Baroda BNP Paribas Floater Fund

By entering your details, you hereby authorize Baroda BNP Paribas Asset Management India Pvt. Ltd. to contact you, which will override any NDNC registration made by you.

Introduction

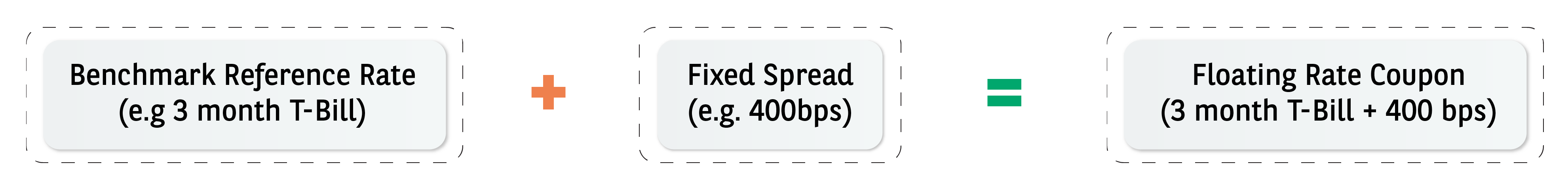

Baroda BNP Paribas Floater Fund invests predominantly in floating rate bonds and Non-Convertible Debentures (NCD). A floating rate bond is a debt instrument with the coupon linked to a benchmark rate and gets set for, typically, 6 month periods. Therefore, as interest rates move, the coupon on the bonds also moves in the same direction. Floating rate bonds have generally lower volatility vis-à-vis fixed rate bonds, as the duration on the portfolio is less than 6 months (the typical reset period of the bond); and lower duration of a bond means lower volatility. Investors seeking a relatively lower risk investment option with the potential for optimal returns, a floater fund can be a good option.

^The above figures are for illustration and information purpose only.

Bonds held till maturity will have a relatively lower volatility and lesser MTM impact

Active Fund Management

Attempts to offer better risk adjusted returns

Helps to navigate the rising rates and offers good investment opportunity to gain from a rising rate environment

With interest rates reset in a predetermined frequency, the interest rate sensitivity of the bonds are lower compared to fixed rate bonds

Aims to generate income/capital appreciation through investment in

1.Natural Floaters

2. Synthetic Floaters

3. Short Maturity Instruments

There is no assured/ guaranteed returns being offered by the AMC. The performance of the scheme shall also depend on various factors including the investment strategy of the scheme.

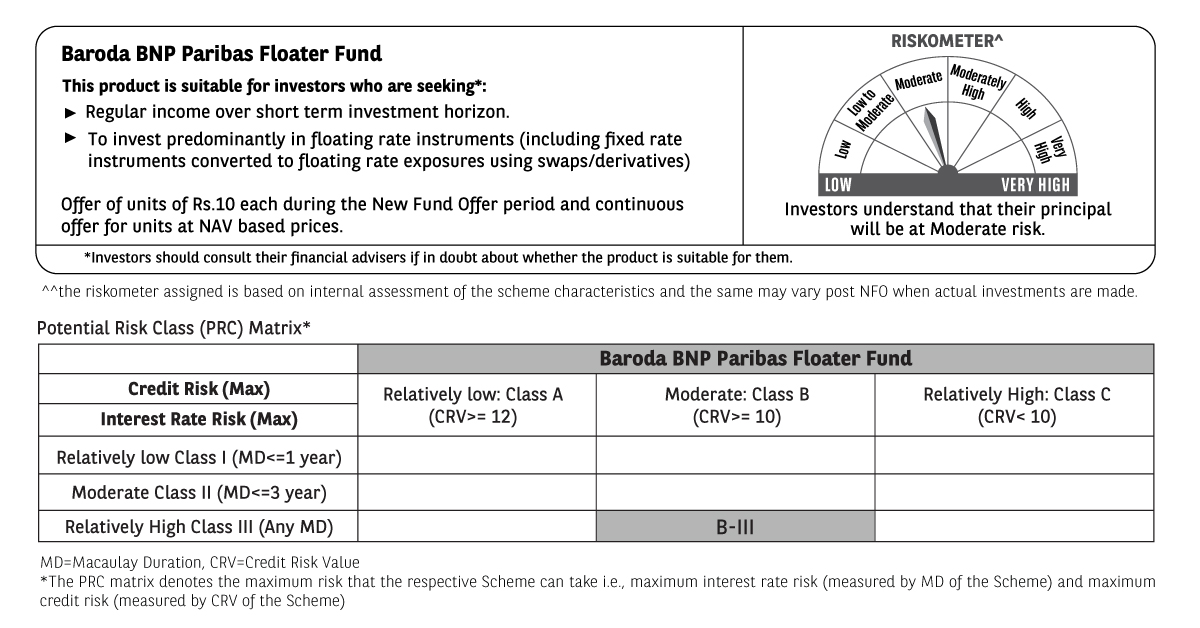

Baroda BNP Paribas Floater Fund

Floater Fund

An open ended debt scheme predominantly investing in floating rate instruments. A relatively High Interest Rate Risk and Moderate Credit Risk.

April 10, 2023 - April 24, 2023

The primary objective of the scheme is to generate regular income through investment in a portfolio comprising predominantly of floating rate instruments and fixed rate instruments swapped for floating rate returns. The Scheme may also invest a portion of its net assets in fixed rate debt and money market instruments. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns.

CRISIL Low Duration Debt Index

Entry Load : Not applicable

Exit Load: Nil

Mayank Prakash (Total Experience: 15 years) & Prashant Pimple (Total Experience: 16 years)

| Type of Instrument | Min (% of Net Assets) | Max (% of Net Assets) | Risk Profile |

|---|---|---|---|

| Floating Rate Debt Instruments (including Fixed Rate Debt Instruments swapped for floating rate returns) | 65 | 100 | High |

| Debt & Money Market instruments | 0 | 35 | Low to Medium |

| Units issued by REITs & INvITs | 0 | 10 | Very High |

For complete details on asset allocation, please refer to SID available on our website (www.barodabnpparibasmf.in).

The scheme will have two Plans Regular and Direct.

Each Plan offers Growth Option and Income Distribution cum Capital Withdrawal (IDCW) option*. The IDCW offers payout and reinvestment facilities.

*Amounts under IDCW option can be distributed out of investors capital (equalization reserve), which is part of sale price that represents realised gains However, investors are requested to note that the amount of distribution under IDCW Option is not guaranteed and subject to availability of distributable surplus.

Lumpsum investment:

Rs. 5,000 and in multiples of Re. 1/- thereafter.

SIP:

(i) Daily, Weekly, Monthly SIP Rs. 500/- and in multiples of

Re. 1/- thereafter,

(ii) Quarterly SIP Rs. 1500/- and in multiples of

Re. 1/- thereafter

Offer of units of Rs.10 each during the New Fund Offer period and continuous offer for units at NAV based prices.