Baroda BNP Paribas Retirement Fund

We are upgrading our transaction portal and will be back soon.

The Baroda BNP Paribas Retirement Fund is a solution for your retirement needs as it aims to create steady source of revenue and financial security for investors after you retire.

The fund will invest in both equity (65% to 80%) and fixed income securities (20% to 35%) thus providing diversification and asset allocation benefits.

It allows auto Systematic Withdrawal Plan option it helps you invest and forget and directly enjoy annuity on retirement.

According to a survey1 conducted across India:

Believe they will run out of their retirement corpus in maximum 5 years

Still depend on family wealth and children to finance their retirement.

Above the age of 50, regret not starting retirement planning earlier.

1Data as of August 2023 (latest available data). Source: Based on the survey findings conducted by Max Life Insurance Company Ltd. in its 3rd edition of retirement survey, India Retirement Index Study (IRIS)

Use the calculator and be future ready for your enjoyment wala retirement.

SIP Amount

Investment Period

Withdrawal Period

Retirement Corpus Required

Residual Portfolio Value

Monthly Withdrawal at Retirement

Source: Internal. The above table is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. The above analysis is based on estimates and is for informational purposes; it can alter based on a person’s age, investment style, risk appetite and market conditions. Retirement needs may vary from person to person. Kindly consult your investment advisor before investing. The SIP amount, tenure of SIP and expected rate of return are assumed figures for the purpose of explaining the concept of advantages of SIP investments. The actual result may vary from depicted results depending on scheme selected. Past performance may or may not be sustained in the future. SIP does not assure a profit or guarantee protection against loss in a declining market. The Fund / AMC is not guaranteeing or promising or forecasting any returns.

One time investment or Lumpsum investment, is a process where an investor capitalizes a substantial amount at one go.

Systematic Investment Plan or SIPs is tool for investing a certain sum of money every month till an investor fulfils his/her investment goal.

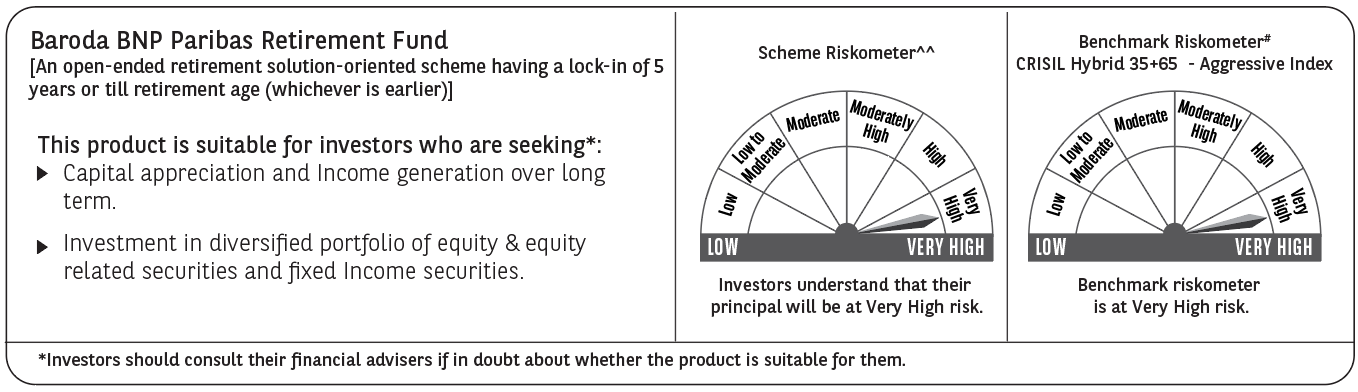

| Benchmark | CRISIL Hybrid 35+65 - Aggressive Index |

| Load Structure | Entry Load: NA; Exit Load: NA |

| Fund Manager | Mr Pratish Krishnan (Equity Portion); Mr Mr. Mayank Prakash (Debt Portion) |

| Minimum Amount for Application during the NFO & Ongoing | A minimum of Rs. 1,000 per application and in multiples of Rs.1

Minimum Additional Application Amount: Rs. 1,000 and imultiples of Rs. 1 thereafter. |

| SIP Details : Minimum Application Amount | (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Rs.

1/- thereafter; (ii) Quarterly SIP: Rs. 1500/- and in multiples of Rs. 1/- thereafter Frequency Available: Daily, Weekly, Monthly & Quarterly |

Offer of units of Rs. 10 each during the New Fund Offer period and continuous offer for units at NAV based prices. In the preparation of the material contained in this document, Baroda BNP Paribas Asset Management India Ltd. (“AMC”) (formerly BNP Paribas Asset Management India Private Limited) has used information that is publicly available, including information developed in-house. The AMC, however, does not warrant the accuracy, reasonableness and/or completeness of any information. This document may contain statements/opinions/ recommendations, which contain words, or phrases such as “expect”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, etc. The AMC (including its affiliates), Baroda BNP Paribas Mutual Fund (“Mutual Fund”), its sponsor / trustee and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this document in any manner. The recipient alone shall be fully responsible / liable for any decision taken based on this document. All figures and other data given in this document are dated and may or may not be relevant at a future date. Prospective investors are therefore advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of the schemes of Baroda BNP Paribas Mutual Fund . Past performance may or may not be sustained in the future. Please refer to the Scheme Information Document of the schemes before investing for details of the scheme including investment objective, asset allocation pattern, investment strategy, risk factors and taxation.

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click HereProduct one pager

Click HereRetirement is a phase in your life where you do not work for a regular monthly income. If you want to ensure that you do not have to compromise on your lifestyle during retirement, you need to plan for your retirement beforehand. Retirement planning consists of ensuring that you are financially secure even in the second innings of your life. Here are few reasons why retirement planning is imperative:

Here’s the process for retirement planning:

Retirement funds are a type of solution- oriented mutual fund schemes which have a lock-in period of at least five years or till retirement age, whichever is earlier.

These funds help you save and invest for your retirement. They aim to provide financial security and steady income in your post-retirement years.

By investing in retirement funds, you can ensure that you are saving for Single goal – retirement. This helps bring more clarity and focus while investing as well as upon retirement, where you can then use this amount to get regular monthly outflows. Moreover, the 5-year lock-in period brings more discipline to investing as it helps investors stick to their goals.

People usually think that they have a lot of time to think about retirement planning. However, the truth is that not planning for retirement earlier is often the most regretted decision during post-retirement years*. One should start investing as soon as possible.

Here’s an illustration that shows the money you could accumulate if you start investing for retirement at various ages. Assuming an investment rate of return at 11.3%.

| Current Age | Working Years (Retirement age is 58) | Monthly SIP | Retirement Corpus (In Crs) |

|---|---|---|---|

| 25 | 33 | ₹ 20,000.00 | ₹ 8.5 |

| 35 | 23 | ₹ 20,000.00 | ₹ 2.6 |

| 45 | 13 | ₹ 20,000.00 | ₹ 0.7 |

Source: Internal. The growth rate considered is at 11.3% for investment in equity. The above table is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. The above analysis is based on estimates and is for informational purposes; it can alter based on a person’s age, investment style, risk appetite and market conditions. Retirement needs may vary from person to person. Kindly consult your investment advisor before investing. The SIP amount, tenure of SIP and expected rate of return are assumed figures for the purpose of explaining the concept of advantages of SIP investments. The actual result may vary from depicted results depending on scheme selected. Past performance may or may not be sustained in the future.

The corpus that you need to accumulate for retirement is a significantly large corpus to be built over a period of years. SIPs invest fixed sums at regular intervals over a period of time and help build disciple in investing, hence an optimum way accumulate corpus for retirement can be through SIPs. One can even opt for step-up SIPs to accumulate this corpus.

Units purchased cannot be assigned/transferred/pledged/ redeemed/switched-out until completion of 5 years from the date of allotment of Units under the Scheme or till retirement age of Unit holder (i.e. completion of 58 years), whichever is earlier.

Yes, a 55-year-old can invest in the fund and their lock-in period will be 3 years (i.e. until completion of 58 years). There will be no lock-in period after that.

| Type of Instrument | Minimum (% of Net Assets) | Maximum (% of Net Assets) | Risk Profile |

|---|---|---|---|

| Equity & Equity related instruments ^ | 65 | 80 | High |

| Debt* & Money Market instruments and/or units of Mutual Fund | 20 | 35 | Low to Medium |

| Units issued by REITs & INvITs | 0 | 10 | Medium to High |

^The Scheme may invest upto 50% of equity assets in equity derivative instruments as permitted under the SEBI (Mutual Funds) Regulations, 1996 from time to time. The Scheme may use equity derivatives for such purposes as maybe permitted under the SEBI (Mutual Funds) Regulations, 1996, including but not limited for the purpose of hedging and portfolio balancing, based on the opportunities available and subject to guidelines issued by SEBI from time to time.

*Debt instruments may include securitized debt upto 20% of the debt portfolio of the scheme. Debt instruments also include debt derivative instruments include Interest Rate Swaps, Interest Rate Forwards, Interest Rate Futures, Forward Rate Agreements and any such other derivative instruments permitted by SEBI/RBI from time to time.

For further details on asset allocation, please refer to SID available on our website (www.barodabnpparibasmf.in).

Equity Allocation helps capture growth and beat inflation. Whereas fixed income provides regular income and relative stability. Moreover, a Hybrid strategy is Tax efficient as it is subject to equity taxation.

The Equity portion helps with:

The Fixed Income portion helps with:

Additionally, a Hybrid strategy (as represented by the CRISIL Hybrid 35+65 - Aggressive Index) has historically given returns that are equivalent to equity with much lower volatility.

Data as on 31st March 2024. Source: AMFI, MFI and Internal.

^ Returns for 5,10 and 15 years are on point to point CAGR (Compounded Annual Growth Rate). Risk Adjusted returns refers to the returns for per unit of volatility.

Past performance may or may not be sustained in the future.

The Scheme is an actively managed scheme. The strategy seeks to generate income and capital appreciation by taking advantage of diversification by investing in a mix of asset classes comprising equity & equity related instruments and fixed income securities including money market instruments. It also aims to manage risk through active selection within the specified asset allocation range.

Equity Investment Strategy:

The following are broad factors that would be considered while building a portfolio of companies:

Fixed Income Investment Strategy:

For equity portion: Mr. Pratish Krishnan shall be the designated Fund manager.

For Debt portion: Mr. Mayank Prakash shall be the designated Fund manager.

Dedicated Fund Manager for Overseas Investments: Mr. Miten Vora

| Name, Designation | Age | Educational Qualification | Previous Work Experience |

|---|---|---|---|

| Mr. Pratish Krishnan, Fund Manager & Senior Analyst |

49 years | B.Com, MMS (Finance) | Mr. Pratish Krishnan has over 23 years of experience in equity markets covering equity research and fund management. Mr. Krishnan was designated as Fund Manager & Senior Analyst with Baroda BNP Paribas Asset Management India Private Limited. In his previous assignment, he has worked with leading institutional brokerage houses such as Antique Finance, Bank of America Merrill Lynch, SBI Capital Markets in equity research. |

| Mr. Mayank Prakash Deputy Head - Fixed Income |

43 Years | ACA and MBA from Kanpur University | Mr. Prakash is currently employed with BNP Paribas AMC and joined the company from Kotak Mahindra Asset Management Co. where he spent approximately 18 years in various roles as a part of investment operations, dealing team and as a fund manager. |

| Mr. Miten Vora Senior Analyst & Fund Manager – Equity |

36 Years | PGDM - specialization in Finance, ICFAI – Hyderabad, B.Com | Mr. Miten Vora has an overall experience of more than 14 years. Prior to this, he has worked with Canara HSBC Oriental Life Insurance, BNP Paribas Asset Management India Private Limited, IDBI Asset Management Company and Antique Stock Broking Limited. Mr. Vora has done his PGDM in Finance from Institute of Chartered Financial Analysts of India, Hyderabad. |

Source: Internal. The growth rate considered is at 11.3% for investment in equity. The above table is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. The above analysis is based on estimates and is for informational purposes; it can alter based on a person’s age, investment style, risk appetite and market conditions. Retirement needs may vary from person to person. Kindly consult your investment advisor before investing. The SIP amount, tenure of SIP and expected rate of return are assumed figures for the purpose of explaining the concept of advantages of SIP investments. The actual result may vary from depicted results depending on scheme selected. Past performance may or may not be sustained in the future.

Auto SWP aims to provide a regular inflow of money to investors (monthly or quarterly) by automatic redemption of units in staggered manner or on attaining of retirement age i.e. 58 years.

Advantages:

Features:

Frequency: monthly or quarterly

Withdrawal:

To add: Scheme Riskometer and NFO related disclosures – It will be put on the website and hence there would be a riskometer

views expressed,

The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (formerly BNP Paribas Asset Management India Private Limited) (AMC) makes no representation that it is accurate or complete. The AMC has no obligation to tell the recipient when opinions or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in this publication, which contain words or phrases such as 'will', 'would', etc., and similar expressions or variations of such expressions may constitute 'forward-looking statements'. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements. The AMC undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/belief are independent perception of the Fund Manager and do not construe as opinion or advise. This information is not intended to be an offer to sell or a solicitation for the purchase or sale of any financial product or instrument. The information should not be construed as investment advice and investors are requested to consult their investment advisor and arrive at an informed investment decision before making any investments. The Trustee, AMC, Mutual Fund, their directors, officers or their employees shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages arising out of the information contained in this document.

Reg. Office of AMC is at 7th floor, Crescenzo, Plot No. C – 38/39, G Block, Bandra Kurla Complex, Bandra (E), Mumbai- 400051, Maharashtra. Corporate Identity Number (CIN): U65991MH2003PTC142972.

Toll free Number: 1800 2670189 Email id: service@barodabnpparibasmf.in Website: www.barodabnppparibasmf.in

^^the riskometer assigned is based on internal assessment of the scheme characteristics and the same may

vary post NFO

when actual investments are made. #Benchmark riskometer is as on 31st March 2024.

Baroda BNP Paribas Retirement Fund