Baroda BNP Paribas Innovation Fund

By entering your details, you hereby authorize Baroda BNP Paribas Asset Management India Pvt. Ltd. to contact you, which will override any NDNC registration made by you.

Right Demographics & Changing Consumer Needs

Thriving Start-up Ecosystem

Green Energy / Climate Change

Digital Transformation

Government Initiatives

The Baroda BNP Paribas Innovation Fund intends to not only chase the next big thing, but also intend to invest in the entire ecosystem that drives it. The fund aims to back the disrupters, the bold pioneers forging revolutionary paths with cutting-edge technologies. The fund aims to empower the legacy companies, seasoned players adapting and reinventing with fresh strategies and partnerships that can lead to disruption. It fuels the enablers i.e. the companies providing infrastructure and expertise that makes it all possible. By nurturing this diverse cast of innovators, the fund intends to ignite a chain reaction of progress, transforming industries and shaping a future brimming with limitless potential.

These are disruptors. Companies at the forefront of innovation.

Large businesses who are early adopters of new technology leading to innovation as they respond to the changing market environment.

These are companies who provide tools/ technologies / know how /infrastructure for innovative businesses.

Baroda BNP Paribas Innovation Fund

An open-ended equity scheme investing in innovation theme

The Scheme is to seek long term capital appreciation by investing at least 80% of its net assets in equity/equity related instruments of companies focusing and benefitting from innovation. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved.

| Type of Instrument | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) | Risk Profile |

|---|---|---|---|

| Equity & Equity related instruments ^ of companies belonging to the innovation theme | 80 | 100 | High |

| Equity and equity related instruments^ of any other companies | 0 | 20 | High |

| Debt* & Money Market instruments | 0 | 20 | Low to Medium |

| Units issued by REITs & INvITs | 0 | 10 | Medium to High |

| Units of Mutual Fund Schemes (Domestic Schemes) | 0 | 10 | Medium to High |

^The Scheme may invest upto 50% of equity assets in equity derivatives instruments as permitted under the SEBI (Mutual Funds) Regulations, 1996 from time to time. The Scheme may use equity derivatives for such purposes as maybe permitted under the SEBI (Mutual Funds) Regulations, 1996, including but not limited for the purpose of hedging and portfolio balancing, based on the opportunities available and subject to guidelines issued by SEBI from time to time.

*Debt instruments may include securitised debt upto 20% of the debt portfolio of the scheme.

For further details on asset allocation, please refer to SID available on our website (www.barodabnpparibasmf.in).

NIFTY 500 TR Index

Mr. Pratish Krishnan (Total Experience: 23 years)

Entry Load: NA

Exit Load:

The Scheme offers following two plans: Regular and Direct. Each plan offers Growth Option, and Income Distribution cum capital withdrawal (IDCW)* Option with payout and reinvestment options.

*Amounts under IDCW option can be distributed out of investors capital (equalization reserve), which is part of sale price that represents realized gains.

Lumpsum Details: Minimum Application Amount: Rs. 5,000 and in multiples of Rs. 1 thereafter.

Minimum Additional Application Amount: Rs. 1,000 and in multiples of Rs. 1 thereafter. SIP Details: Minimum Application Amount - (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Rs. 1/- thereafter; (ii) Quarterly SIP: Rs. 1500/- and in multiples of Rs. 1/- thereafter Frequency Available: Daily, Weekly, Monthly & Quarterly

* Miten Vora (Dedicated Fund Manager for Overseas Investment)

Disclaimer:

In the preparation of the material contained in this document, Baroda BNP Paribas Asset Management India Pvt. Ltd. (“AMC”) (formerly BNP Paribas Asset Management India Private Limited) has used information that is publicly available, including information developed in-house. The AMC, however, does not warrant the accuracy, reasonableness and/or completeness of any information. This document may contain statements/opinions/ recommendations, which contain words, or phrases such as “expect”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, etc. The AMC (including its affiliates), Baroda BNP Paribas Mutual Fund (“Mutual Fund”), its sponsor / trustee and any of its officers, directors, personnel and employees, shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this document in any manner. The recipient alone shall be fully responsible / liable for any decision taken based on this document. All figures and other data given in this document are dated and may or may not be relevant at a future date. Prospective investors are therefore advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of the schemes of Baroda BNP Paribas Mutual Fund . Past performance may or may not be sustained in the future. Please refer to the Scheme Information Document of the schemes before investing for details of the scheme including investment objective, asset allocation pattern, investment strategy, risk factors and taxation.

Investment strategy stated above may change from time to time and shall be in accordance with the investment objective and strategy stated in the SID of the scheme.

Offer of units of Rs. 10 each during the New Fund Offer period and continuous offer for units at NAV based prices.

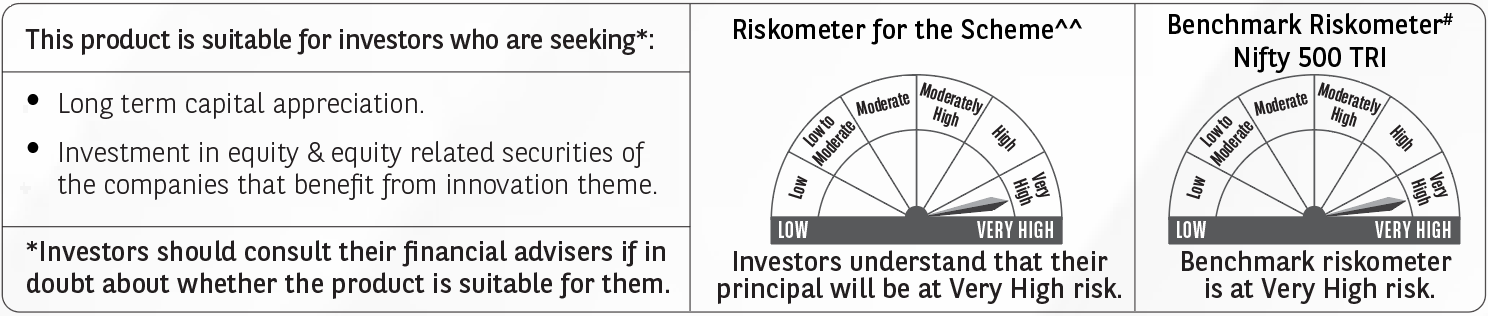

^^the riskometer assigned is based on internal assessment of the scheme characteristics and the same may vary post NFO when actual investments are made.

# Benchmark Riskometer is as on 31st December 2023.

Baroda BNP Paribas Innovation Fund