The Nifty Index declined 2% in the month of February— third consecutive month of decline. Globally sentiments turned bearish as fears of further rate hikes

emanated post strong jobs data, sticky core inflation levels and resilient GDP data in the US. Consequently, global markets corrected. Hong Kong (-9%), Brazil

(-7%) and US Dow Jones (-4%) lost the most, while France (+3%), Germany (+2%) and Taiwan (+2%) gained the most.

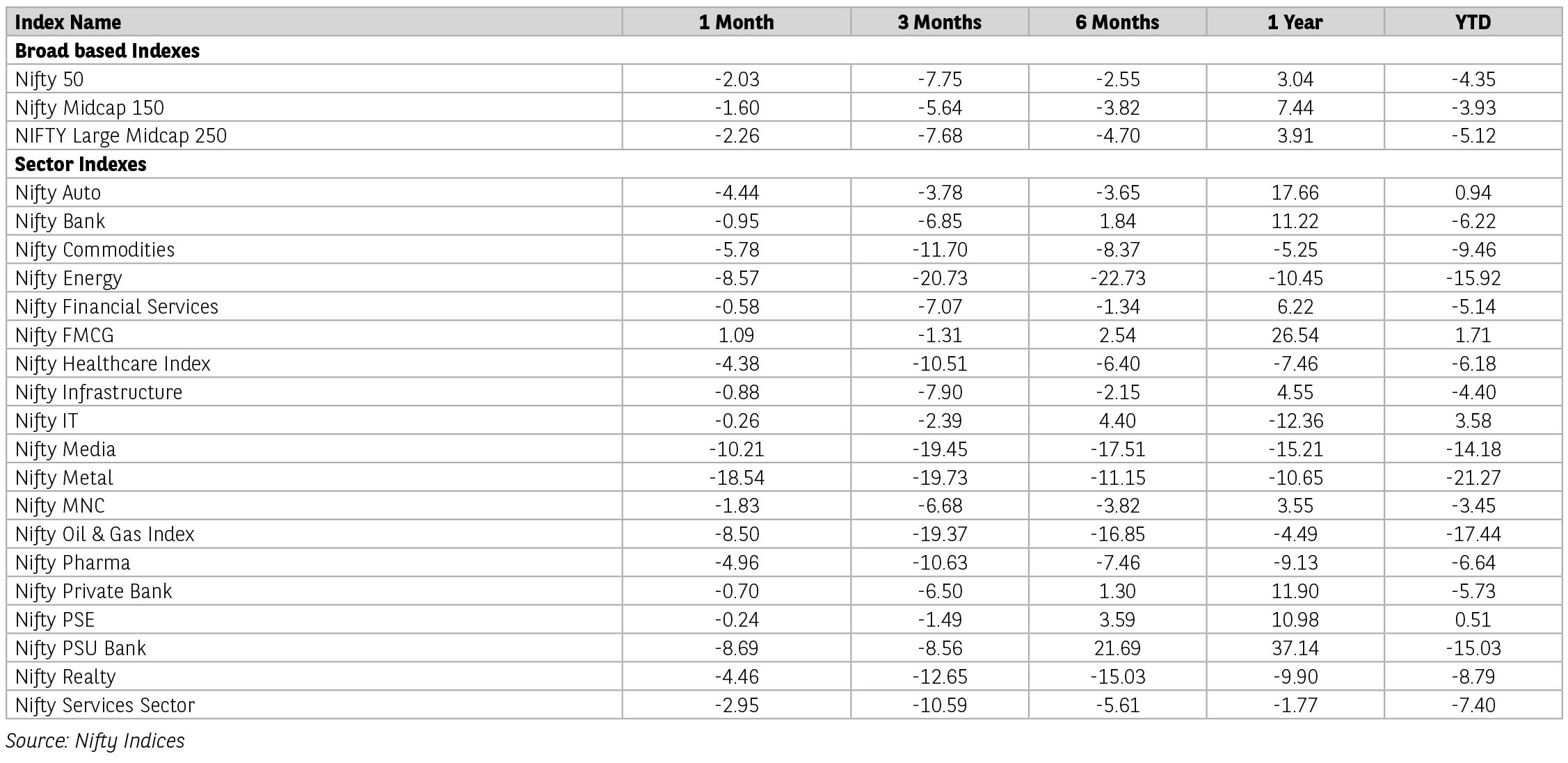

In India, Inflation challenges, earnings season and stock market rout in a particular groups’ companies led to Index correcting to 17,500 levels. Mid-cap and small-cap indices were down nearly 2% and 4%, respectively. Sector-wise, power (-16%), metals (-10%) and oil & gas (-9%) declined the most, while FMCG and capital goods were the only indices to close in green.

The US FOMC, in line with expectations, hiked the target range for the federal funds rate by 25 bps. The RBI MPC hiked the repo rate by 25 bps and remained concerned about elevated inflation, especially core inflation, while being optimistic about growth. Minutes of the recent meetings of the RBI and the US Fed suggest that banks are willing to increase the interest rates further as inflation remains a concern. In the first week of February, central banks - US, BoE and ECB raised rates by 25 bps, 50 bps and 50 bps respectively, in line with consensus expectations.

Q3FY23 earnings were in-line with market expectations, with similar number of companies beating/missing earnings expectations for Nifty. Strong earnings growth (YOY) was seen in Automobiles, FMCG, Banks, Capital Goods, NBFCs and Telecom while substantial contraction was recorded in Metals & Mining and Cement. The sectors that witnessed major EPS beat were automobiles, banks, capital goods, consumer staples and IT, while the major miss was in cement, gas, utilities, and metals. 3QFY23 results surprises helped IT and FMCG sectors to outperform the index, while capex boost from the Union budget continues to drive the capital goods index’s outperformance.

Domestic economic activity shows a mixed trend post festival cheer in the Dec 2022 quarter. GST collections and E-way bills recorded the second-best monthly performance in Jan 2023, electricity consumption, Purchasing Managers Index and merchandise trade deficit improved sustainably.

However, easing credit growth, a spike in consumer inflation above the RBI’s threshold, a sustained fall in exports and job losses at start-ups and likely prolonged higher interest rate expectations likely to keep a check on market sentiments.

January CPI inflation surprised sharply on the upside at 6.52% from 5.7% in December, mainly due to a sequential rise in cereal prices. January WPI inflation moderated to 4.7% from 5% in December. December IIP moderated to 4.3% compared to 7.4% in November. January exports fell by 6.6% (YOY) to US $32.9 bn. January imports fell by 3.6% (YOY) to US $50.7 bn. 3QFY23 real GDP growth moderated to 4.4% (2QFY23: 6.3%).

Markets are in consolidation phase currently with one year returns at 5%, outperforming emerging markets. Globally sentiments likely to remain in check with FED firm on its path to curtail inflation levels at 2%. In India key to watch could be capex spends, which is holding well, rural recovery considering worries on rains this year and governments continued thrust on infrastructure spends. Sectoral, we are bullish on credit, capex and selective consumer names.

Source: Kotak Securities

In India, Inflation challenges, earnings season and stock market rout in a particular groups’ companies led to Index correcting to 17,500 levels. Mid-cap and small-cap indices were down nearly 2% and 4%, respectively. Sector-wise, power (-16%), metals (-10%) and oil & gas (-9%) declined the most, while FMCG and capital goods were the only indices to close in green.

The US FOMC, in line with expectations, hiked the target range for the federal funds rate by 25 bps. The RBI MPC hiked the repo rate by 25 bps and remained concerned about elevated inflation, especially core inflation, while being optimistic about growth. Minutes of the recent meetings of the RBI and the US Fed suggest that banks are willing to increase the interest rates further as inflation remains a concern. In the first week of February, central banks - US, BoE and ECB raised rates by 25 bps, 50 bps and 50 bps respectively, in line with consensus expectations.

Q3FY23 earnings were in-line with market expectations, with similar number of companies beating/missing earnings expectations for Nifty. Strong earnings growth (YOY) was seen in Automobiles, FMCG, Banks, Capital Goods, NBFCs and Telecom while substantial contraction was recorded in Metals & Mining and Cement. The sectors that witnessed major EPS beat were automobiles, banks, capital goods, consumer staples and IT, while the major miss was in cement, gas, utilities, and metals. 3QFY23 results surprises helped IT and FMCG sectors to outperform the index, while capex boost from the Union budget continues to drive the capital goods index’s outperformance.

Domestic economic activity shows a mixed trend post festival cheer in the Dec 2022 quarter. GST collections and E-way bills recorded the second-best monthly performance in Jan 2023, electricity consumption, Purchasing Managers Index and merchandise trade deficit improved sustainably.

However, easing credit growth, a spike in consumer inflation above the RBI’s threshold, a sustained fall in exports and job losses at start-ups and likely prolonged higher interest rate expectations likely to keep a check on market sentiments.

January CPI inflation surprised sharply on the upside at 6.52% from 5.7% in December, mainly due to a sequential rise in cereal prices. January WPI inflation moderated to 4.7% from 5% in December. December IIP moderated to 4.3% compared to 7.4% in November. January exports fell by 6.6% (YOY) to US $32.9 bn. January imports fell by 3.6% (YOY) to US $50.7 bn. 3QFY23 real GDP growth moderated to 4.4% (2QFY23: 6.3%).

Markets are in consolidation phase currently with one year returns at 5%, outperforming emerging markets. Globally sentiments likely to remain in check with FED firm on its path to curtail inflation levels at 2%. In India key to watch could be capex spends, which is holding well, rural recovery considering worries on rains this year and governments continued thrust on infrastructure spends. Sectoral, we are bullish on credit, capex and selective consumer names.

Source: Kotak Securities

During the month of February, we witness some

major event unfolding in domestic and globally. To

start with Union budget in India whereby all eyes

were on the fiscal projections and the quality of the

budget spending. It was in line with government

making credible efforts to move towards capital

spending than revenue. It also showed a promise

towards fiscal consolidation by FY 2026. However,

market was divided over the gross borrowing

numbers of Central govt. and its demand supply

dynamics.

Further, globally the central bank have kept their rate hikes on; however, we could sense a underlying concern on the economic growth over higher than targeted inflation readings.

The geopolitics also kept market on the tenterhooks with Russia Ukraine war as well as South China sea discussions taking centre stage. The market was looking optimistically over the China re-opening and with its impact over the supply issues getting sorted as well as its impact on commodities in general.

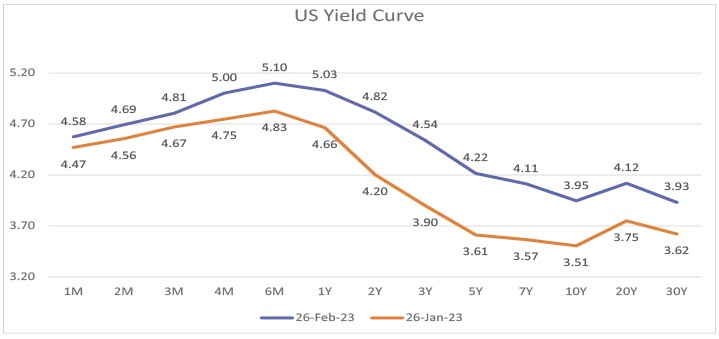

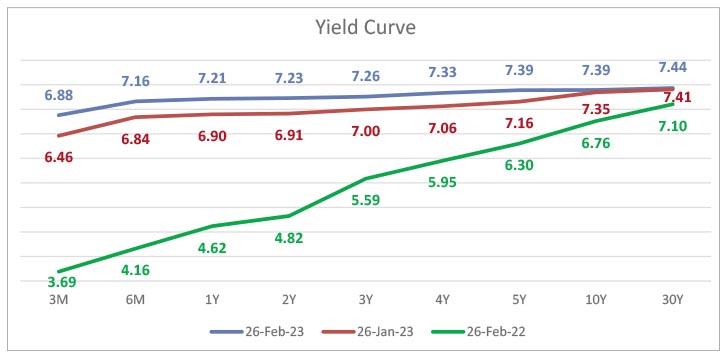

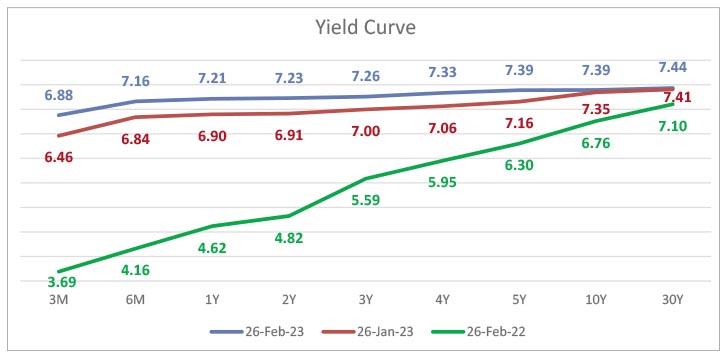

The uncertainty over the broad economic data largely driven by better-than-expected retail sales number in US and much higher inflation number pushing back the FED pause by a couple months. As a result, we saw the global as well as domestic yields moving higher by 25-30 bps across the curve.

Global Scenario

Inflation

Inflation

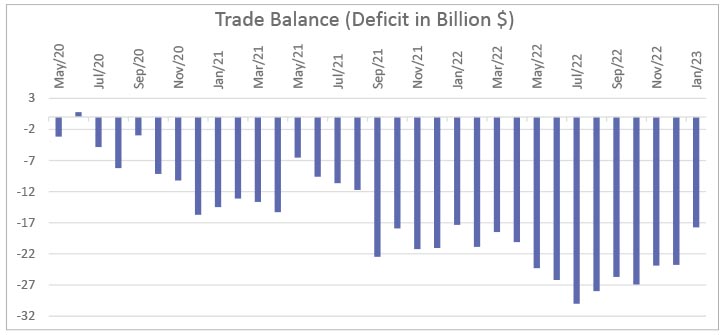

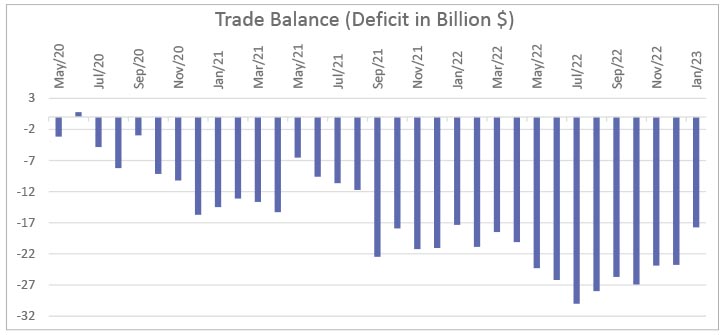

India's trade deficit widened to USD 17.75 billion in January 2023, up from USD 17.42 in the same month last year. Exports were down 4.6 percent amid weaker global demand, Meanwhile, imports dropped at a slower 2.4 percent as purchases of gold tumbled more than 11.0 percent. The exports were supported by higher software services, and professional and management consulting.

Going forward

Source: Bloomberg, Budget Document, and Internal Research.

This information is meant for general reading purpose only and is not meant to serve as a professional guide for the readers. The information should not be construed as an investment advice and investors are requested to consult their investment advisor and arrive at an informed investment decision before making any investments.

Further, globally the central bank have kept their rate hikes on; however, we could sense a underlying concern on the economic growth over higher than targeted inflation readings.

The geopolitics also kept market on the tenterhooks with Russia Ukraine war as well as South China sea discussions taking centre stage. The market was looking optimistically over the China re-opening and with its impact over the supply issues getting sorted as well as its impact on commodities in general.

The uncertainty over the broad economic data largely driven by better-than-expected retail sales number in US and much higher inflation number pushing back the FED pause by a couple months. As a result, we saw the global as well as domestic yields moving higher by 25-30 bps across the curve.

Global Scenario

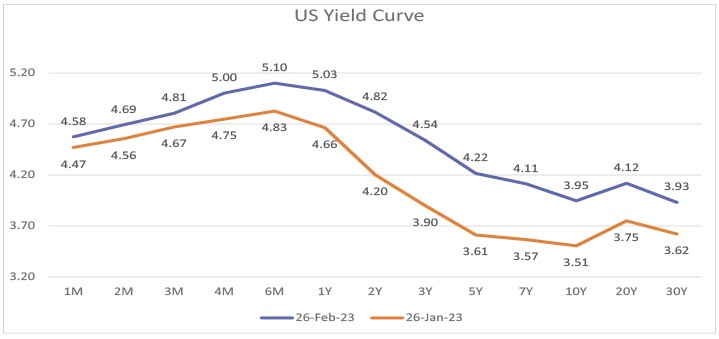

- US Fed has hiked the rate by 25 bps, taking the fed funds rate to 4.50 - 4.75% in February Meeting. although a few officials favoured raising it by 50bps, minutes from the last meeting showed.

- The Bank of England also hiked interest rates by 50 basis points, taking rates to 4%.

- The Bank of Japan will see a change of guard at the helm and we expect them to continue with yield curve control together with bond buying to support the economic growth as well as FX stability.

- The People’s Bank of China has been the first Central bankers to start pro-growth measure with liquidity infusion in the banking system.

Inflation

- The ECB has pre-committed a 50 bps rate hike in Mar-23 and sticky core inflation is likely to result in more rate hikes by the ECB.

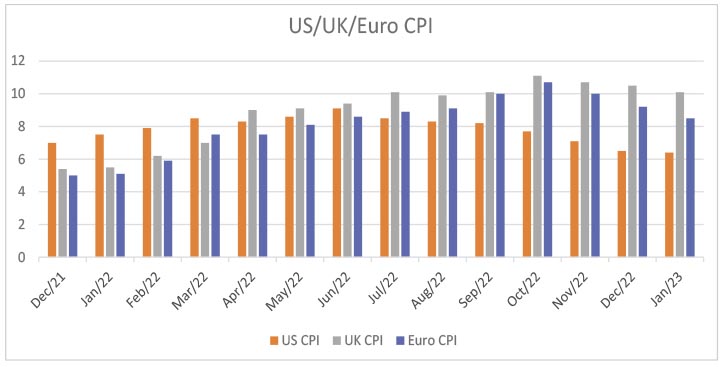

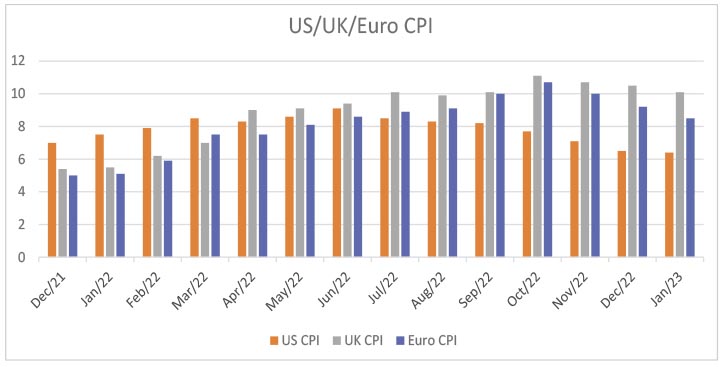

- US Inflation moderated to 6.4% in January of 2023 from 6.5% in December.

- Inflation rate in the UK fell to 10.1% in January of 2023 from 10.5% in December, below market forecasts of 10.3%. The CPI in the Euro was revised slightly higher to 8.6 percent YoY in January 2023, well above the European Central Bank’s target of 2.0 percent.

Inflation

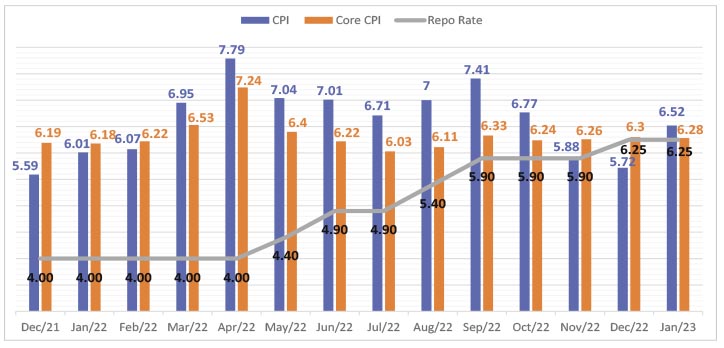

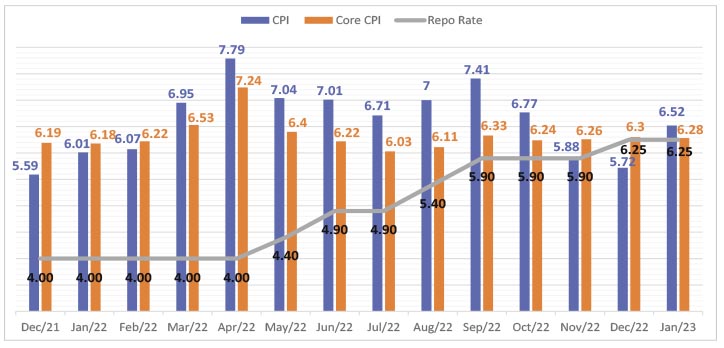

- CPI Increase sharply to 6.52 in Jan 2023, the highest in three months, compared to 5.72% in December, and above market expectations of 5.9%, led by core inflation, food inflation, and unfavorable base effects.

- Food inflation jumped to 5.94% from 4.19%, housing at (4.62% vs 4.47%); fuel and light came at 10.84% vs 10.97%.

- India’s Q3 GDP for FY23 came in at 4.4% YoY (Q2: 6.3% YoY), while real GVA slipped to 4.6% YoY (Q2: 5.5% YoY).

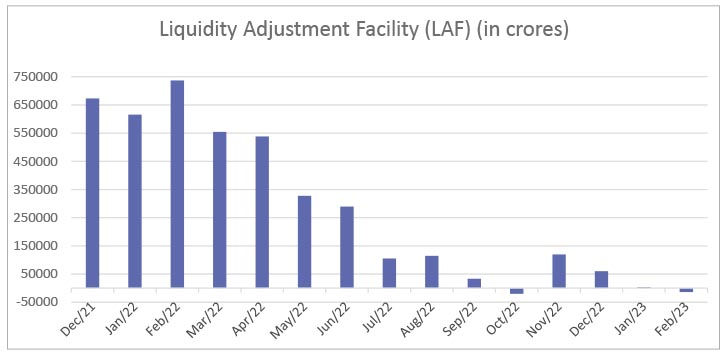

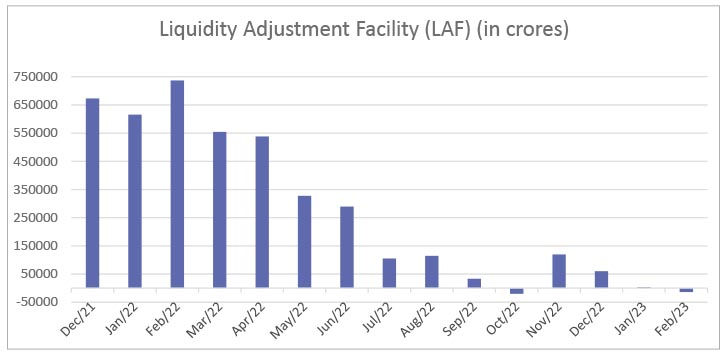

- Liquidity remained neutral to tight towards the end of month due to higher GST collection and low government spending and direct & Indirect tax collections lined up.

- The RBI did not rollover a repo auction, rather announced VRRR auction. Resulting implications for short term rates.

- RBI Increased the t-bill borrowing amount by 50,000 cr for remaining auctions for this fiscal year.

- Tight liquidity conditions and supply pressure at the shorter end led by Banks and Corporates across the curve taking the levels higher by almost 20-30 bps making the curve more flatter.

- Demand for money may keep the front end of the curve elevated for this month.

India's trade deficit widened to USD 17.75 billion in January 2023, up from USD 17.42 in the same month last year. Exports were down 4.6 percent amid weaker global demand, Meanwhile, imports dropped at a slower 2.4 percent as purchases of gold tumbled more than 11.0 percent. The exports were supported by higher software services, and professional and management consulting.

Going forward

- We find that Central bankers have suggested a quite submission over inflation being higher than their targets and have started to focus on growth.

- The question over terminal rates rests now on economic data and we expect that the conflicting data particularly in US could be seasonal and more clarity emerges in couple of months.

- We firmly believe that higher rates are beginning to impact broader economy across the globe and we could see a pause from FED much sooner than market expectation; We are pencilling FED to stop at 5.00%, which is lower than market expectation of around 5.25 - 5.50%.

- Liquidity in the banking system may remain very tight and may remain negative for most part of the month owing to extra T-bill borrowing, tax outflows. This may result in hardening in money market and short end making the curve flatter.

- In the near term, bond yields are likely to be dominated by US fed and RBI monetary policy moves and stance going ahead.

- We expect 10-year to trade in the 10-15 bps range from the current levels.

Source: Bloomberg, Budget Document, and Internal Research.

This information is meant for general reading purpose only and is not meant to serve as a professional guide for the readers. The information should not be construed as an investment advice and investors are requested to consult their investment advisor and arrive at an informed investment decision before making any investments.