Baroda BNP Paribas Small Cap Fund

We are upgrading our transaction portal and will be back soon.

By entering your details, you hereby authorize Baroda BNP Paribas Asset Management India Pvt. Ltd. to contact you, which will override any NDNC registration made by you.

Big things start small, and every small thing dreams of being big. Similarly, Baroda BNP Paribas Small Cap Fund aims to invest in small cap companies that can help in wealth creation in long term. Invest Today and aim to capitalize on untapped growth opportunities.

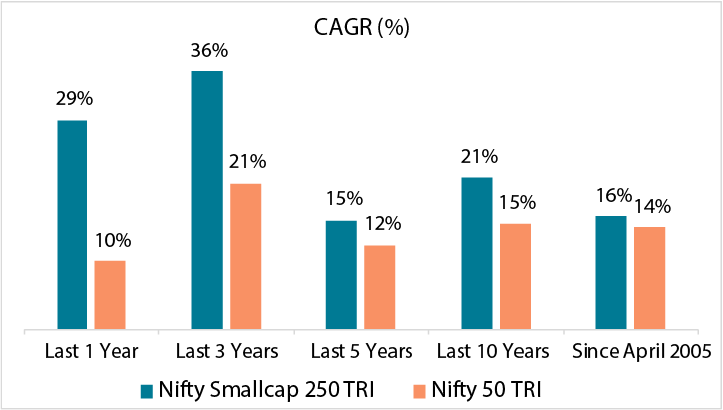

Source: MFI explorer. Data as on Aug 31, 2023. Past performance, including such scenarios, is not an indication of future performance.

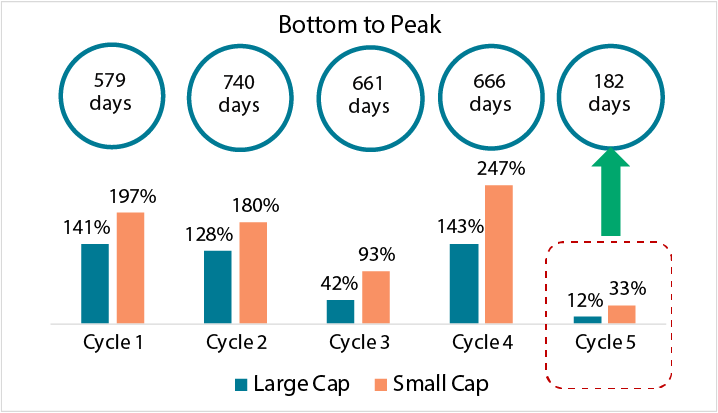

Source: NSE Indices and Internal Research. Data as of August 31, 2023. The average is calculated by taking a simple average of returns in Cycle 1, Cycle 2, Cycle 3 and Cycle 4. Similarly average number of days is also calculated by taking a simple average of number day in Cycle 1, Cycle 2, Cycle 3 and Cycle 4. Past performance, including such scenarios, is not an indication of future performance.

✓ An average bottom to top cycle lasts about 660 days.

✓ Small caps grew 179% on average in absolute terms across the 4 cycles.

✓ The current cycle has completed 182 days and small caps have gone up by 33% suggesting headroom for growth.

Baroda BNP Paribas Small Cap Fund

An open-ended equity scheme predominantly investing in Small Cap stocks.

The scheme seeks to generate long-term capital appreciation by investing predominantly in equity and equity related securities of small cap companies. The scheme does not guarantee/indicate any returns.

Nifty Small Cap 250 TR Index

Mr. Shiv Chanani (Senior Fund Manager - Equity) (Experience: 24 years)

Entry Load : Not applicable

Exit Load :

The Scheme offers following two plans:

Each Plan offers Growth Option and Income Distribution cum Capital Withdrawal (IDCW) Option

The IDCW option offers two options: Payout of Income Distribution cum capital withdrawal option and Reinvestment of Income Distribution cum capital withdrawal option.

Lumpsum investment: ₹5,000 and in multiples of ₹1 thereafter.

SIP:

(i) Daily, Weekly, Monthly SIP: ₹500/- and in multiples of ₹1/- thereafter;

(ii) Quarterly SIP: ₹1500/- and in multiples of ₹1/- thereafter. There is no upper limit.

The AMC reserves the right to change the minimum application amount from time to time.

| Type of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) | Risk Profile |

|---|---|---|---|

| Equity & Equity related instruments ^ of small cap companies$ | 65 | 100 | High |

| Equity and equity related instruments^ of other than small cap companies | 0 | 35 | High |

| Debt** & Money Market instruments | 0 | 35 | Low to Medium |

| Units issued by REITs & INvITs | 0 | 10 | Medium to High |

| Units of Mutual Fund Schemes | 0 | 10 | Medium to High |

For complete details refer SID

$ Small Cap companies are those companies which are classified as small cap companies by Securities and Exchange Board of India (SEBI) or Association of Mutual Funds in India (AMFI) in terms of market capitalisation. Small Cap Companies as defined by SEBI: 251st company onwards in terms of full market capitalization.

**Debt instruments may include securitised debt up to 20% of the debt portfolio of the scheme.

^The Scheme may invest up to 50% of equity assets in equity derivatives instruments as permitted under the SEBI (Mutual Funds) Regulations, 1996 from time to time. The Scheme may use equity derivatives for such purposes as maybe permitted under the SEBI (Mutual Funds) Regulations, 1996, including but not limited for the purpose of hedging and portfolio balancing, based on the opportunities available and subject to guidelines issued by SEBI from time to time. The scheme shall not invest in debt derivative instruments.

*Mr Miten Vora is the dedicated fund manager for overseas investments

#Market Capitalization as per AMFI - Large Cap: 1st - 100th company, Mid Cap: 101st - 250th company and Small Cap: 251st company onwards in terms of full market capitalization. Average market cap of 251st company as of Dec 22 to June 23 of Rs 17,385 Crs

Disclaimer:

All figures and other data given in this document are dated and may or may not be relevant at a future date. The recipient alone shall be fully responsible / liable for any decision taken based on this document. Prospective investors are therefore advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implications or consequence of subscribing to the units of the schemes of Baroda BNP Paribas Mutual Fund. Past performance may or may not be sustained in the future. Please refer to the Scheme Information Document of the schemes before investing for details of the scheme including investment objective, asset allocation pattern, investment strategy, risk factors and taxation. The risks involved in investing in the small cap companies could be higher compared to the large/ mid cap ones and hence investor should consider their risk appetite at the time of investing in small cap funds.

A small-cap fund is an equity -oriented mutual fund scheme that predominantly invests in the stocks of small-cap companies. Small-cap companies are those with a market capitalization of less than Rs. 17,390 crores (As per AMFI average market cap from Dec 22 to Jun 23).

Small-cap funds has the potential for providing higher returns. This is because small-cap companies are expected to grow faster than large-cap companies and are more likely to generate higher profits.

Small-cap funds are also more risky as compared to other types of mutual funds. This is because small-cap companies are more volatile and can be more susceptible to market fluctuations. As a result, small-cap funds are not suitable for all investors.

Small-cap funds are suitable for investors who are willing to take on more risk in exchange for the potential for higher returns. Investors who have a long-term investment horizon and are comfortable with the volatility of small-cap companies are more likely to be successful investing in small-cap funds.

When choosing a small-cap fund, it is important to consider the following factors:

You can invest through multiple channels including:

Small caps have outperformed large caps in recent years. Over the past 10 years, small caps have outperformed large caps by a significant margin. This is because small caps are expected to be more growth-oriented than large caps, and they have benefited from the strong economic growth in India. The Indian economy is expected to grow at a rate of 7-8% in the coming years. This growth may create opportunities for small caps, as they are often involved in the newer and emerging sectors of the economy.

Disclaimers:

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (formerly BNP Paribas Asset Management India Private Limited) (AMC) makes no representation that it is accurate or complete. The AMC has no obligation to tell the recipient when opinions or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in this publication, which contain words or phrases such as 'will', 'would', etc., and similar expressions or variations of such expressions may constitute 'forward-looking statements'. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements. The AMC undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/belief are independent perception of the Fund Manager and do not construe as opinion or advise. This information is not intended to be an offer to sell or a solicitation for the purchase or sale of any financial product or instrument. The information should not be construed as investment advice and investors are requested to consult their investment advisor and arrive at an informed investment decision before making any investments. The sector(s) mentioned in this document do not constitute any recommendation of the same and Baroda BNP Paribas Mutual Fund may or may not have any future position in these sector(s). The Trustee, AMC, Mutual Fund, their directors, officers or their employees shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages arising out of the information contained in this document.

Reg. Office of AMC is at 7th floor, Crescenzo, Plot No. C – 38/39, G Block, Bandra Kurla Complex, Bandra (E), Mumbai- 400051, Maharashtra. Corporate Identity Number (CIN): U65991MH2003PTC142972.

Toll free Number: 1800 2670189 Email id: [email protected] Website: www.barodabnppparibasmf.in

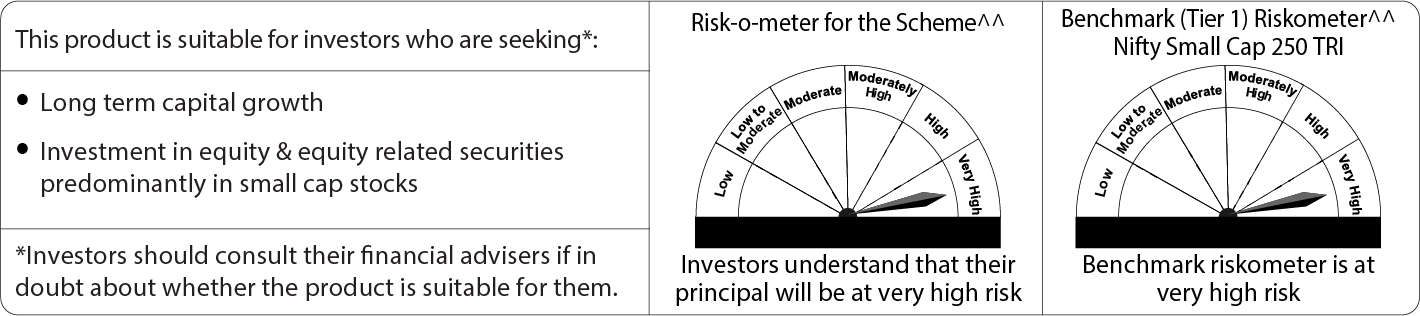

Offer of units of Rs. 10 each during the New Fund Offer period and continuous offer for units at NAV based prices. Riskometer as on 31st August 2023

^^the riskometer assigned is based on internal assessment of the scheme characteristics and the same may vary post NFO when actual investments are made.

Baroda BNP Paribas Small Cap Fund