Baroda BNP Paribas Energy Opportunities Fund

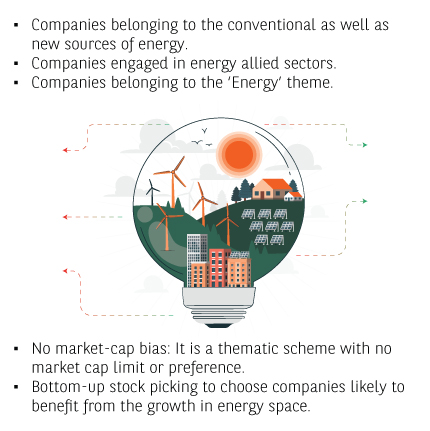

Thematic funds are a type of equity mutual funds, investing in companies that are focused on a specific theme.

We are upgrading our transaction portal and will be back soon.

Energy is not just a resource; it is the lifeblood of a nation’s prosperity. For developing countries like India, the demand for higher energy is essential during their transformative phases. With aspirations of becoming a $10 trillion economy, India’s energy consumption is set to soar, making electricity an indispensable resource such as oil in today’s world. Seize this opportunity by investing in the Baroda BNP Paribas Energy Opportunities Fund, which invests in equities of companies engaged in energy, focusing on traditional energy which includes but is not limited to sources of energy such as crude oil, natural gas, coal and renewable energy such as hydropower, solar, wind among others to unlock significant growth potential.

Developing countries like India require higher energy during growth phases, driven by increased manufacturing and data centres, along with investments in energy infrastructure.

Intiatives to enhance energy self-sufficiency include pricing reforms for exploration and production and support for oil marketing companies.

The anticipated doubling of India’s middle class will help drive higher energy consumption through lifestyle upgrades influenced by necessity, convenience, productivity, and innovation.

A significant shift towards cleaner energy sources emphasizes improved energy efficiency, reduced carbon footprints, and the adoption of renewables and alternative energies.

The scheme is designed to capitalize on the growing energy sector, providing investors with a strategic avenue for growth. With energy being a long-term theme, the scheme is best suited for those looking to hold their investments for over three years to fully benefit from the sector's growth potential.

As we ride this wave of opportunity, investing in the fund not only positions you for potential financial returns but also fuels the nation's progress and contributes to creating a brighter future for all.

The scheme will invest 80% of its net assets in companies belonging to the Energy theme.

Mining & Oil Exploration companies

Oil Refining companies Energy Generating companies

Power Transmission companies, Power InVITs Gas Pipelines

Oil Marketing Power Distribution Gas Distribution

Transition to renewable energy

Energy Ancillary Companies: Equipment manufacturers, companies making components of new energy.

Energy Services Companies: Industrial and capital goods companies that are engaged in energy consultancy.

| Category | Equity Scheme - Sectoral / Thematic Fund |

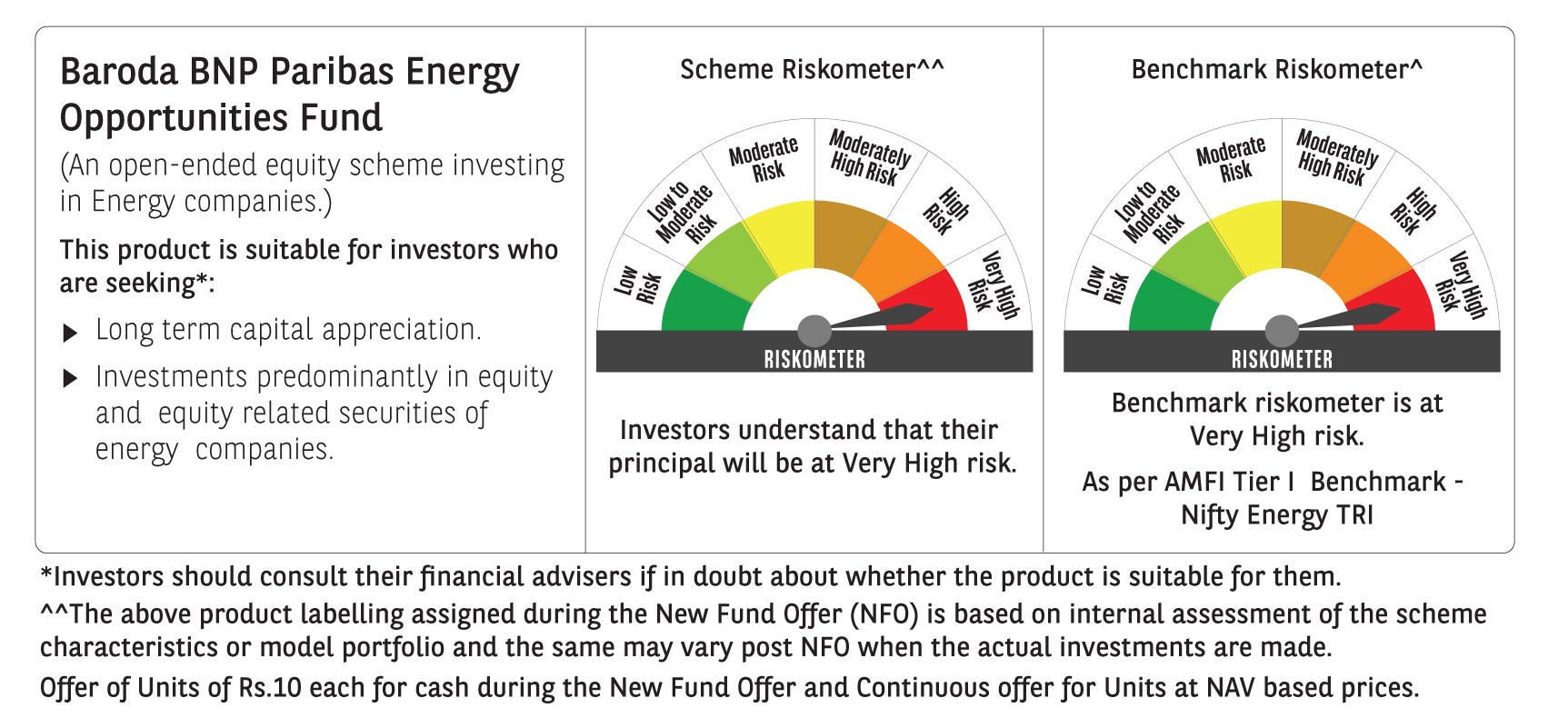

| Investment Objective | The investment objective of the Scheme is to provide investors with opportunities for long term capital appreciation by investing in equity and equity related instruments of companies engaging in activities such as exploration, production, distribution, transportation and processing of traditional & new energy including but not limited to industries/sectors such as oil & gas, utilities and power. The scheme does not guarantee/indicate any returns. There can be no assurance that the scheme’s objectives will be achieved. |

| Benchmark | Nifty Energy TRI |

| Fund Manager | Sanjay Chawla and Sandeep Jain |

| Load Structure | Exit Load: For redemption/switch out of units more than 10% of units, within 1 year from the date of allotment: 1% of applicable NAV. For redemption / switch out of units in other cases -NIL. |

| Minimum Amount for Application during the NFO & Ongoing Offer |

Minimum Amount for Application during the NFO & Ongoing: A minimum of Rs. 1,000 per application and in multiples of Rs.1 Minimum Additional Application Amount: Rs. 1,000 and imultiples of Rs. 1 thereafter. |

| SIP Details: Minimum Application Amount |

(i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Rs. 1/- thereafter; (ii) Quarterly SIP: Rs. 1500/- and in multiples of Rs. 1/- thereafter |

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click HereProduct one pager

Click HereThematic funds are a type of equity mutual funds, investing in companies that are focused on a specific theme.

Baroda BNP Paribas Energy Opportunities Funds an equity oriented thematic fund that predominantly invests in energy companies. The investment objective of the Scheme is to provide investors with opportunities for long term capital appreciation by investing in equity and equity related instruments of companies engaging in activities such as exploration, production, distribution, transportation and processing of traditional & new energy including but not limited to industries/sectors such as oil & gas, utilities and power. The Scheme does not guarantee/indicate any returns. There can be no assurance that the scheme’s objective will be achieved.

Investing in energy opportunity funds can be a strategic move for several reasons, particularly in the context of the evolving energy landscape and government initiatives. Here are some of the key factors to consider:

The following are the constituents of the benchmark:

| Stock | Weights |

|---|---|

| Reliance Energy | 33.71 |

| NTPC | 14.45 |

| Power Grid Corporation of India | 12.52 |

| ONGC | 8.36 |

| Coal India | 7.93 |

| Tata Power | 5.87 |

| BPCL | 4.74 |

| Indian Oil Corporation | 4.36 |

| Adani Power | 4.06 |

| Adani Green Energy | 4.00 |

Source: Nifty Indices| Data as of 29th November 2024

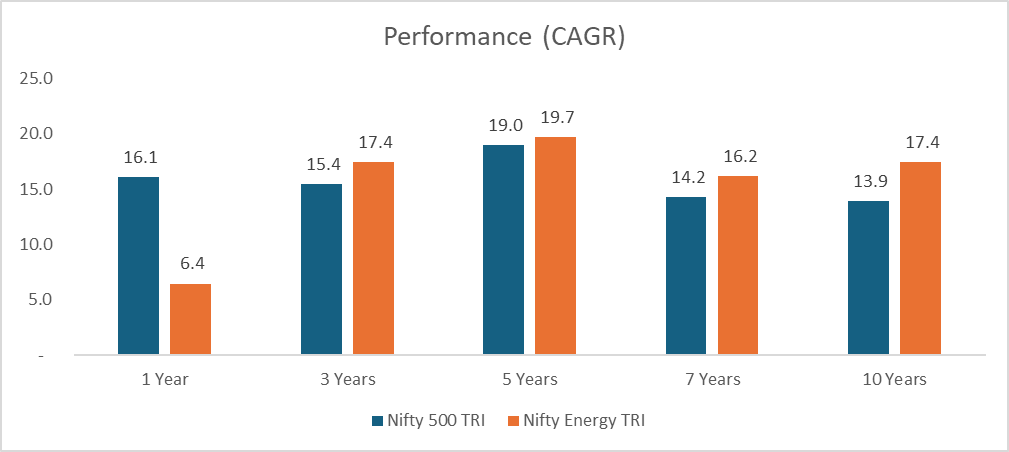

Source: NSE India and Internal. Data as on 31st December 2024| CAGR = Compounded Annualized Growth Returns

The above data is for understanding only and should not constitute as investment advice. Past performance is no guarantee for future returns.

| Type of Instrument | Minimum (% of Net Assets) | Maximum (% of Net Assets) |

|---|---|---|

| Equity and equity related^ instruments of companies in the Energy and allied sectors | 80 | 100 |

| Equity and equity related^ instruments of companies other than those in the Energy and allied sectors | 0 | 20 |

| Debt & Money Market instruments* | 0 | 20 |

| Units of Mutual Funds (Domestic Schemes) | 0 | 10 |

| Units issued by REITs & InvITs | 0 | 10 |

^The Scheme may invest upto 50% of equity assets in equity derivatives instruments as permitted under the SEBI (Mutual Funds) Regulations, 1996 from time to time. The Scheme may use equity derivatives for such purposes as maybe permitted under the SEBI (Mutual Funds) Regulations, 1996, including but not limited for the purpose of hedging and portfolio balancing, based on the opportunities available and subject to guidelines issued by SEBI from time to time.

*Debt instruments may include securitized debt up to 20% of the debt portfolio of the scheme.

For detailed asset allocation including indicative asset allocation table, please refer to SID on our website www.barodabnpparibasmf.in

Disclaimer: The investment strategy mentioned in this document should not be construed an investment advice or any recommendation. Investors should check with their financial advisors before taking any investment decisions.

Investors looking for new sector / theme to diversify their portfolio Investors should consult their financial advisors to know their risk appetite before investing.

Given that energy represents a long-term investment theme, it is recommended that investors maintain a holding period of possibly more than three years.

1 BP Statistical Review and IMF| Data as of March 2023

2 Source: IMF, Jefferies and internal research. The estimated figures in this graph are based on internal research and may vary based on change in various factors. Data as on 31st October 2024(latest available data).

3 Data as on July 2023 (latest available data) Report by Price 3600 Surveys.

4 Expenditure Budget, Union Budget 2024-25

5 Government of India - Press Information Bureau, Ministry of New and Renewable Energy – PLI

Disclaimer: Please refer to the Scheme Information Document of the scheme before investing for details including investment objective, asset allocation pattern, investment strategy, risk factors and taxation.

Disclaimer In the preparation of this document, Baroda BNP Paribas Asset Management India Pvt. Ltd. (“AMC”) has used information that is publicly available and developed in-house. The AMC, however, does not warrant the accuracy, reasonableness and/or completeness of any information. This document may contain statements/opinions/ recommendations, which contain words, such as “expect”, “believe” and similar expressions or variations that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, etc. The AMC (including its affiliates), Baroda BNP Paribas Mutual Fund (“Mutual Fund”), its sponsor / trustee and any of its officers, directors, employees, shall not liable for any loss, damage of any nature, including direct, indirect, punitive, exemplary, consequential, or loss of profit arising from use of this document. The recipient alone shall be fully responsible for decision taken based on this document. All data given in this document is dated and may or may not be relevant at a future date. Investors are advised to consult their legal/tax/financial advisors to determine possible tax, legal and other financial implication or consequence of investing into the scheme. Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Baroda BNP Paribas Energy Opportunities Fund