An Open-ended Scheme replicating / Tracking the nifty 50 total return index

We are upgrading our transaction portal and will be back soon.

By entering your details, you hereby authorize Baroda BNP Paribas Asset Management India Pvt. Ltd. to contact you, which will override any NDNC registration made by you.

Passive investing or index investing as it is commonly understood as an long term investment strategy that tracks / replicates a specified underlying market index. The index can range from a broad market index like Nifty 50, Sensex to a sector specific index like Nifty Bank. Passive investing has seen increasing interest / AUM growth in India in the last few years, especially post the pandemic.

(Source: AMFI)

Easy to understand investment strategy: Tracking or replicating a pre-specified benchmark/index as closely as possible.

Efficient Investment: Portfolio reflecting the collective wisdom of the market with index performance subject to tracking error and expenses.

Economical: Generally lower expense ratio than a traditional mutual fund due to no fund manager involvement in investment decision.

Index: A rule-based portfolio with stock/company selection based on pre-defined rules and free from any individual biases.

Source: Nifty Indices Methodology document from Niftyindices.com. Data as on Nov 30, 2023.

| Nifty 50 TRI | 7 Year Rolling Returns |

|---|---|

| Average | 11.7% |

| Median | 11.7% |

| Minimum | 5.0% |

| Maximum | 18.7% |

| Returns Range | % of observations |

|---|---|

| Negative | 0% |

| 0% to 10% | 26% |

| >10% to 15% | 69% |

| >15% to 20% | 5% |

| >20% | 0% |

Source: Niftyindices.com, MFI explorer. Data as on Dec 31, 2023. Daily Rolling Returns calculated assuming 250 trading days in a year. Above returns are CAGR returns

An Open-ended Scheme replicating / Tracking the nifty 50 total return index

The investment objective of the scheme is to provide investment returns closely corresponding to the total returns of the securities as represented by the Nifty 50 Total Returns Index before expenses, subject to tracking errors, fees and expenses. However, there is no assurance that the objective of the Scheme will be realized, and the Scheme does not assure or guarantee any returns

08-01-2024 to 22-01-2024

During NFO:

Lumpsum investment: Rs. 5,000 and in multiples of Re. 1 thereafter. There is no upper limit.

Ongoing basis:

Lumpsum investment: Rs. 5,000 and in multiples of Re. 1 thereafter.

SIP: (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Re. 1/- thereafter,

(ii) Quarterly SIP: Rs. 1500/- and in multiples of Re. 1/- thereafter.

Note: Allotment of units will be done after deduction of applicable stamp duty and transaction, if any.

Entry Load: Not Applicable

Exit Load: 0.2% - if redeemed on or before 30 days from the date of allotment

Nil – If redeemed after 30 days from the date of allotment

Regular & Direct plans with growth and IDCW options

Nifty 50 Total Return Index

Neeraj Saxena

Index funds are a type of mutual funds that track / replicate a specified benchmark index. The list of indices can range from broad market indices like Nifty 50, Sensex to sector concentrated indices like Nifty Bank, Nifty IT etc.

An index fund tracks / replicates the specified benchmark index of the fund by buying securities comprising the index in the same weightage as that in the index.

A stock market index is a representative of a subset of stock market performance. It helps investors to ascertain performance of the broad stock market by comparing current index levels with previous index levels.

An index is a hypothetical portfolio of securities that represent various segments of the financial markets. Indexes are constructed using pre-defined rules that govern security selection and their weights in the portfolio.

Passive investment options are broadly categorized in two segments: Index Funds and Exchange Traded Funds (ETFs). The underlying principle remains the same for i.e., both track / replicate the specified underlying benchmark index of the fund by investing in securities comprising the index.

The difference between the two options is in the way they are administered. Index Funds are like traditional mutual funds in their administration. Investors can subscribe / redeem units with the AMC at Day end NAV.

Exchange Traded Funds as their name suggest are listed on stock exchanges and are traded like shares. Investors can buy and sell units on the exchange without coming to the AMC directly. AMCs also appoint dedicated market makers for the ETF who provide liquidity for the units on the exchange.

An index fund tracks / replicates the specified index by investing in securities comprising the index constituents in the same weight as the weight of the security in the index.

The index provider calculates the daily weight of the security in the index and releases the file to the AMCs who then use the file to rebalance their portfolio and align it with the index. Any addition / deletion of securities from the index are also intimated to the AMC by the index provider which then takes the necessary steps to buy or sell the respective securities.

There is no active stock selection or investment decision requirement to be made by the fund manager in an index fund. This eliminates the time involvement of the fund manager and the research requirements. Additionally, index funds tend to have less portfolio churn as compared to active funds resulting in saving on transaction costs. These costs which forms major portion of a fund’s expense ratio are eliminated resulting in index funds having a relatively low expense ratio.

Index funds are an easy, efficient, and economical investment instrument catering to all types of investors. New investors may benefit considering the easy-to-understand structure along with relatively low costs and diversification benefits that an index fund offers. Experienced investors may benefit from using index funds in a core satellite portfolio construction approach with the bulk of their portfolio (core) in broad market index funds and the remainder portion (satellite) in riskier investments.

Tracking difference is the difference in the return generated by the index fund and the returns generated by the underlying index. For example, if Nifty 50 has generated a return of say 10% in a year and the index fund tracking the index has generated a return of 9.5% in the same period, the tracking difference of the fund is 0.5%.

Tracking error is a measure of deviation of fund returns from the benchmark returns. Unlike tracking difference which computes point to point returns and highlights difference of returns between fund and index, tracking error calculates standard deviation of daily difference in performance between the fund and index and highlights the annualized number which is known as tracking error.

Tracking error is the mark of efficiency and consistency of an index fund with it indicating how closely the fund manages to track / replicate the index. A lower tracking error indicates the fund is consistent in replicating its portfolio with that of the index whereas a higher tracking error points to inconsistencies in benchmark tracking / replication.

The main sources of tracking error and tracking difference are as follows:

One can invest in an index fund in a similar way to normal mutual funds i.e. by submitting the application form online or in physical to the AMC. Also, one may contact their distributor or relationship manager for investing in an index fund as well. Finally, one can use the latest fintech platforms for investing in an index fund.

The major risks associated with index funds remain the same as with any traditional mutual funds investing in the same asset class. All equity funds including equity index funds will be subject to the same risk and same goes for debt index funds. Additional risks involved with index funds include the following:

Investors are requested to read the Scheme Information document for detailed information on the risk factors of the scheme.

Index funds are taxed basis the asset class that they invest in. Equity index funds will be taxed as per equity taxation and debt index funds will be taxed as per debt taxation. Investors are requested to read the Scheme Information document before investing.

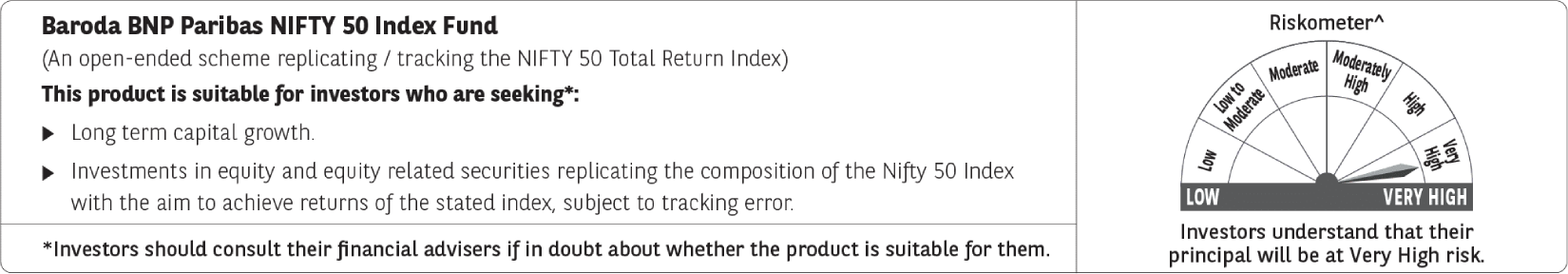

^the riskometer assigned is based on internal assessment of the scheme characteristics and the same may vary post NFO when actual investments are made.

Offer of units of Rs. 10 each during the New Fund Offer period and continuous offer for units at NAV based prices

NSE Disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the Disclaimer Clause of NSE.

Disclaimer: The risks associated with investments in equities include fluctuations in prices, as stock markets can be volatile and decline in response to political, regulatory, economic, market and stock-specific development etc. Please refer to scheme information document for detailed risk factors, asset allocation, investment strategy etc. Further, to the extent the scheme invests in fixed income securities, the Scheme shall be subject to various risks associated with investments in Fixed Income Securities such as Credit and Counterparty risk, Liquidity risk, Market risk, Interest Rate risk & Re-investment risk etc., Further, the Scheme may use various permitted derivative instruments and techniques which may increase the volatility of scheme’s performance. Also, the risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Investor should consider their risk appetite at the time of investing in index funds. Please refer to Scheme Information Document available on our website (www.barodabnpparibasmf.in) for detailed Risk Factors, assets allocation, investment strategy etc.

Baroda BNP Paribas Nifty 50 Index Fund