Baroda BNP Paribas Manufacturing Fund

Thematic funds are a type of equity mutual funds, investing in companies that are focused on a specific theme.

We are upgrading our transaction portal and will be back soon.

India’s manufacturing sector is on the cusp of a holistic surge, driven by a potent combination of government initiatives and expanding domestic market. Capitalize on this exciting opportunity by investing in Baroda BNP Paribas Manufacturing Fund.

Government Support: The government has initiated several schemes, like the Skill India / Apprentice program, Atmanirbhar Bharat for import items, and PLI schemes to provide technical and financial assistance to build in India. Reforms like GST helps in bringing a shift from unorganized to organized sectors, thereby leading to more transparency, and boosting a conducive business environment.

Demographic Dividend: India has a large young population which is well educated, speaks English, and is available at a comparatively low cost leading to cost advantages in manufacturing.

Focus on Infrastructure Development: The government’s emphasis on improving the overall infrastructure by adding new tracks and new-age railways, constructing massive highways, and adding more airports and ports, provides impetus to the manufacturing sector.

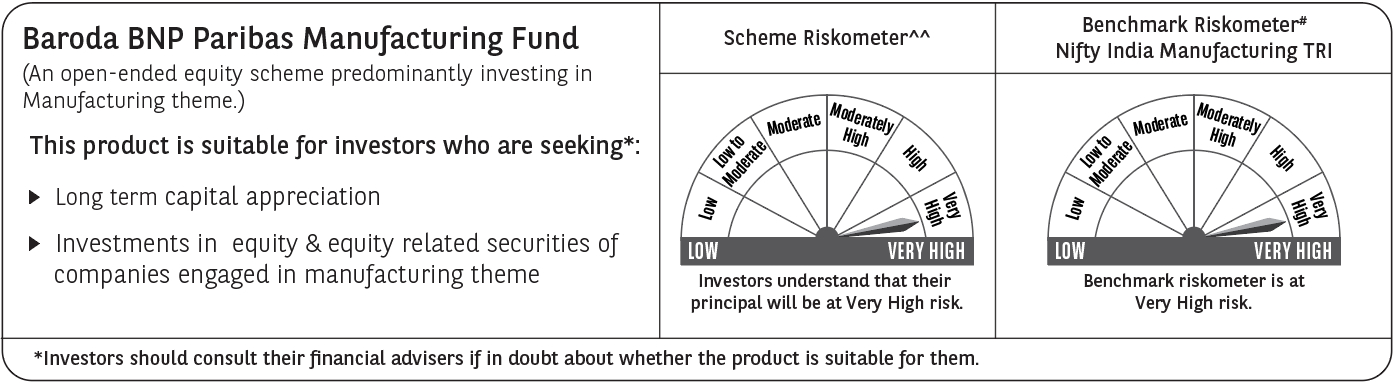

The scheme aims to maximize long-term capital appreciation by investing in equity & equity related securities of companies engaged in the manufacturing sector. Manufacturing is the backbone of any economy. By investing in the scheme, investors can participate in India’s growth journey.

Increase in Capex, infrastructure upgradation / digitization and focus on self-reliance to create opportunities in the below mentioned key areas:

| Benchmark | Nifty India Manufacturing TRI |

| Load Structure | Exit Load: If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 1 year from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 1 year from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 1 year from the date of allotment - Nil. |

| Fund Manager | Mr. Jitendra Shriram |

| Minimum Amount for Application during the NFO & Ongoing | A minimum of Rs. 1,000 per application and in multiples of Rs.1 Minimum Additional Application Amount: Rs. 1,000 and imultiples of Rs. 1 thereafter. |

| SIP Details : Minimum Application Amount | (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Rs. 1/- thereafter; (ii) Quarterly SIP: Rs. 1500/- and in multiples of Rs. 1/- thereafter |

Dedicated Fund Manager for Overseas Investments: Mr. Miten Vora

Offer of units at Rs. 10 each during the New Fund Offer period and continuous offer for units at NAV based prices.

In the preparation of the material contained in this document, Baroda BNP Paribas Asset Management India Ltd. (“AMC”) (formerly BNP Paribas Asset Management

India Private Limited) has used information that is publicly available, including information developed in-house. The AMC, however, does not warrant the accuracy, reasonableness and/or

completeness of any information. This document may contain statements/opinions/ recommendations, which contain words, or phrases such as “expect”, “believe” and similar expressions or

variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties

associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an

impact on our investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or

prices, etc. The AMC (including its affiliates), Baroda BNP Paribas Mutual Fund (“Mutual Fund”), its sponsor / trustee and any of its officers, directors, personnel and employees, shall not liable for

any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this document

in any manner. The recipient alone shall be fully responsible / liable for any decision taken based on this document. All figures and other data given in this document are dated and may or may not be

relevant at a future date. Prospective investors are therefore advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or

consequence of subscribing to the units of the schemes of Baroda BNP Paribas Mutual Fund. Past performance may or may not be sustained in the future. Please refer to the Scheme Information Document

of the schemes before investing for details of the scheme including investment objective, asset allocation pattern, investment strategy, risk factors and taxation.

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click HereProduct one pager

Click HereThematic funds are a type of equity mutual funds, investing in companies that are focused on a specific theme.

Manufacturing Fund is an equity oriented thematic fund that predominantly invests in companies engaging in manufacturing activities. These funds invest in a diversified portfolio of manufacturing related sectors like the auto and auto ancillaries, capital goods, healthcare, chemicals, oil and gas and consumable fuel.

Manufacturing is the backbone of any economy. It can be a driver of economic growth and employment generation, especially in developing countries like India. By investing in this sector, investors can gain from India’s economic growth, domestic consumption, and higher exports.

The Indian manufacturing sector is likely to grow. Key factors driving this growth are:

The following are the sectors of stocks in the Nifty India Manufacturing Index:

| Sectors | Nifty India Manufacturing Index (% to total) |

|---|---|

| Automobile and Auto Components | 30.61 |

| Capital Goods | 21.24 |

| Healthcare | 14.01 |

| Metals & Mining | 12.46 |

| Oil, Gas & Consumable Fuels | 8.61 |

| Chemicals | 7.20 |

| Consumer Durables | 4.41 |

| Textiles | 0.87 |

| Forest Materials | 0.32 |

| Telecommunication | 0.26 |

Source: Nifty Indices. Data as on 30th April 2024

Nifty 500 Index which is a diversified equity index, has highest exposure to Financials and Information Technology stocks. Whereas these two major sectors are not present in the Nifty India Manufacturing Index. This is the key difference between a normal diversified fund and a manufacturing fund. This is the key reason why manufacturing funds will help diversify investors’ portfolio.

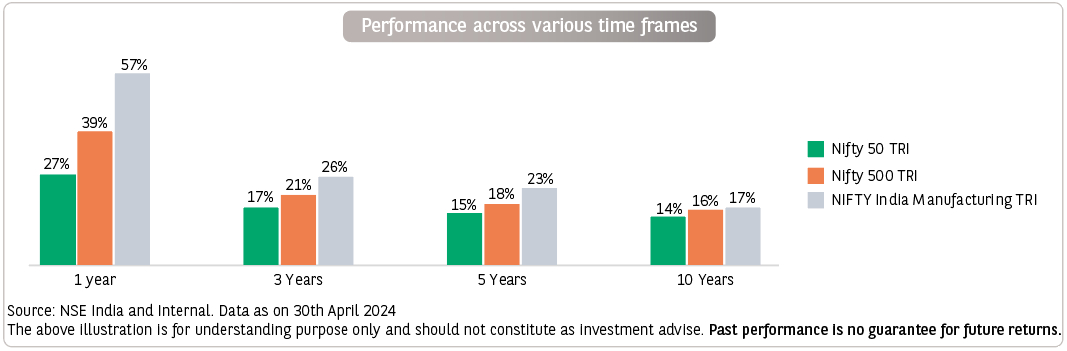

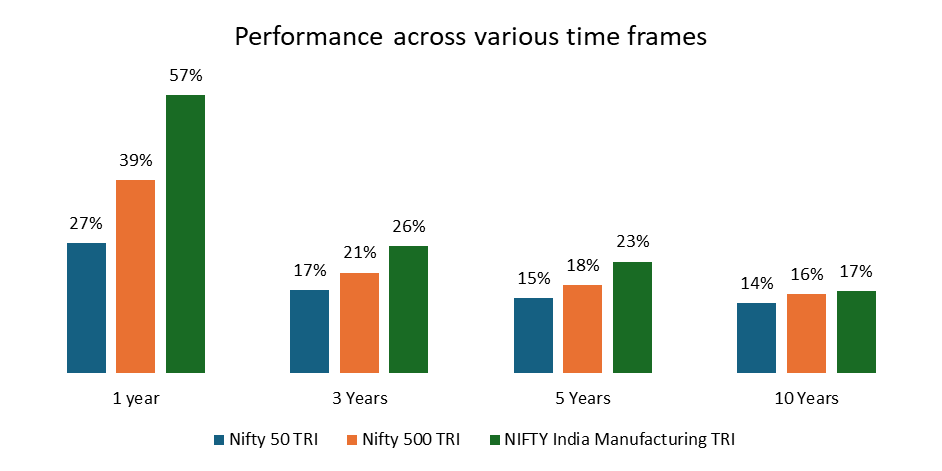

Source: NSE India and Internal. Data as on 30th April 2024

The above illustration is for understanding only and should not constitute as investment advice. Past performance is no guarantee for future returns.

Baroda BNP Paribas Manufacturing Fund is a thematic equity fund that aims to invest in companies which are engaged in manufacturing related activities.

The Portfolio seeks to invest in companies that:

| Type of Instrument | Minimum (% of Net Assets) | Maximum (% of Net Assets) |

|---|---|---|

| Equity & Equity^ related instruments of companies having manufacturing theme | 80 | 100 |

| Other Equity and equity related^ instruments of companies other than having manufacturing theme | 0 | 20 |

| Debt* & Money Market instruments | 0 | 20 |

| Units of Mutual Funds (Domestic Schemes) | 0 | 10 |

| Units issued by REITs & INvITs | 0 | 10 |

^The Scheme may invest upto 50% of equity assets in equity derivatives instruments as permitted under the SEBI (Mutual Funds) Regulations, 1996 from time to time. The Scheme may use equity derivatives for such purposes as maybe permitted under the SEBI (Mutual Funds) Regulations, 1996, including but not limited for the purpose of hedging and portfolio balancing, based on the opportunities available and subject to guidelines issued by SEBI from time to time.

*Debt instruments may include securitised debt up to 20% of the debt portfolio of the scheme.

For detailed asset allocation, please refer to SID on our website www.barodabnpparibasmf.in.

The Scheme is an actively managed Scheme. The Scheme aims to maximize long-term capital appreciation by investing in equity and equity related securities of companies engaged in manufacturing sector. The Scheme may also invest a small portion of its corpus in money market instruments to manage its liquidity requirements.

The scheme aims to invest in listed companies that manufacture goods and that have/will have manufacturing facilities. The Portfolio seeks to invest in companies that:

The following are the broad parameters/factors that shall be considered while building the portfolio of companies.

Transportation Improvements

Urban Infrastructure buildout

Energy & Green Energy

Defence

The sector(s) mentioned in this document do not constitute any recommendation of the same and Baroda BNP Paribas Mutual Fund may or may not have any future position in these sector(s).

Manufacturing is a theme that is closely linked with the economy. It is a multi-decade theme and not a quick cycle and hence investors looking to build their wealth through this theme should stay invested for a minimum of 5 to 7 years.

^^The riskometer assigned is based on internal assessment of the scheme characteristics and the same may vary post NFO when actual investments are made.

#Benchmark riskometer is as on 30th April 2024.

Baroda BNP Paribas Manufacturing Fund

**basis portfolio of the Scheme as on April 30, 2024

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them

**Basis constituents of the scheme as on April 30, 2024

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

*The PRC matrix denotes the maximum risk that the respective Scheme can take i.e. maximum interest rate risk (measured by MD of the Scheme) and maximum credit risk (measured by CRV of the Scheme)

Before going in deep, Let us understand you little bit better. And we will provide proper guidince accordingly.

Yes, Let's start from basic No, I want to continueYou will need the following:

Start investing with your I-PIN and password

Start investing without

an I-PIN

You will need the following:

You have chosen

Select Option

Choose update frequency

Disclaimer:

1. NAV of the selected fund will be sent on the next working day. For example NAV of Monday will be sent on Tuesday.

2. At a time, you are allowed to subscribe to at most 3 schemes for daily/weekly/monthly updates.

3. For daily alerts, the NAV of the selected scheme will be sent the next morning.

4. For weekly alerts, the NAV of the selected option will be sent every Monday morning.

5. For monthly alerts, the NAV of the last applicable date of the month will be sent on the 1st of the subsequent month.

6. The weekend NAVs of Liquid schemes will be sent on the subsequent Monday.

7. Receipt of the SMS alert is subject to validity of the mobile number and availability of network. Baroda BNP Paribas is not liable in case of either of these two being insufficient.