rate cut, with the Fed fund rate now at 4.75-5%. China also announced various stimulus packages to support the economy.

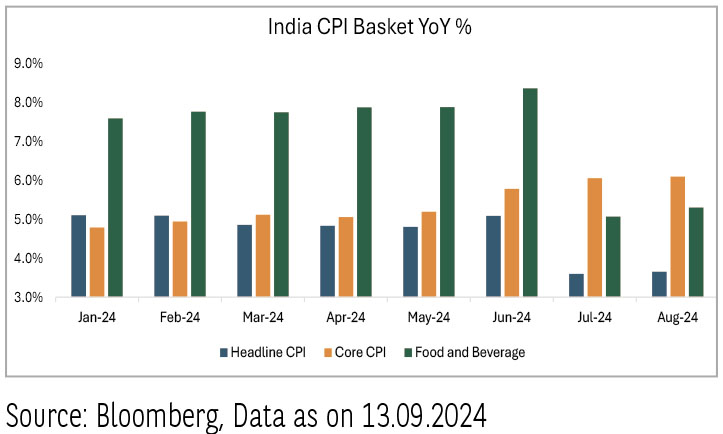

Indian economy is on a strong footing. Moody’s revised its CY2024 Gross Domestic Product growth forecast for India to 7.1% from its earlier estimates of 6.8%; S&P retained India's FY2025 growth forecast at 6.8%. August Consumer Price Index in ation inched up marginally to 3.7% from 3.5% in July. India’s Wholesale Price Index dropped to a four-month low of 1.3% in August. Index of Industrial Production growth in July rmed up to 4.8% compared to an upwardly revised June reading of 4.7%. The index of eight core industries grew by 6.1% year on year in Jul 2024. The strong growth was anchored by electricity generation, steel and re nery production. India’s Quarter 1 FY25 current account de cit (CAD) widened to USD 9.7bn (1.1% of GDP) from a surplus of USD4.6bn (0.5% of GDP) in Quarter 4 FY24, led by increase in goods trade de cit.

With above-average monsoon rains, all eyes are on festive demand recovery. Monsoon progress improved further in September 2024. Cumulative rainfall improved to 7% above normal as of 27th September 2024. Corporate pro ts remain in an up-cycle, and the market expects a recovery in earnings from a weak June quarter, which was adversely affected by the elections. Government spending has picked up, and private spending also appears to be on a recovery path, led by rural consumption.

In September 2024, two-wheelers saw strong Year on Year growth, while commercial vehicles experienced a double-digit decline, and cars had mixed results due to the inauspicious period affecting retail sales. Inventory build-up occurred as festivals bunched in October, leading to selective volume growth and increased discounts.

Consumer sentiment in India marginally improved in Aug 2024, after easing from its July 2024 peak. After the heat wave and torrential rains hurt consumer foot falls, there is hope due to the better spending trend in the current year for both essential and discretionary goods ahead of the festive season. The onset of the holiday season in the southern and western regions will be closely observed, as it will offer preliminary indicators of the trend in festive demand for the next two months. Nifty is trading at 20x FY26E which is in line with 5-year averages. Focus will shift to corporate earnings and there are hopes of a rural & festival-led recovery in coming months. Normal monsoon in Sep’24, pick up in government spending and robust investment trajectory is expected to boost the economy.

Source: Kotak and Incred research; date: 30th September 2024

Global Economy-

Post the Aug-2024 RBI policy, global assessment has shown that many central banks especially in the west have started cutting rates and this includes recent FED’s pivot in Sep-2024. This comes after declining in ation in major economies and slowing labour market conditions in advanced economies. In ation dynamics in the US have showed a slow decay whereas the concerns have shifted towards labour market. US Nonfarm payroll numbers re ect moderation in the labour markets and every release of the same during the FED FOMC has been raising brows.

Amongst the most recent high frequency indicators of global economic activity, job growth is getting softer as labour markets continue to slow down, unemployment rates are ticking up and wage growth is easing, for economies like UK, Euro area etc.

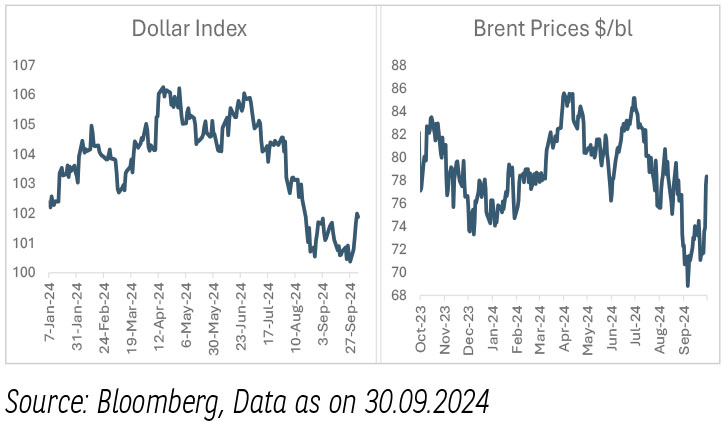

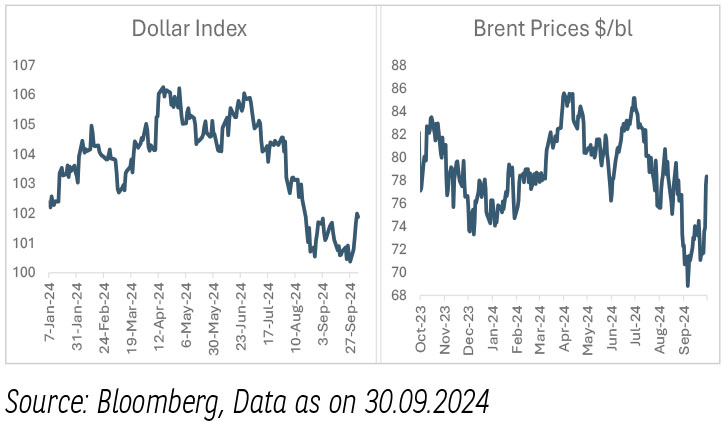

The concern on demand outlook was re ected in declining commodity prices as Brent prices in September declined to as low as 69$/bl. The recent are up between Israel and Iran has led to jump in brent prices and remains a key risk in the future trajectory of energy prices and subsequent impact on global in ation. In last three years we have noticed that the impact of these geopolitical tensions have been re ected in in ation shocks and growth slowdown, eventually bringing the brent prices under control with a lag.

As growth became a visible concern for global central banks, global bond rates softened driven by easing monetary conditions and the most awaited Fed pivot. On the given back drop major emerging market currencies appreciated as the dollar index showed softer declines to 100 and again raced by closer to 101. Japanese yen appreciated to 140 levels and soon inched up to 147 levels as dollar indexed stabilised. China’s economy continues to remain sluggish with easing monetary and scal expansion weighing on its currency.

Domestic Economy-

The month of September aligns with the onset of festive season in India and thus the production and inventory build up starts taking pace. The decline in brent prices in September remained supportive of the input cost in ation. PMI surveys for manufacturing and services re ected expansion at a slower pace. The constrain was visible in total sales growth led by softer increase in new export orders. The recent months Aug-Sep-24 have seen a moderating trend in some high frequency growth indicators such as passenger vehicles sales, power demand, cement and steel production. While some activity indicators have softened, we believe this is mainly due to disruption to production activity on account of higher rainfall especially in August and seasonal trends.

On the scal front, the central government’s scal de cit in FYTD basis was 27% of FY2025 budget estimates (BE), with receipts holding up. The receipts were supported by strong growth in personal income taxes and non-tax revenues. Direct taxes on FYTD basis stood 36% y/y. Indirect tax collection growth was higher by 9.5% y/y on FYTD basis.

Domestic Inflation-

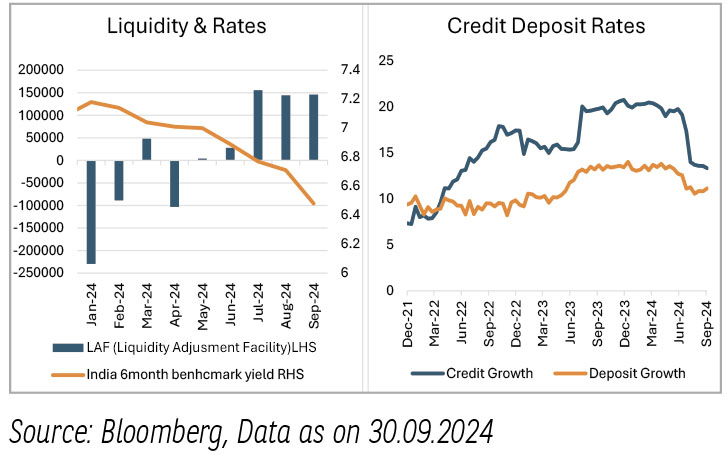

Liquidity and Rates –

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any nancial product or instrument. Past Performance may or may not be sustained in future.

Post the Aug-2024 RBI policy, global assessment has shown that many central banks especially in the west have started cutting rates and this includes recent FED’s pivot in Sep-2024. This comes after declining in ation in major economies and slowing labour market conditions in advanced economies. In ation dynamics in the US have showed a slow decay whereas the concerns have shifted towards labour market. US Nonfarm payroll numbers re ect moderation in the labour markets and every release of the same during the FED FOMC has been raising brows.

Amongst the most recent high frequency indicators of global economic activity, job growth is getting softer as labour markets continue to slow down, unemployment rates are ticking up and wage growth is easing, for economies like UK, Euro area etc.

The concern on demand outlook was re ected in declining commodity prices as Brent prices in September declined to as low as 69$/bl. The recent are up between Israel and Iran has led to jump in brent prices and remains a key risk in the future trajectory of energy prices and subsequent impact on global in ation. In last three years we have noticed that the impact of these geopolitical tensions have been re ected in in ation shocks and growth slowdown, eventually bringing the brent prices under control with a lag.

As growth became a visible concern for global central banks, global bond rates softened driven by easing monetary conditions and the most awaited Fed pivot. On the given back drop major emerging market currencies appreciated as the dollar index showed softer declines to 100 and again raced by closer to 101. Japanese yen appreciated to 140 levels and soon inched up to 147 levels as dollar indexed stabilised. China’s economy continues to remain sluggish with easing monetary and scal expansion weighing on its currency.

Domestic Economy-

The month of September aligns with the onset of festive season in India and thus the production and inventory build up starts taking pace. The decline in brent prices in September remained supportive of the input cost in ation. PMI surveys for manufacturing and services re ected expansion at a slower pace. The constrain was visible in total sales growth led by softer increase in new export orders. The recent months Aug-Sep-24 have seen a moderating trend in some high frequency growth indicators such as passenger vehicles sales, power demand, cement and steel production. While some activity indicators have softened, we believe this is mainly due to disruption to production activity on account of higher rainfall especially in August and seasonal trends.

On the scal front, the central government’s scal de cit in FYTD basis was 27% of FY2025 budget estimates (BE), with receipts holding up. The receipts were supported by strong growth in personal income taxes and non-tax revenues. Direct taxes on FYTD basis stood 36% y/y. Indirect tax collection growth was higher by 9.5% y/y on FYTD basis.

Domestic Inflation-

- Headline in ation remained below 4% led by favourable base. Sep-2024 inflation expectations are clocking a number closer to 5% y/y as the favourable base fades.

- Future trajectory of in ation is expected to be supported by softer input cost in ation and supportive commodity prices.

- Our in ation projections foresee in ation trajectory to soften in Q4 FY25 supported by winter food crop arrival.

- Any space from in ation perspective for a monetary pivot is visible in Q4 FY25 and that coincides with the Feb-2024 RBI MPC.

Liquidity and Rates –

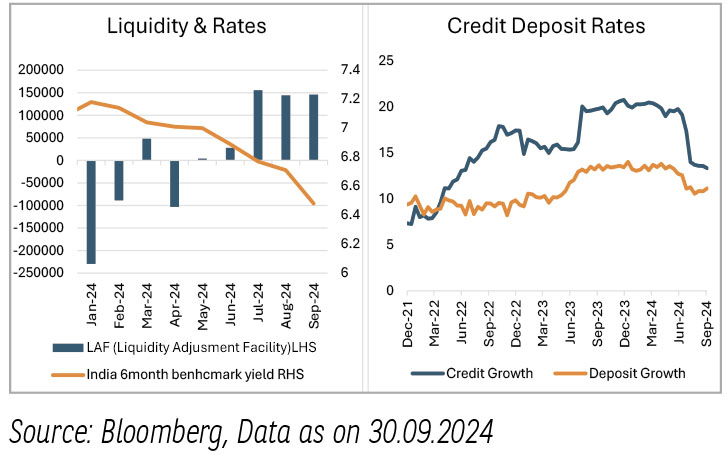

- Credit growth has been above deposit growth for the past 29-months.

- Although credit growth has moderated to 13.3% in Sep-24, the credit-deposit ratio remains elevated at 78.6%, having tracked above 77% since Nov-22.

- We expect seasonal factors such as increased incremental credit demand alongside currency in circulation driven by the festival / wedding season to create some pressure on liquidity in 2HF25.

- However, this will likely be offset by an improving trend in government spending.

- Government cash balances is expected to have picked up to around Rs 3.9 trn around September end, due to indirect and direct tax collections. Going forward, we expect the government cash balances to re ect in terms of spending in domestic liquidity.

- We remain positive on liquidity outlook given expectations of stance change in Q3 2024.

- FED’s pivot in Sep-9.2200224 4, comes after declining in ation and slowing labour market conditions. This also marks pivot to easing liquidity conditions globally.

- In the light of above, India is placed as a favorable destination amongst other emerging market economies. Also, we have already started to witness robust ows in both equity and debt segments.

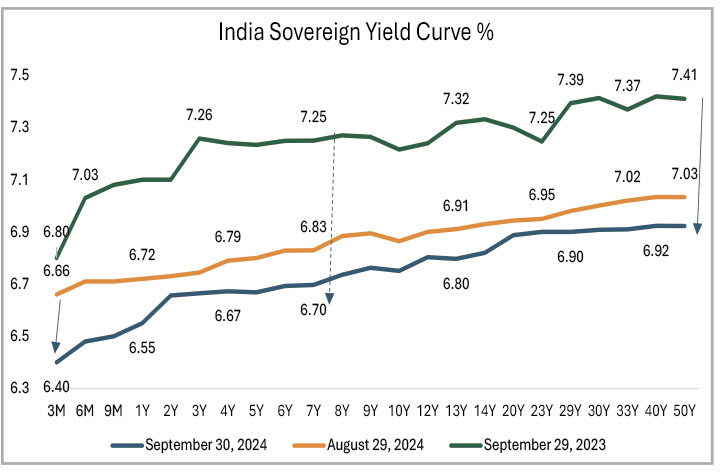

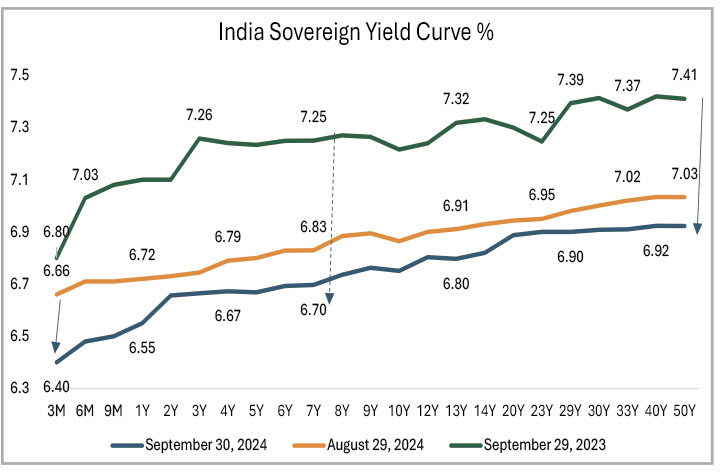

- Additionally post the JP Morgan GBI-EM inclusion we have witnessed favourable demand supply dynamics in the domestic bond markets, navigating the rates further lower.

- Firstly, Global Monetary policy dynamics will be the key trigger for global liquidity and ows.

- Secondly, domestic in ation remains a key watch for RBI’s monetary policy decision making.

- In the upcoming policy we expect RBI to disassociate from the interest rate developments globally and take view on the domestic rates based on evolving conditions of domestic in ation and growth dynamics.

- RBI’s response is expected to be attuned to rst a stance change and followed by a lag in rate cut. The space to pivot is expected in Q4 FY25.

- Our view on rates remains optimistic with fundamentals aligning with fixed income outlook expectations of softening across the curve.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any nancial product or instrument. Past Performance may or may not be sustained in future.