(An Open ended Dynamic Debt Scheme investing

across duration. A Relatively High Interest Rate Risk

and Moderate Credit Risk Scheme)

(An Open ended Dynamic Debt Scheme investing

across duration. A Relatively High Interest Rate Risk

and Moderate Credit Risk Scheme)

The primary objective of the Scheme is to generate income through investments in a range of Debt and Money Market Instruments of various maturities with a view to maximising income while maintaining an optimum balance between yield, safety and liquidity. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns.

NAV Details (As on December 31, 2024)

NAV Details (As on December 31, 2024)| Regular Plan - Weekly IDCW Option | : ₹ 10.0728 |

| Regular Plan - Quarterly IDCW Option | : ₹ 10.3043 |

| Regular Plan - Monthly IDCW Option | : ₹ 10.3482 |

| Regular Plan - Half Yearly IDCW Option | : ₹ 10.3604 |

| Regular Plan - Growth Option | : ₹ 43.9874 |

| Regular Plan - Daily IDCW Option | : ₹ 10.0998 |

| Direct Plan - Weekly IDCW Option | : ₹ 10.0786 |

| Direct Plan - Quarterly IDCW Option | : ₹ 10.6733 |

| Direct Plan - Monthly IDCW Option | : ₹ 10.7285 |

| Direct Plan - Growth Option | : ₹ 48.7613 |

| Direct Plan - Daily IDCW Option | : ₹ 10.1068 |

Benchmark Index (Tier 1)

Benchmark Index (Tier 1)CRISIL Dynamic Bond A-III Index

Date of Allotment

Date of AllotmentSeptember 23, 2004

Fund Manager

Fund Manager | Fund Manager | Managing fund since | Experience |

| Gurvinder Singh Wasan | 21-Oct-24 | 21 years |

| Prashant Pimple | 11-Jul-24 | 24 years |

Load Structure

Load Structure

Exit Load: Nil

For detailed load structure please refer Scheme

Information Document of the scheme.

Minimum Application Amount:

₹ 5,000 and in multiples of ₹ 1 thereafter.

Minimum Additional Application Amount:

₹ 1,000 and in multiples of ₹ 1 thereafter.

| Monthly AAUM## As on December 31, 2024 | : ₹ 173.46 Crores |

| AUM## As on December 31, 2024 | : ₹ 176.80 Crores |

## excluding inter-scheme Investments, if any, by other schemes of Baroda BNP Paribas Mutual Fund, as may be applicable

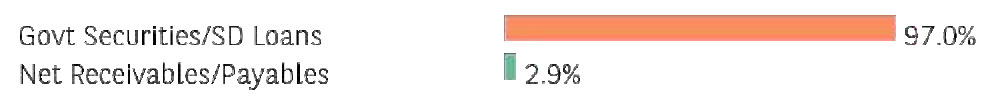

| Fixed Income Holdings | Rating | % of Net Assets |

| GOVERNMENT BOND | 97.06% | |

| ✔6.79% GOI (MD 07/10/2034) | Sovereign | 39.67% |

| ✔7.1% GOI (MD 08/04/2034) | Sovereign | 37.53% |

| ✔7.34% GOI (MD 22/04/2064) | Sovereign | 10.58% |

| ✔7.32% GOI (MD 13/11/2030) | Sovereign | 7.54% |

| ✔7.18% GOI (MD 14/08/2033) | Sovereign | 1.74% |

| Corporate Debt Market Development Fund Class A2 | 0.23% | |

| ✔Corporate Debt Market Development Fund | 0.23% | |

| STATE GOVERNMENT BOND | 0.00% | |

| 7.64% Haryana SDL (MD 29/03/2027) | Sovereign | 0.00% |

| 8.26% Maharashtra SDL (MD 02/01/2029) | Sovereign | 0.00% |

| CORPORATE BOND | 0.00% | |

| Total FixedIncome Holdings | 97.29% | |

| TREPS, Cash & Other Net Current Assets | 2.71% | |

| GRAND TOTAL | 100.00% |

Investment in Top 10 scrips constitutes 97.29% of the portfolio

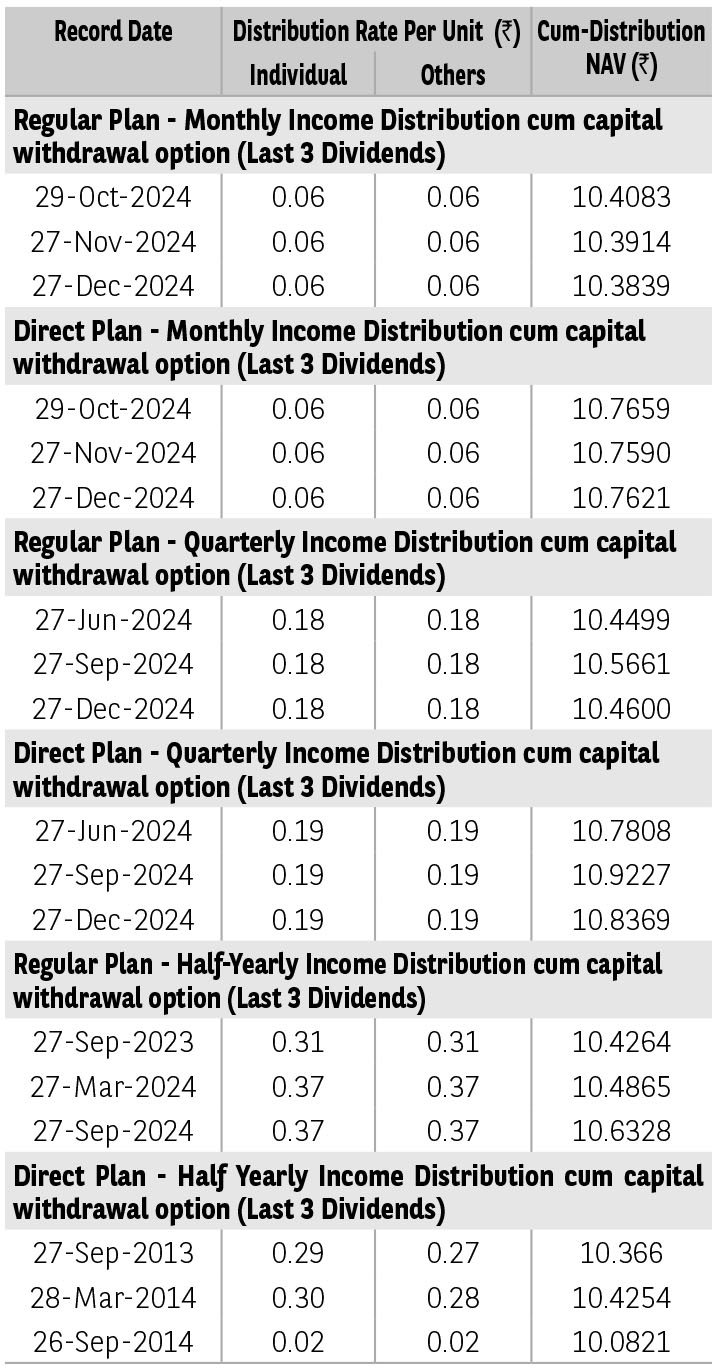

Pursuant to distribution under Income Distribution cum Capital Withdrawal (‘IDCW’) option, NAV of the IDCW option of the scheme(s) would fall to the extent of payout and statutory levy (if applicable). The

amounts under IDCW options can be distributed out of investors capital (Equalization Reserve), which is part of sale price that represents realized gains. Past performance may or may not be sustained in future.

The above stated distribution rate per unit is net distribution rate after deducting applicable taxes. The above distribution rates are on face value of ₹ 10 per unit.

| TER - Regular Plan (%) | 1.69% |

| TER - Direct Plan (%) | 0.71% |

* The information contained in this report has been obtained

from sources considered to be authentic and reliable. The

quantitative data does not purport to be an offer for purchase

and sale of mutual fund units.

| Average Maturity (years) | 12.32 |

| Modified Duration (years) | 7.21 |

| YTM (%) | 6.80% |

| Macaulay Duration† (years) | 7.46 |

†Concept of Macaulay duration: The Macaulay Duration is a measure of a bond’s sensitivity to interest rate changes. It is expressed in annual terms. It is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. Factors like a bond’s price, maturity, coupon, yield to maturity among others impact the calculation of Macaulay duration. The Macaulay duration can be viewed as the economic balance point of a group of cash flows. Another way to interpret the statistic is that it is the weighted average number of years an investor must maintain a position in the bond until the present value of the bond’s cash flows equals the amount paid for the bond. As it provides a way to estimate the effect of certain market changes on a bond’s price, the investor can choose an investment that will better meet his future cash needs.

| Credit Risk (Max) → | Relatively Low Class A (CRV>=12) | Moderate: Class B (CRV>=10) | Relatively High: Class C (CRV<10) |

| Interest Rate Risk (Max) ↓ | |||

| Relatively Low: Class I (MD<=1 year) | |||

| Moderate: Class II (MD<=3 year) | |||

| Relatively High: Class III (Any MD) | B-III |

MD=Macaulay Duration, CRV=Credit Risk Value.

‡ The PRC matrix denotes the maximum risk that the respective Scheme can take i.e. maximum interest rate risk (measured

by MD of the Scheme) and maximum credit risk (measured by CRV of the Scheme)

➤ Regular income in long term.

➤ Investments in debt and money market instruments .

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

^^Riskometer For Scheme: basis it’s portfolio, ^Riskometer For Benchmark (CRISIL Dynamic Bond A-III Index): basis it’s constituents; As on December 31, 2024

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.