(An Open ended Low Duration Debt Scheme investing in

instruments such that Macaulay duration of

portfolio is between 6 months and 12 months.

A relatively low interest rate risk and moderate credit risk scheme)

(An Open ended Low Duration Debt Scheme investing in

instruments such that Macaulay duration of

portfolio is between 6 months and 12 months.

A relatively low interest rate risk and moderate credit risk scheme)

The primary objective of the Scheme is to provide income consistent with the prudent risk from a portfolio comprising investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 6 months - 12 months. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns.

NAV Details ( As on December 31, 2024 )

NAV Details ( As on December 31, 2024 )| Regular Plan - Weekly IDCW Option | : ₹ 10.0102 |

| Regular Plan - Monthly IDCW Option | : ₹ 10.3098 |

| Regular Plan - Growth Option | : ₹ 38.5947 |

| Regular Plan - Daily IDCW Option | : ₹ 10.0604 |

| Direct Plan - Weekly IDCW Option | : ₹ 10.0102 |

| Direct Plan - Monthly IDCW Option | : ₹ 10.3252 |

| Direct Plan - Growth Option | : ₹ 42.1023 |

| Direct Plan - Daily IDCW Option | : ₹ 10.0952 |

Benchmark Index (Tier 1)

Benchmark Index (Tier 1)CRISIL Low Duration Debt A-I Index

Date of Allotment

Date of AllotmentOctober 21, 2005

Fund Manager

Fund Manager | Fund Manager | Managing fund since | Experience |

| Vikram Pamnani | 27-Dec-17 | 14 years |

| Gurvinder Singh Wasan | 21-Oct-24 | 21 years |

Load Structure

Load Structure

Exit Load: Nil

For detailed load structure please refer Scheme

Information Document of the scheme.

Minimum Application Amount:

₹ 5,000 and in multiples of ₹ 1 thereafter.

Minimum Additional Application Amount:

₹ 1,000 and in multiples of ₹ 1 thereafter.

| Monthly AAUM## As on December 31, 2024 | : ₹ 226.93 Crores |

| AUM## As on December 31, 2024 | : ₹ 218.34 Crores |

## excluding inter-scheme Investments, if any, by other schemes of Baroda BNP Paribas Mutual Fund, as may be applicable

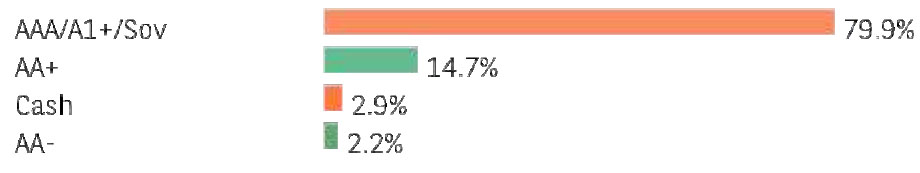

| Fixed Income Holdings | Rating | % of Net Assets |

| CORPORATE BOND | 43.06% | |

| ✔Power Finance Corporation Limited | CRISIL AAA | 9.13% |

| ✔National Bank For Agriculture and Rural Development | CRISIL AAA | 6.86% |

| ✔National Housing Bank | CRISIL AAA | 6.86% |

| ✔Bharti Telecom Limited | CRISIL AA+ | 4.61% |

| ✔Shriram Finance Limited | CRISIL AA+ | 4.60% |

| PNB Housing Finance Limited | CARE AA+ | 4.58% |

| Mindspace Business Parks REIT | CRISIL AAA | 3.21% |

| IndoStar Capital Finance Limited | CARE AA- | 2.29% |

| Hero Fincorp Limited | CRISIL AA+ | 0.92% |

| CERTIFICATE OF DEPOSIT | 28.33% | |

| ✔Kotak Mahindra Bank Limited | CRISIL A1+ | 8.93% |

| ✔Punjab National Bank | CRISIL A1+ | 6.61% |

| ✔HDFC Bank Limited | CARE A1+ | 6.59% |

| ICICI Bank Limited | ICRA A1+ | 3.54% |

| Axis Bank Limited | CRISIL A1+ | 2.66% |

| COMMERCIAL PAPER | 15.20% | |

| ✔Export Import Bank of India | CRISIL A1+ | 6.44% |

| Birla Group Holdings Private Limited | CRISIL A1+ | 4.43% |

| Piramal Capital & Housing Finance Limited | CRISIL A1+ | 4.33% |

| GOVERNMENT BOND | 7.98% | |

| ✔4.7% GOI FRB (MD 22/09/2033) | Sovereign | 7.05% |

| 7.38% GOI (MD 20/06/2027) | Sovereign | 0.93% |

| PTC | 2.18% | |

| India Universal Trust | CRISIL AAA(SO) | 2.18% |

| Corporate Debt Market Development Fund Class A2 | 0.26% | |

| Corporate Debt Market Development Fund | 0.26% | |

| Total FixedIncome Holdings | 97.01% | |

| TREPS, Cash & Other Net Current Assets | 2.99% | |

| GRAND TOTAL | 100.00% |

Investment in Top 10 scrips constitutes 67.68% of the portfolio

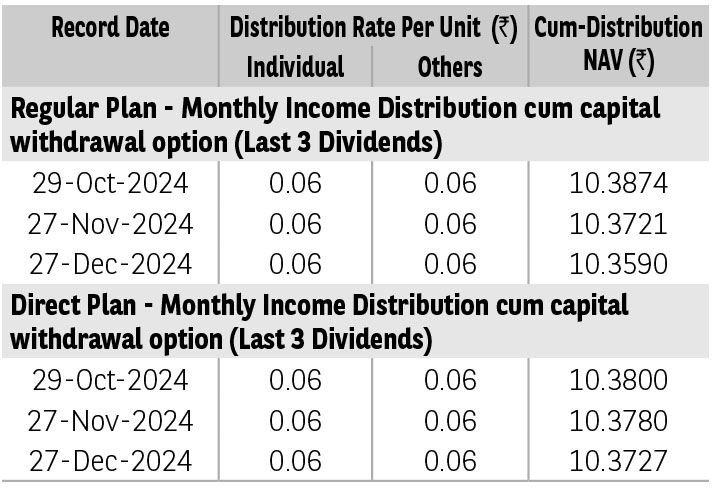

Pursuant to distribution under Income Distribution cum Capital Withdrawal (‘IDCW’) option, NAV of the IDCW option of the scheme(s) would fall to the extent of payout and statutory levy (if applicable). The

amounts under IDCW options can be distributed out of investors capital (Equalization Reserve), which is part of sale price that represents realized gains. Past performance may or may not be sustained in future.

The above stated distribution rate per unit is net distribution rate after deducting applicable taxes. The above distribution rates are on face value of ₹ 10 per unit.

| TER - Regular Plan (%) | 1.10% |

| TER - Direct Plan (%) | 0.31% |

* The information contained in this report has been obtained

from sources considered to be authentic and reliable. The

quantitative data does not purport to be an offer for purchase

and sale of mutual fund units.

| Average Maturity (years) | 1.43 |

| Modified Duration (years) | 0.76 |

| YTM (%) | 7.84% |

| Macaulay Duration† (years) | 0.79 |

†Concept of Macaulay duration: The Macaulay Duration is a measure of a bond’s sensitivity to interest rate changes. It is expressed in annual terms. It is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. Factors like a bond’s price, maturity, coupon, yield to maturity among others impact the calculation of Macaulay duration. The Macaulay duration can be viewed as the economic balance point of a group of cash flows. Another way to interpret the statistic is that it is the weighted average number of years an investor must maintain a position in the bond until the present value of the bond’s cash flows equals the amount paid for the bond. As it provides a way to estimate the effect of certain market changes on a bond’s price, the investor can choose an investment that will better meet his future cash needs.

| Credit Risk (Max) → | Relatively Low Class A (CRV>=12) | Moderate: Class B (CRV>=10) | Relatively High: Class C (CRV<10) |

| Interest Rate Risk (Max) ↓ | |||

| Relatively Low: Class I (MD<=1 year) | B-I | ||

| Moderate: Class II (MD<=3 year) | |||

| Relatively High: Class III (Any MD) |

MD=Macaulay Duration, CRV=Credit Risk Value.

‡ The PRC matrix denotes the maximum risk that the respective Scheme can take i.e. maximum interest rate risk

(measured by MD of the Scheme) and maximum credit risk (measured by CRV of the Scheme)

➤ Regular income in short term.

➤ Investments in portfolio comprising of debt & money market instruments and derivatives.

]] *Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

^^Riskometer For Scheme: basis it’s portfolio, ^Riskometer For Benchmark (CRISIL Low Duration Debt A-I Index): basis it’s constituents; As on December 31, 2024

** CARE’s fund quality rating is not a recommendation to purchase, sell, or hold a security/ fund. It neither comments on the current

market price, suitability for a particular investor nor on the prospective performance of the fund with respect to appreciation,

volatility of net asset value (NAV), or yield of the fund. The ratings do not address the funds ability to meet the payment obligations

to the investors.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.