Baroda BNP Paribas Nifty Midcap 150 Index Fund

Passive investing or index investing as it is commonly understood, is a long-term investment strategy that tracks / replicates a specified underlying market index. The index for tracking can range from a broad market index like Nifty 50 Index to a sector specific index like Nifty Bank Index.

Passive investing has seen increasing investor interest / AUM growth in India in the last few years, especially post the pandemic.

Passive funds have an easy-to-understand investment strategy, namely tracking / replicating a pre-specified benchmark / index, as closely as possible.

An index is a rule-based portfolio with stock / company selection based on pre-defined rules and free from any individual biases.

Portfolio reflects the collective wisdom of the market with index performance subject to tracking error and fees.

Generally, passive funds have a lower expense ratio than an active mutual fund due to no active decision by fund manager.

The Nifty Midcap 150 index comprises of 150 Midcap stocks (Stocks ranked 101st -250th by full market capitalization).

The index is a representation of the entire Midcap universe and is designed to track/measure performance of midcaps.

Securities are weighed using free float market capitalization.

The index is reconstituted twice in March and September.

Source : NiftyIndices.com

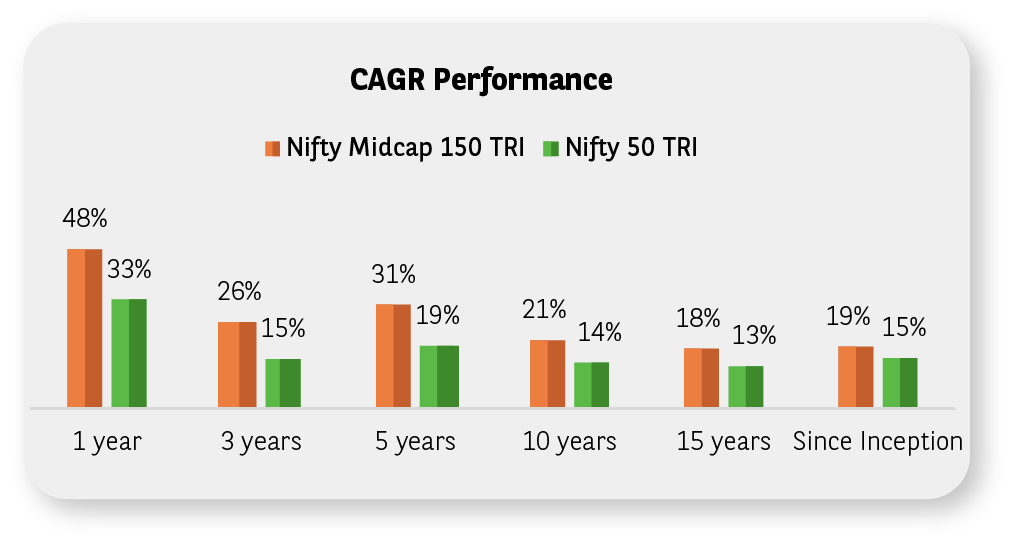

Consistent and significant outperformance against the Nifty 50 Index.

Consistent and significant outperformance against the Nifty 50 Index historically.

Source for the above charts: Niftyindices.com. Data as on Sep 30, 2024. Above returns are CAGR (Compound Annual Growth Rate) returns. The above data is provided for information purposes only and should not be construed as investment advice or used to develop an investment strategy. Past performance may or may not be sustained in future and is not a guarantee of any future returns. Nifty 50 being a broad market bellwether index and recommended by AMFI as additional benchmark for all equity schemes has been used for comparison.

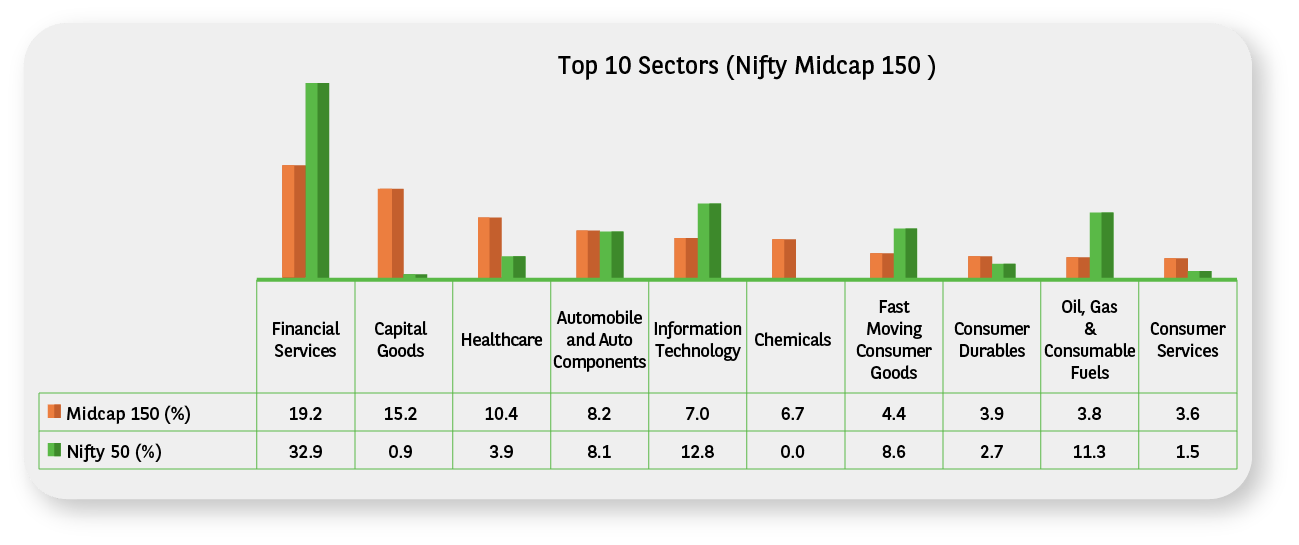

Balanced and wider sector allocation as compared to the Nifty 50 Index including 12% weight in sectors not covered by the Nifty 50 index for the period considered below:

Source for the above charts: Niftyindices.com. Data as on Sep 30, 2024. The stocks/sector(s) mentioned in this document are of the index. It does not constitute any recommendation of the stocks/sectors and Baroda BNP Paribas Mutual Fund may or may not have any future position in these sector(s)/stock(s). Further, the portfolio of the Scheme is subject to changes within the provisions and limitations of Scheme Information Document (SID). For further details on asset allocation, investment strategy and risk factors of the Scheme please refer to SID available on our website (www.barodabnpparibasmf.in). Nifty 50 being a broad market bellwether index and recommended by AMFI as additional benchmark for all equity schemes has been used for comparison.

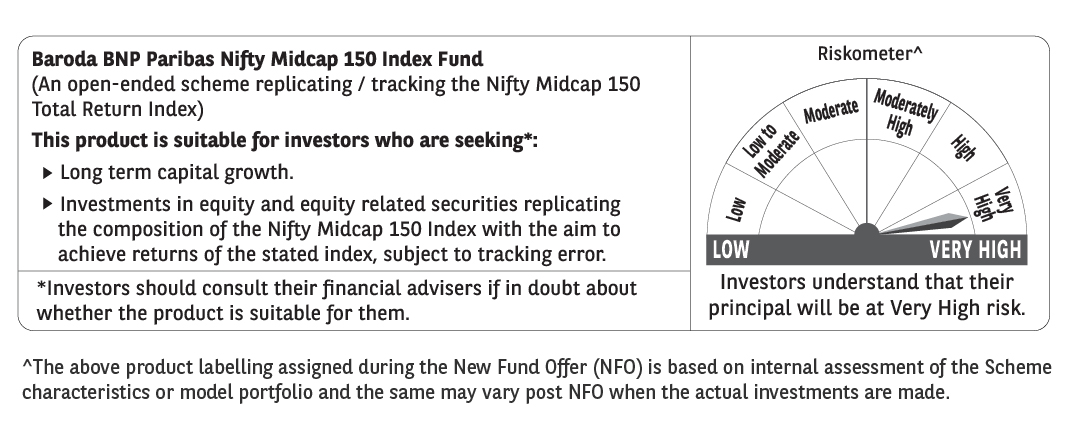

Baroda BNP Paribas Nifty Midcap 150 Index Fund is an index fund investing primarily in equity and equity related securities comprising the Nifty Midcap 150 Total Returns Index. The fund will seek to replicate the portfolio of the Nifty Midcap 150 Total Returns Index i.e. the scheme will hold stocks in a similar proportion to the index and will aim to generate returns that closely track the returns of the Nifty Midcap 150 Total Returns Index.

Long term investors looking for capital appreciation.

Investors seeking investments in equity and equity related securities replicating the composition of the Nifty Midcap 150 Total Return Index with an aim to achieve returns of the underlying index, subject to tracking error.

| NFO Date | 14-10-2024 to 28-10-2024 |

| Minimum application amount |

During NFO:

Ongoing basis:

Lumpsum investment: Rs. 1,000 and in multiples of Re. 1 thereafter. |

| Load Structure |

Exit Load: 0.2% - if redeemed on or before 7 days from the date of allotment Nil – If redeemed after 7 days from the date of allotment |

| Plans & Options | Regular & Direct plans with growth option |

| Benchmark | Nifty Midcap 150 Total Return Index |

| Fund Manager | Neeraj Saxena |

Risk Factors & Disclaimer: The scheme tracks a benchmark index which consists of Mid Cap stocks which can be riskier and more volatile on a relative basis.

The scheme being passively managed invests in stocks of the underlying index and will therefore be subject to the risks associated with concentration of investments in a particular company/sector.

Over time the category has demonstrated different levels of volatility and investment returns.

Historically these companies have been more volatile in price than large company securities, especially over the short term.

The risks associated with investments in equities include fluctuations in prices, as stock markets can be volatile and decline in response to political, regulatory, economic, market

and stock-specific development etc. Please refer to scheme information document for detailed risk factors, asset allocation, investment strategy etc. Further, to the extent

the scheme invests in fixed income securities, the Scheme shall be subject to various risks associated with investments in Fixed Income Securities such as Credit and Counterparty risk,

Liquidity risk, Market risk, Interest Rate risk & Re-investment risk etc., Further, the Scheme may use various permitted derivative instruments and techniques which may increase the

volatility of scheme’s performance. Also, the risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in

securities and other traditional investments. investor should consider their risk appetite at the time of investing in index funds. Please refer to Scheme Information Document

available on our website (www.barodabnpparibasmf.in) for detailed Risk Factors, assets allocation, investment strategy etc.

NSE Disclaimer: The “Product” offered by “the issuer” is not sponsored, endorsed, sold or promoted by NSE INDICES LIMITED (formerly known as India Index Services & Products Limited (IISL)). NSE INDICES LIMITED does not make any representation or warranty, express or implied (including warranties of merchantability or fitness for particular purpose or use) and disclaims all liability to the owners of “the Product” or any member of the public regarding the advisability of investing in securities generally or in the “the Product” linked to Baroda BNP Paribas Nifty Midcap 150 Index Fund or particularly in the ability of the Nifty Midcap 150 Index to track general stock market performance in India. Please read the full Disclaimers in relation to the Nifty Midcap 150 Index Fund in the in the Offer Document / Prospectus / Information Statement.”

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click HereProduct one pager

Click Here

Baroda BNP Paribas Nifty Midcap 150 Index Fund